Overview

Wyoming has the largest uranium reserves of all the US states and is the home of in-situ recovery (ISR) uranium mining, with experimental ISR mining during the early 1960s and commercial ISR mining starting in 1974. The state is an energy powerhouse in the US, second only to Texas in energy production and accounting for more than 80 percent of the country’s uranium production. It has a production history that dates back to the late 1940s. With a soaring uranium price that passed $90 by the end of 2023, many analysts believe the price will remain on the higher end for years to come.

GTI Energy (ASX:GTR, OTCQB:GTRIF) is a mineral exploration company focused on developing a portfolio of attractive uranium projects in the United States. The company now boasts approximately 42,000 acres in the prolific Great Divide and Powder River Basins, which are low-cost ISR uranium-producing districts within 100 miles of each other.

In 2022, the company completed an additional 103 mud rotary exploration drill holes to increase the total trend length for GTI’s projects in the Great Divide Basin to 7.5 miles.

The company has also commenced work at its Green Mountain ISR uranium project next to Rio Tinto’s (ASX:RIO) uranium deposits. GTI has historical drill data confirming the presence of uranium mineralised roll fronts on the properties.

The company is led by a highly experienced management and exploration team with an extensive track record in the mineral exploration industry. GTI’s operational team has proven development and engineering expertise with a history of success in ISR uranium deposit discovery in Wyoming.

GTI’s acquisition of Branka Minerals in November 2021 gave the company control of the largest non-US or Canadian-owned uranium exploration landholding in the Great Divide Basin, with approximately 19,500 acres. The landholding included underexplored and highly prospective sandstone-hosted uranium properties which are the company’s Wyoming projects today. This holding then grew with the purchase of the 13,800-acre Green Mountain project in 2022.

