On Tuesday, August 20, Dogecoin (DOGE) price registered a 6% increase as it attempted to retest $0.11. This rise also spread to the volume, which noted a substantial increase as well.

Shortly after, specifically as of this writing, the meme coin has erased all of those gains. While DOGE holders may hope for another jump, this analysis reveals that it could be difficult.

Dogecoin’s Path to Respite Has Been Hindered

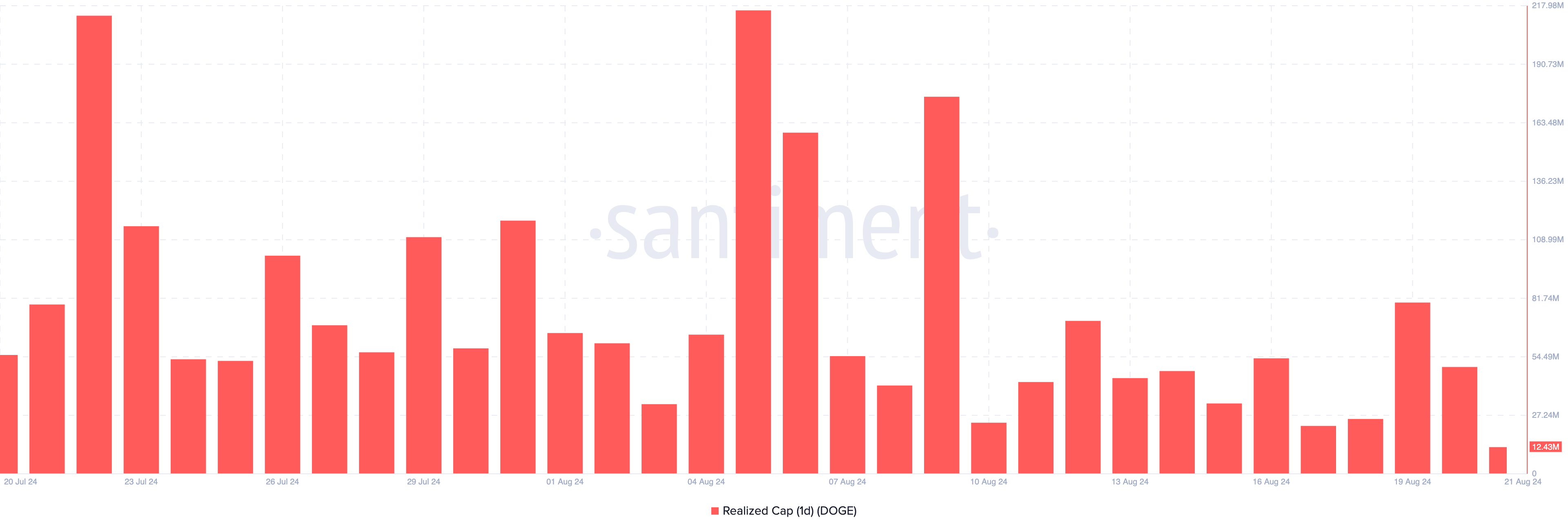

Data from Santiment shows that Dogecoin’s one-day Realized Cap has reached a monthly low of $12.43 million. As a short form of Realized Capitalization, this metric serves as an aggregate cost basis for coins on a blockchain.

Given this methodology, the Realized Cap is the value of all coins as of the time they last moved. An increase in this value indicates that the cryptocurrency can be re-priced higher as cheaper coins have been spent.

However, a drawdown is largely driven by capitulation as crypto prices can be re-valued lower because more expensive coins have been spent. Considering the thesis above, DOGE’s price might find it challenging to jump past $0.10 despite previous bullish cues.

