Last week went through under the flag of filings for multiple exchange traded-funds on cryptocurrencies from the likes of Grayscale, 21Shares, Canary and others. Among the most notable advancements in the crypto investments field was the filing for GADA — a Cardano ETF from Grayscale, one of the biggest players in this segment of the crypto market.

As a result, the price of ADA, the native token of the Cardano blockchain, showed exceptional performance and soared by 20% inside the week, going up from as low as $0.663 to $0.83 per coin.

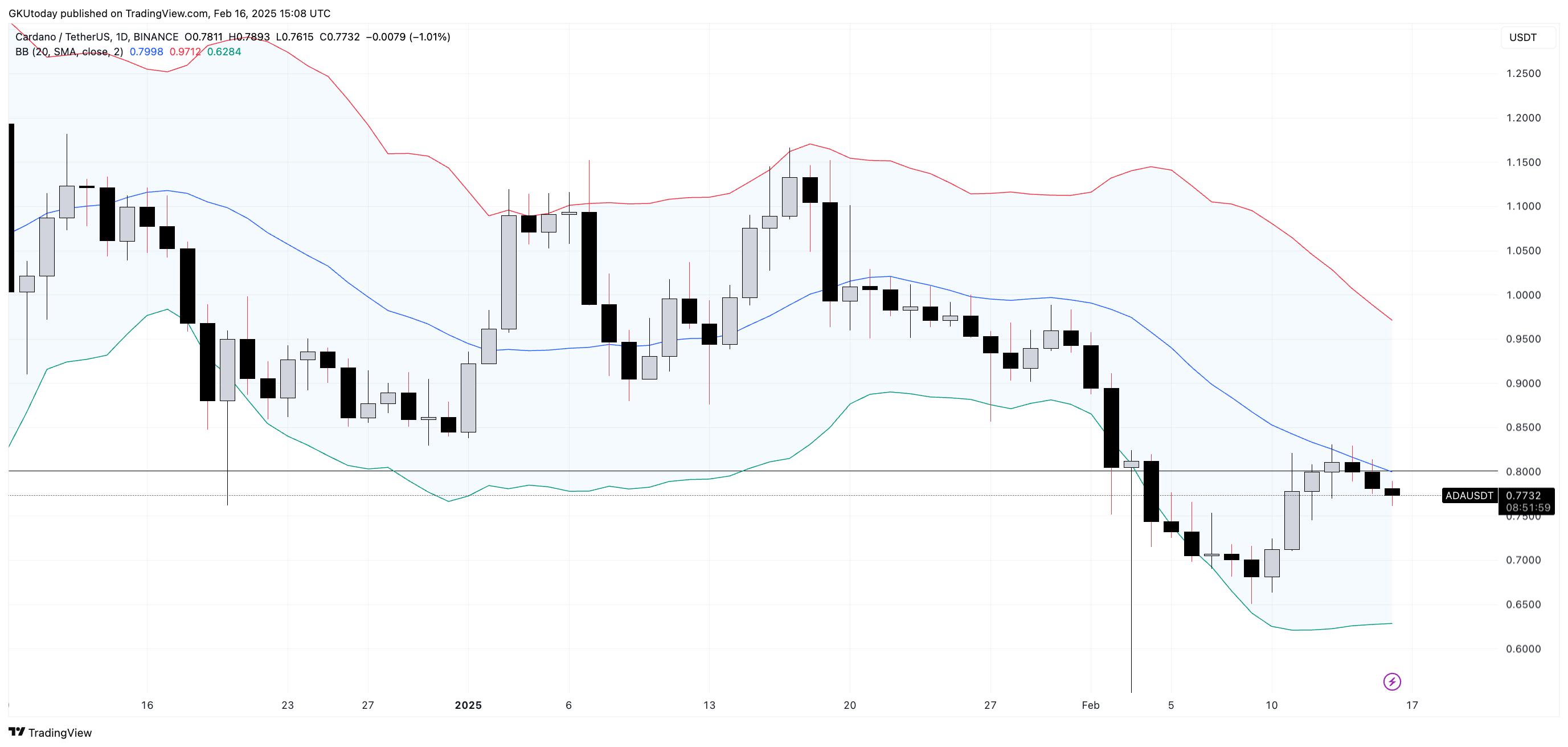

However, ADA failed to do one thing — maintain above crucial resistance level at $0.8, and in the last three days its price fell below the key threshold. Right now the Cardano token is quoted at $0.77, and the picture does not look like a short-term downfall.

Bollinger Bands also signal weakness for ADA as the price remains below the median curve of the popular indicator on a daily time frame.

With the ETF news being “priced in” already and the fears, uncertainty and doubts surrounding the crypto market right now, it makes ADA more prone to downfall then further ascent.

Downfall, however, is a strong word as everything can change within days, and if the market suddenly gets its dose of positivity, this notorious resistance level for ADA will be the first one to be tested.

Trying to make a conclusion, it may be stated that independent triggers for the Cardano token right now came to an end, and the popular altcoin is once again controlled by overall crypto market movement. Where it will take the coin, though, is an open question.

Credit: Source link