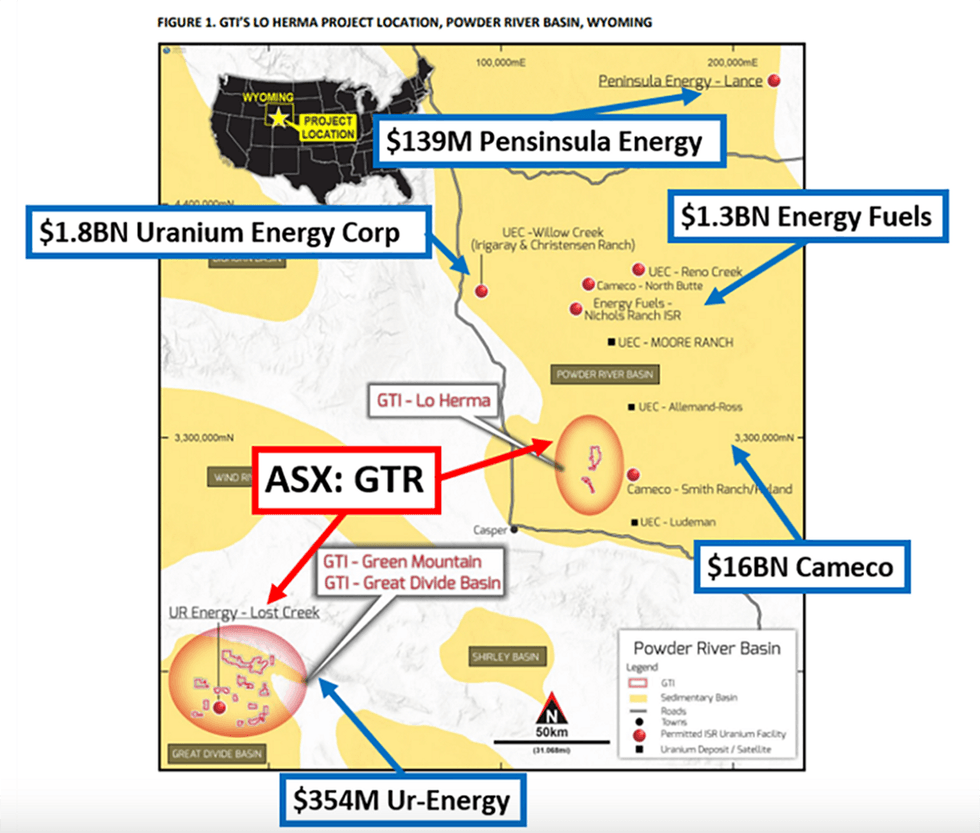

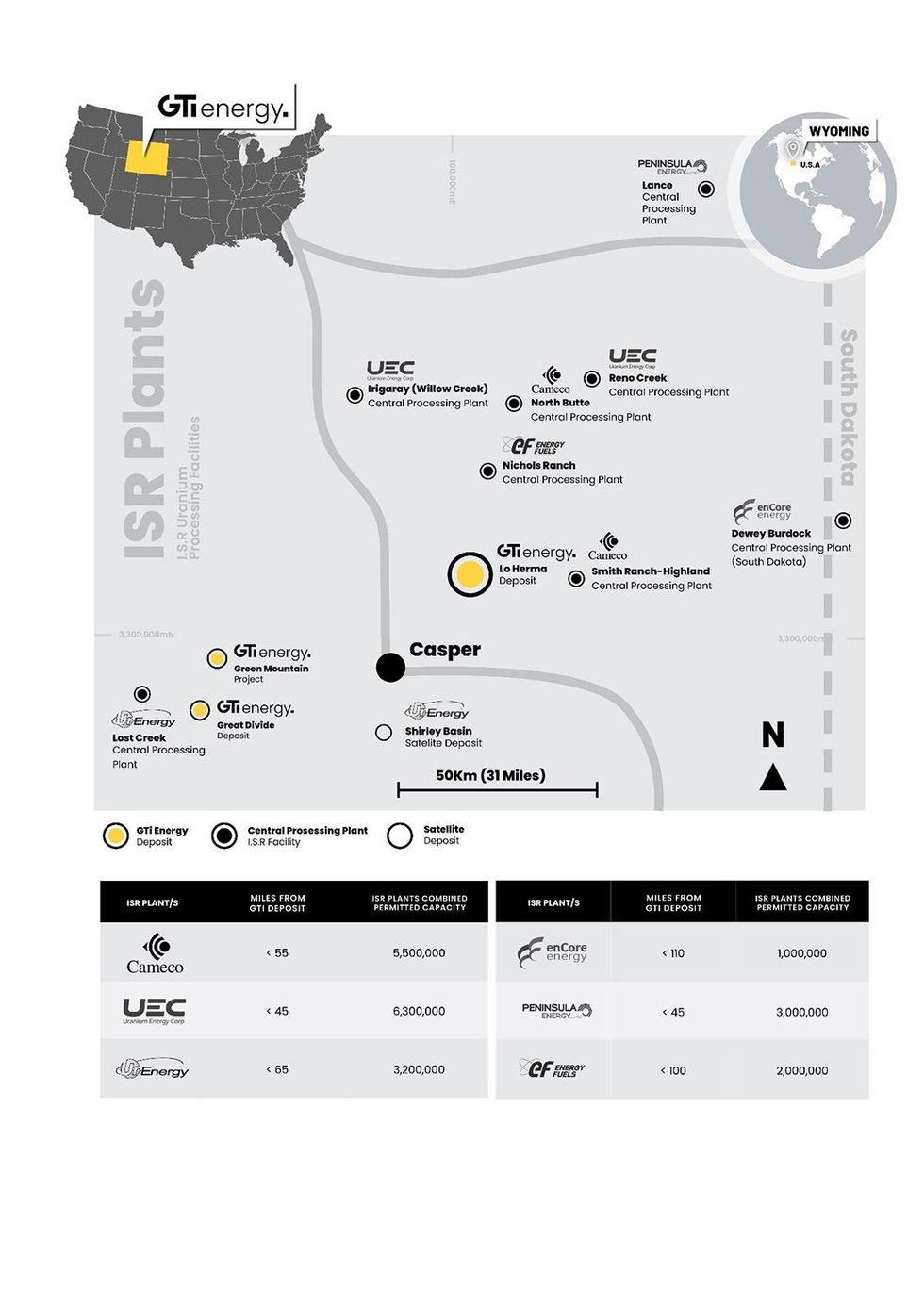

The company further expanded its ISR uranium portfolio in 2023 by acquiring the Lo Herma Project in Wyoming’s prolific Powder River Basin uranium district. The newly staked 13,300 acres of claims are located within 16 kilometers of Cameco’s Smith Ranch-Highland ISR uranium production plant – the largest production site in Wyoming

GTI Energy leverages the strategic positioning of its Wyoming projects, which are located near Ur Energy’s (TSX:URE,NYSE:URG) Lost Creek ISR production plant and the now-rehabilitated historic Rio Tinto Kennecott Sweetwater Mill. The Lost Creek plant is claimed by Ur Energy to be the lowest-cost ISR uranium production plant outside of Kazakhstan.

