With the third quarter winding down, and the final quarter of the year almost upon us, it’s time to take stock of stock markets. Where are we likely to go in the next few months, and what are the likely forces to impact trading? In some recent comments on CNBC, Citi strategist Scott Chronert lays out his own belief that we’re likely to see some further gains.

Chronert first points out that fears of a hard recession have faded, or as he puts it, “We’ve been pricing in a soft landing since the first part of June.” Backing this, Chronert states that the Fed’s rate cycle is near its peak, and that corporate earnings are likely to remain resilient. At his bottom line, Chronert adds, “I think all told the balance is still to the upside into the end of the year, and we’re going to fall back on our ongoing view that the fundamental underpinning for the S&P remains pretty positive at this point.”

Running with this positive sentiment, the analysts at Citi pinpointed three names that they see as poised to deliver over 40% gains. We ran this trio of Citi-recommended names through the TipRanks database to find out what the rest of the Street has to say about them. It turns out that all three are rated as Buys by the analyst consensus. Let’s find out why.

Camping World Holdings (CWH)

We’ll start in the leisure sector, with Camping World Holdings, one of the largest companies in the outdoor recreation niche. Camping World is mainly a dealer in new and used recreational vehicles, as well as RV rentals, but the company also deals in RV accessories, for both inside and outside the vehicles, in boats and other watercraft, in portable generators, and in camping equipment and accessories.

The company is a holding firm and operates mainly through two brands: its eponymous Camping World and the Good Sam brand. Through these subsidiaries, Camping World Holdings has become the US leisure market’s largest RV dealer and a leader in related outdoor and camping products. The firm makes a point of knowing its customers and adjusting product lines to meet their preferences. It has been in business since 1966.

Turning to company results, we find that CWH reported record-level sales of used vehicle units in 2Q23, the most recent quarter reported. However, the company’s top-line revenue of $1.9 billion fell more than 13% year-over-year and missed the forecast by $70 million. At the bottom line, Camping World Holdings had a non-GAAP EPS of 73 cents per share, 3 cents below expectations.

Camping World Holdings offers investors regular share dividends and has a history of adjusting the payment to adapt to current conditions. The most recent declaration for 3Q23 set the common share payment at $0.125 per share or 50 cents annualized, giving a 2.3% yield. The payment is scheduled for September 29. The current dividend represents an 80% reduction from the previous quarter.

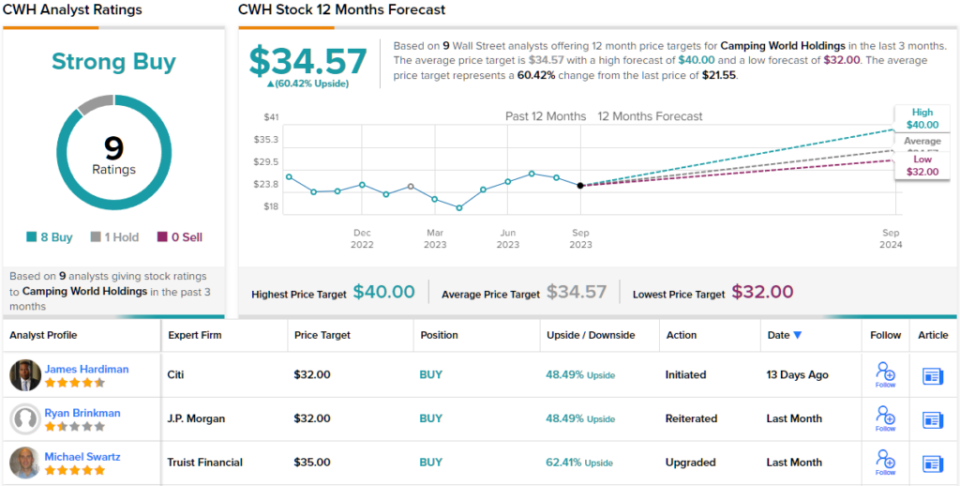

Shares in this veteran leisure company tumbled after the earnings release and dividend cut. The stock is down 31% from pre-release levels. For Citi 5-star analyst, James Hardiman, however, this reduction in share price marks an opportunity for investors to buy in.

