On November 2, 2023, Richard Fairbank, Chairman and CEO of Capital One Financial Corp (NYSE:COF), sold 7,782 shares of the company. This move is part of a series of transactions made by the insider over the past year, during which he sold a total of 165,583 shares and made no purchases.

Richard Fairbank is a prominent figure in the financial industry, having co-founded Capital One Financial Corp in 1988. Under his leadership, the company has grown into a Fortune 500 company and one of the largest banks in the United States by assets. Capital One Financial Corp is a diversified banking company that offers a broad array of financial products and services to consumers, small businesses, and commercial clients.

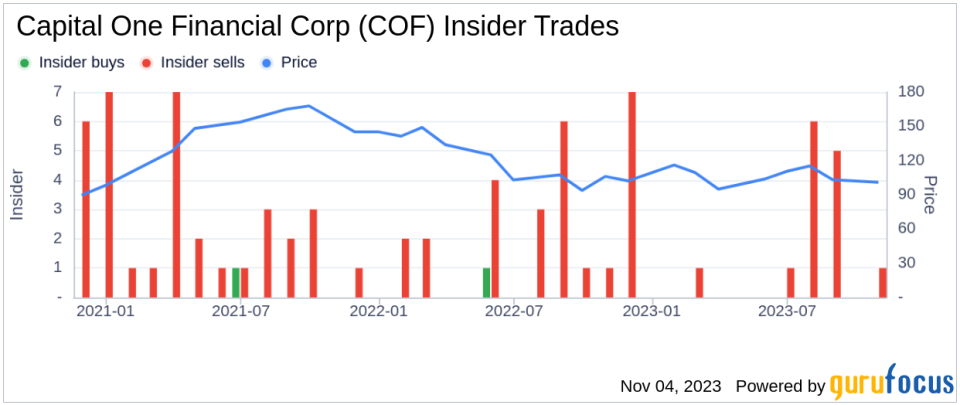

The insider’s recent sell-off is part of a broader trend within the company. Over the past year, there have been 20 insider sells and no insider buys. This trend is illustrated in the following image:

The relationship between insider transactions and the stock price is complex. While insider selling can sometimes indicate a lack of confidence in the company’s future prospects, it can also be motivated by personal financial planning needs. In this case, the insider’s consistent selling over the past year suggests a strategic decision rather than a reaction to short-term market fluctuations.

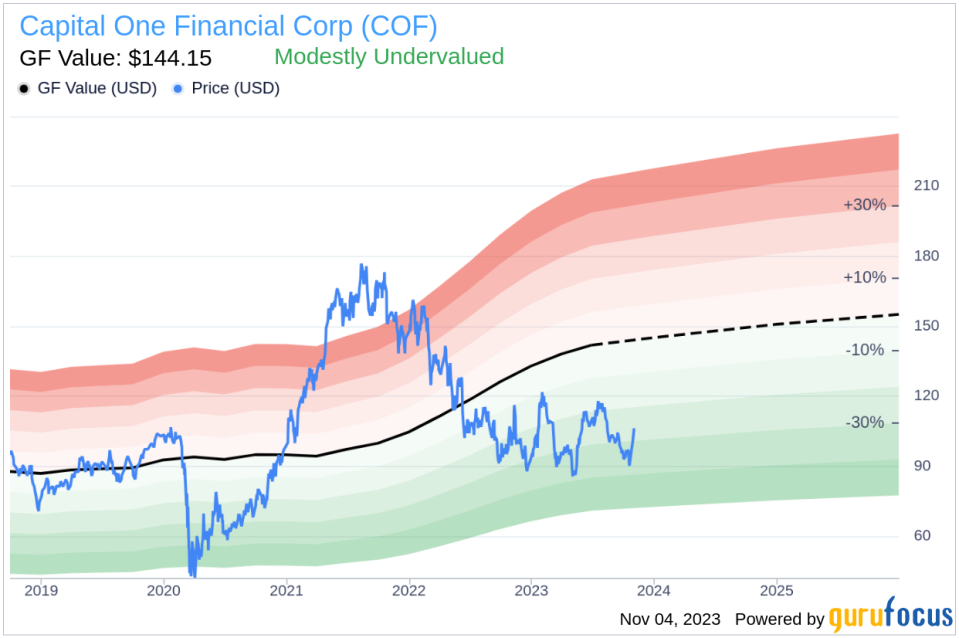

On the day of the insider’s recent sell, shares of Capital One Financial Corp were trading at $101.83, giving the company a market cap of $40.49 billion. The stock’s price-earnings ratio of 7.99 is lower than both the industry median of 12 and the company’s historical median, suggesting that the stock may be undervalued.

This assessment is supported by the GuruFocus Value of $144.15, which indicates that the stock is modestly undervalued with a price-to-GF-Value ratio of 0.71. The GF Value is calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts. The GF Value is illustrated in the following image:

In conclusion, while the insider’s consistent selling over the past year may raise some concerns, the stock’s current valuation suggests that it may still offer a good investment opportunity. As always, potential investors should conduct their own research and consider their individual financial circumstances before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Credit: Source link