GTI is committed to strong environmental, social and governance (ESG) initiatives to support the clean energy transition. In November 2021, the company adopted an internationally recognized Environmental, Social and Governance Stakeholder Capitalism Metrics framework, with 21 core metrics and disclosures.

In December 2021, GTI Energy announced it would be transitioning to carbon-neutral operations. The company has subsequently received its carbon neutral certification for its Australian head office and US field operations, through the Australian Government’s Climate Active Program.

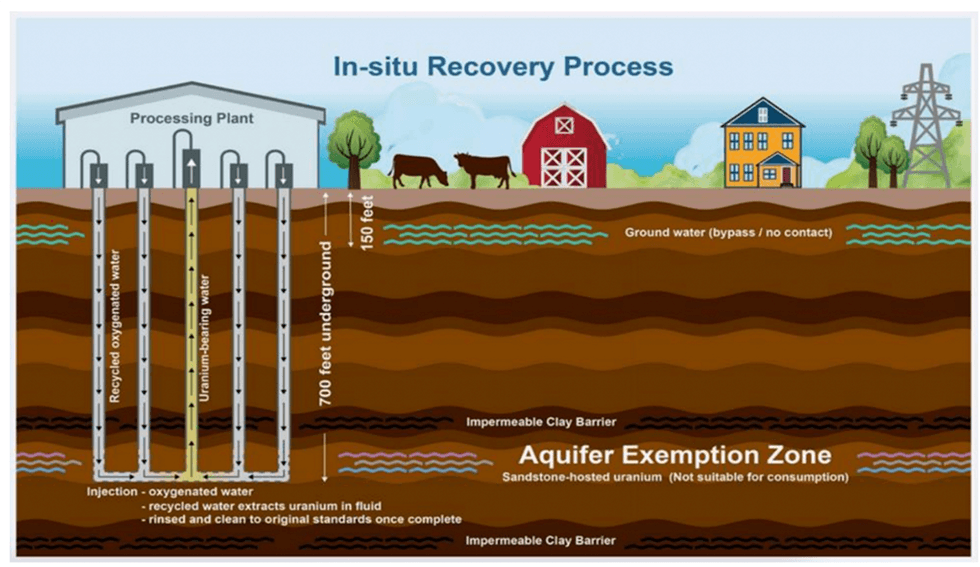

GTI Energy is positioned for growth with the pursuit of ISR mining on its Wyoming projects, presenting an opportunity for low operating expenses and capital expenditures with low environmental impact compared to conventional mining. ISR mining supports the company’s goal of low-impact mining and carbon neutrality on its Wyoming projects.

In 2021, the company completed field exploration on its Henry Mountains project in Utah. In the same year, GTI Energy also began a 15,000-meter drill program on its Wyoming projects, concluding the program in early 2022. The drilling confirmed that the targeted ISR-amenable uranium mineralization was present at the Thor project. In 2022, the company completed an additional 103 mud rotary exploration drill holes to increase the total trend length for GTI’s projects in the Basin to 7.5 miles.

Company Highlights

- GTI Energy owns multiple promising assets in Wyoming’s prolific and in-situ recovery (ISR) uranium-producing Great Divide and Powder River Basins. Wyoming is the leading US uranium production state and is “uranium-friendly”.

- GTI’s flagship Lo Herma project comprises 13,300 acres of ground in Wyoming within circa 16 kilometers of Cameco’s $16-billion ISR uranium plant (the largest permitted ISR production facility in Wyoming) and 80 kilometers of five permitted ISR uranium production facilities, including UEC’s Christensen Ranch (due to restart in August 2024) and Peninsula Energy’s (ASX:PEN) Lance Project (due to recommence production in late 2024).

- GTI’s Great Divide Basin projects are strategically located near Ur Energy’s (TSX:URE,NYSE:URG) Lost Creek ISR production plant which has re-commenced production.

- Maiden uranium resource and updated exploration target at the Lo Herma ISR project delivered an inferred mineral resource estimate of 5.71 Mlbs uranium oxide at an average 630 ppm plus an exploration target of an additional 5.87 to 10.26 Mlbs potential at average grade of 500 to 700 ppm.