“CWH is our Top Pick in the RV space and we believe it is the best way to play an RV industry recovery, whenever it arrives, as the company has a long-term macro-independent market share story driven by M&A and scale in a fragmented industry. The RV industry is showing initial signs of stabilization and recovery that we believe will begin to play out over the course of 2024 and beyond. We expect pricing/margin to remain under pressure for RV manufacturers in 2024, which could help spur demand for RV dealers. Meanwhile, shares have sold off recently, providing what we believe is an attractive entry point from a valuation perspective,” Hardiman opined.

Based on that bullish stance, Hardiman rates CWH stock a Buy and gives it a $32 price target, implying a one-year upside potential of ~48%. (To watch Hardiman’s track record, click here)

Overall, the Street remains bullish on CWH. The stock’s 9 recent analyst reviews break down 8 to 1 favoring Buys over Holds, for a Strong Buy consensus rating, and the $34.57 average price target suggests a 60% one-year gain from the current trading price of $21.55. (See CWH stock forecast)

Sociedad Quimica Y Minera de Chile (SQM)

Next under the Citi microscope is SQM, a Chilean mining firm with a powerful presence in the lithium industry. SQM is the world’s single largest producer of lithium and is also known for its work in the chemical industry, where it produces iodine and potassium used in plant fertilizers and industrial chemicals. The company has noted that lithium sales volumes are at record levels, driven by increased demand – particularly in the electric vehicle market.

In addition to production work, SQM also distributes lithium. This year, the company has entered into new agreements with Ford Motor Company and LG Energy Solutions for the long-term supply of lithium, a move that promises to keep the company’s sales at high levels. Lower spot prices in the Chinese lithium markets, however, are having a depressing effect on SQM’s bottom line.

This is reflected in misses in both revenues and earnings in the company’s last reported results. Specifically, SQM’s second-quarter topline of $2.05 billion was down 21% year-over-year and missed the estimates by $74.5 million. On earnings, the Q2 EPS of $2.03 was 61 cents below expectations.

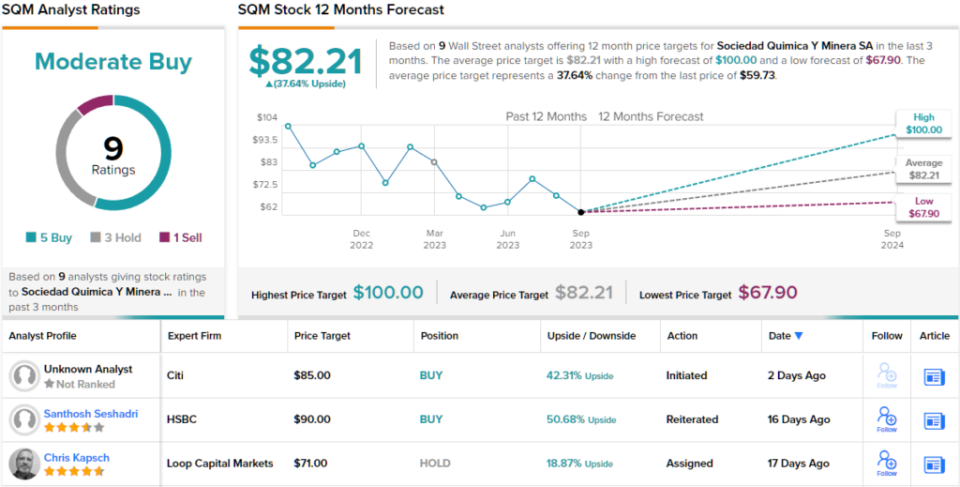

SQM shares have declined more than 21% so far this year. That decline doesn’t bother Citi analyst Carolina Cruzat, however, who believes that SQM is selling well below where it ‘should.’

“Taking into account that SQM has been an underperformer in the local market and current valuations seem to be on the bottom, we believe the share discount to be excessive, considering: (i) solid mid-term fundamentals on the lithium market; and (ii) the stock is currently priced below the value of the cash flows until 2030, with a relevant upside if they get fair renewal conditions on their lease agreement with Corfo. We believe investors internalize a very negative scenario regarding the potential outcome from the proposed new lithium regulatory framework, even if it means losing the concession over the Salar de Atacama,” Cruzat explained.

Adding that the main risks here are already priced in, Cruzat rates the stock a Buy. Her price target, of $85, points toward a 42% upside potential on the one-year horizon.

