Industrial and Commercial Bank of China (ICBC), the largest Chinese bank, recently published a report highlighting Bitcoin (BTC) and Ethereum’s (ETH) potential. Notably, the report refers to Ethereum as “digital oil,” emphasizing its role in the digital economy.

This endorsement by such a prominent financial institution highlights Ethereum’s growing importance and potential for future technological advancements.

ICBC Spotlights Ethereum’s Vital Role in Digital Economy

In a report widely circulated by Matthew Sigel, Head of Digital Assets Research at asset manager VanEck, ICBC acknowledges the potential of various digital currencies. These include BTC, ETH, stablecoins, and central bank digital currencies (CBCDs).

While ICBC notes that Bitcoin retains gold-like scarcity, the bank also praises Ethereum for its continuous security, scalability, and sustainability upgrades. ICBC analysts say these aspects provide technical power for the digital future.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

Furthermore, the report highlights Ethereum’s unique advantage of introducing Turing completeness with its Solidity programming language and Ethereum Virtual Machine (EVM). This capability enables complex smart contracts and applications.

“Its flexibility has been widely recognized in the fields of decentralized finance (DeFi) and non-fungible tokens (NFT) and is gradually extending to the physical infrastructure network (DePin),” the report reads.

However, ICBC points out that this flexibility presents challenges. ICBC emphasizes security concerns arise because Turing completeness allows arbitrary code execution, including potentially malicious code. Additionally, complex smart contracts are prone to vulnerabilities, complicating security audits.

Scalability is another challenge, as the computational demands of smart contracts can cause network congestion and increase transaction fees. Despite these challenges, ICBC recognizes the efforts of developers continuously seeking technological breakthroughs.

ICBC’s report is particularly noteworthy given China’s stringent stance on Bitcoin and crypto-related transactions. Traditional banks typically adopt a cautious approach toward digital assets, making ICBC’s perspective even more significant.

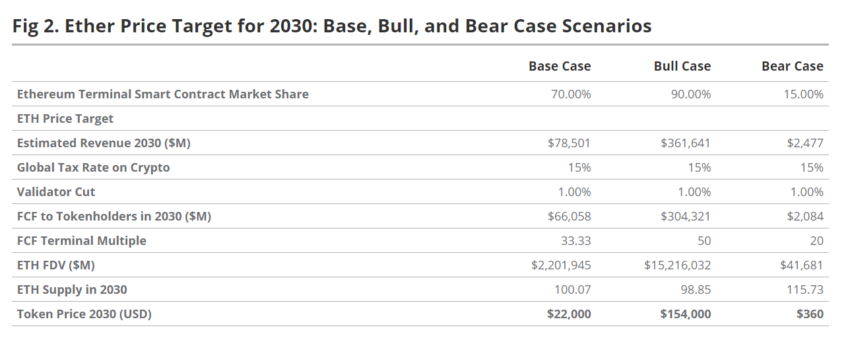

The bank’s view aligns with a recent report from VanEck, which also mentions Ethereum as “digital oil.” They liken Ethereum to “digital oil” because it is consumed during Ethereum network activities. Moreover, they consider this asset “programmable money” due to its automatic financialization without intermediaries.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Based on this analysis model, VanEck’s analysts are bullish on Ethereum’s future, predicting its price could reach $22,000 per token by 2030.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Credit: Source link