Read more: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

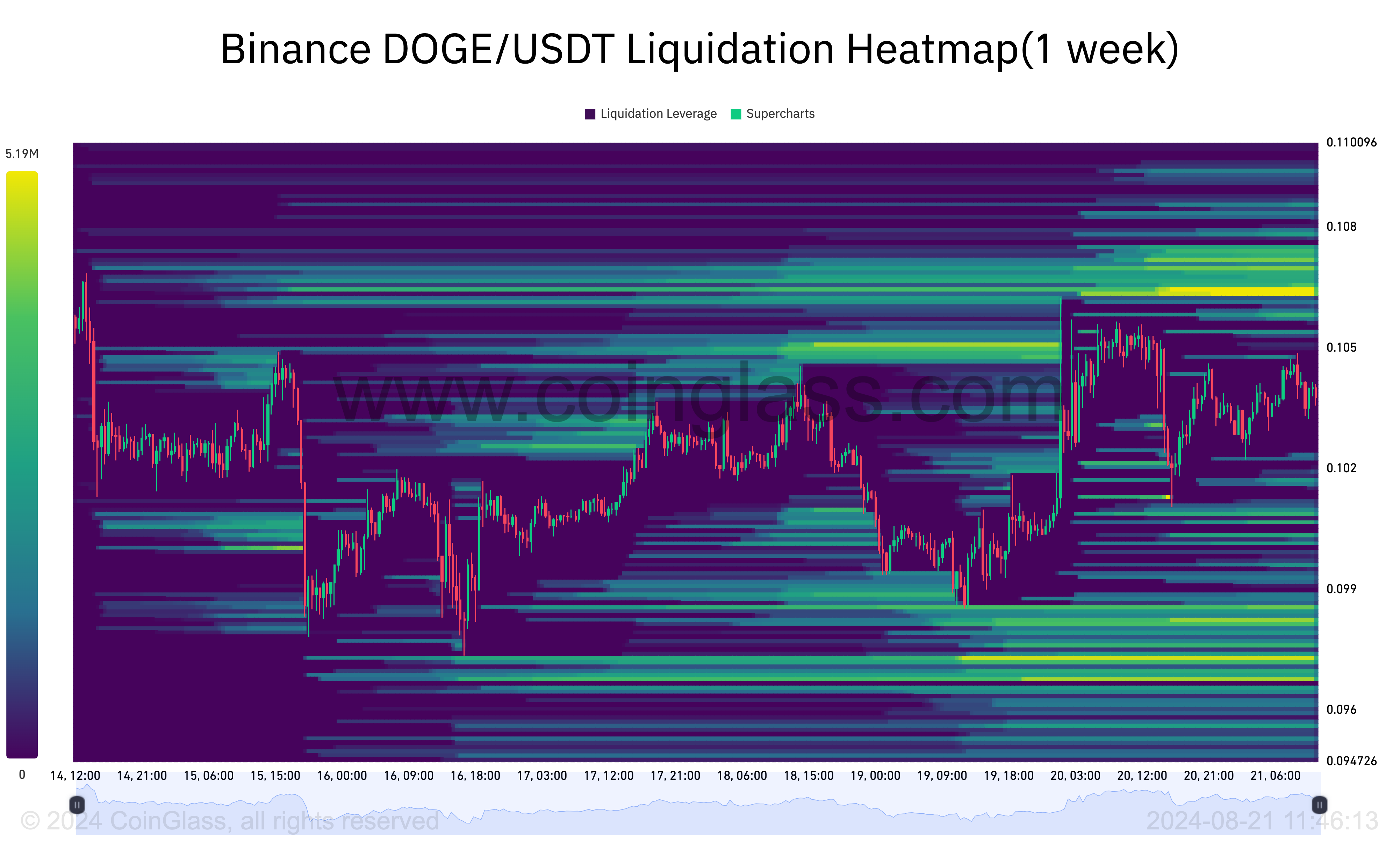

The liquidation heatmap is another indicator suggesting that Dogecoin could struggle. This heatmap predicts price levels where large-scale liquidation might occur. For context, liquidation occurs when an exchange forcefully closes an open position due to insufficient margin balance and to prevent further losses.

Beyond that, the heatmap gauges price direction using the concentration of liquidity within a range. Notably, the higher the liquidity at a price range, denoted by the color yellow, the higher the chances of a crypto price moving toward the direction.

As seen below, the heatmap shows a high concentration around the same $0.10 level over the last 24 hours. When viewed using a seven-day lens, it is the same. As such, if nothing changes, DOGE’s price might be stuck around $0.10 in the short term.

DOGE Price Prediction: Roadblocks at $0.10

The technical perspective sheds more light on DOGE’s potential price movement. According to the daily chart, the Relative Strength Index (RSI) remains below the neutral 50.00 region. As a technical oscillator measuring momentum, a reading below the midpoint suggests that the coin is yet to exit the bearish dominance.

Although the RSI rating has increased, it has to jump above the 50.00 point to validate the bullish bias. Thus, it is not out of place to infer that Dogecoin price might continue to swing below $0.09 and $0.10 unless the condition mentioned happens.

A look at the Fibonacci retracement levels adds more insights to the prediction. Typically, the indicator spots price levels a crypto might reach. At press time, DOGE hovers around the $0.10 pullback region where the 23.6% Fib level positions. If the market condition remains the same, the price might fail to elevate beyond this point.

Read more: Dogecoin (DOGE) Price Prediction 2024/2025/2030

However, an increase in buying pressure might change the situation. Should this be the case, DOGE’s price could attempt to hit $0.13, where the 61.8% Fib level lies. But if the broader market collapses like it did on August 5, the Dogecoin price could drop to $0.080 again.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Credit: Source link