What does the rest of the Street think? Looking at the consensus breakdown, opinions from other analysts are more spread out. 5 Buys, 3 Holds and 1 Sell add up to a Moderate Buy consensus. In addition, the $82.21 average price target indicates ~38% upside potential from current levels. (See SQM stock forecast)

Sunrun, Inc. (RUN)

Last but not least is Sunrun, a leader in the field of residential solar power installations. Sunrun is known as a full-service provider in the home solar niche, designing, building, and installing package solar deals and made-to-order installations for single-family homes. Their packages include everything needed for a specific installation, from rooftop photovoltaic panels to local grid connections, as well as smart control systems and power storage batteries.

In addition to home solar installations, Sunrun also offers financing services. Customers can choose to pay in full in advance or amortize the full cost of the installation as a lease on the equipment, with long-term or month-by-month payment options. Sunrun bills itself as the #1 company in the US residential solar power market, with over 800,000 customers across 22 states plus Puerto Rico and $1.1 billion in annual recurring revenue.

This strong foundation is the result of Sunrun’s ongoing efforts to expand its presence in the market. While revenue in 2Q23, the last reported, increased by only 1% year-over-year to $590.2 million, the company achieved notable milestones. Sales activity outside the state of California, where the company has its largest footprint, grew by 25% year-over-year. Moreover, the total installed storage capacity increased by 35% year-over-year, reaching 103 megawatt hours. The company’s most surprising achievement, however, was posting a net profit of 25 cents per diluted share in Q2, surpassing the expected net loss by 64 cents per share.

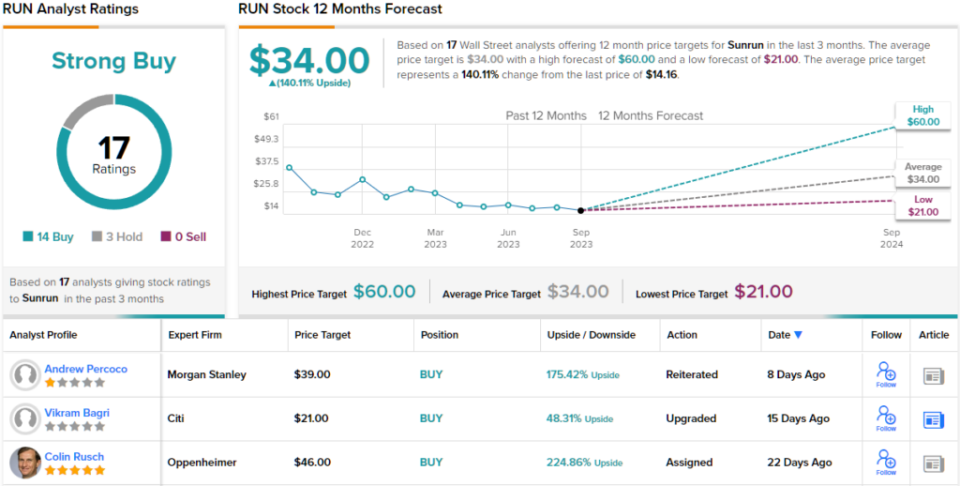

The company’s non-California growth caught the eye of Citi analyst Vikram Bagri, who sees that as an important factor supporting the stock going forward.

“Higher rates and NEM impacts appear to be largely priced-in, but RUN is not getting due credit for 1) market share gains from TPO shift, 2) path to FCF generation, 3) no corporate level equity raises, 4) projected component cost deflation, 5) ITC adder benefits, and 6) demonstrated success in selling battery storage (>80% attach rate on new sales in CA and >30% nationally). CA will face headwinds in ’24 but RUN’s leading >60% TPO market share and financing runway means consensus expectations for ~6% MW installation growth in FY24 appear achievable as consumers seek out solar+storage to save on utility bills. In addition, we believe there is upside to net subscriber value estimates,” Bagri opined.

“We received multiple questions on valuation for RUN and believe the stock is conservatively worth ~$21/sh in the LT,” Bagri adds, pointing out a solid bottom line to his stance.

Overall, the analyst’s Buy rating and $21 price target indicate confidence in a 48% gain going forward into next year. (To watch Bagri’s track record, click here)

The Citi view may turn out to be the conservative look at Sunrun – the stock’s Strong Buy consensus rating is based on 17 analyst reviews that include 14 Buys and 3 Holds. The shares are priced at $14.16 and the $34 average price target suggests a robust upside of 140%. (See RUN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Credit: Source link