- Updated total resources across its Wyoming projects of 7.37 Mlbs plus an exploration target of an additional 11.97 to 19.79 Mlbs potential at average grade of 500 – 700 ppm.

- In early 2022, the company completed a further 103 mud rotary exploration drill holes to increase the total trend length for GTI’s projects in the Great Divide Basin to 7.5 miles.

- In late 2023, GTI completed 26 holes at Lo Herma to verify the historical data base & confirm exploration potential along trend & at depth.

- GTI acquired a 1,771 drill hole data set over Lo Herma with a replacement value of AU$15 million.

- GTI received its carbon neutral certification for its Australian head office and US field operations, through the Australian Government’s Climate Active Program.

- GTI aims to utilize ISR mining at its Wyoming projects, which offers lower environmental impact, lower opex and capex than conventional mining.

- GTI Energy has a highly experienced exploration team including the recent appointment of ISR specialist, Matt Hartmann, with a history of successful uranium discovery in Wyoming.

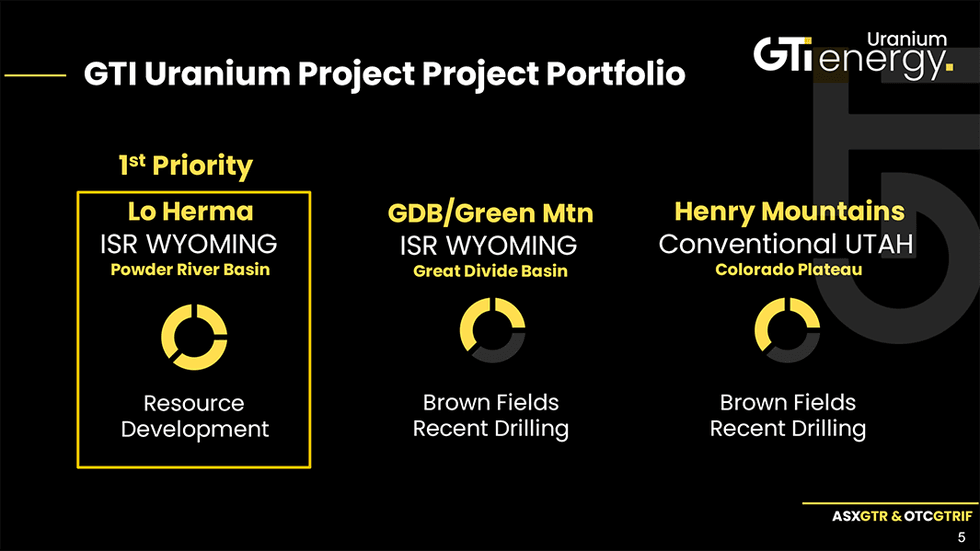

Key Projects

Wyoming Projects

The Wyoming projects are located in the Powder River & Great Divide Basins in Wyoming and the Henry Mountains (Colorado Plateau) Utah, United States. The Greta Divide Basin projects consist of the Thor, Logray, Loki, Odin, Teebo, Wicket and Green Mountain claims. The approximately 13,000 hectare group of projects is prospective for ISR-amenable sandstone-hosted roll-front uranium. The Wyoming projects are situated 5 to 30 kilometers from Ur-Energy’s Lost Creek ISR plant. The projects are also located near Rio Tinto’s Sweetwater/Kennecott Mill.

GTI Energy’s land holding in the Great Divide Basin was bolstered by the acquisition of the Green Mountain project comprising 5,585 hectares of contiguous ISR uranium exploration claims which abuts the Rio Tinto claims at Green Mountain. Historical drill data and geophysics confirms the presence of major uranium mineralisation at the projects.

Initial drilling at Lo Herma commenced in November 2023 and was completed in December with 26 drill holes successfully verifying the historical Lo Herma drill hole database. A drilling permit amendment is currently in progress aiming to optimise follow-up drilling, increase the total number of drill holes, and construct monitoring wells for groundwater data collection. Drilling is expected to resume by July 2024 with an enlarged program, and the mineral resource estimate and exploration targets are expected to be updated in the fourth quarter of 2024.

The company began initial exploration on Thor in 2021, and in 2022, it completed an additional 103 mud rotary exploration drill holes. The drilling of 70 holes was previously reported at the Thor prospect and an additional 33 holes combined have now been completed at the Odin, Teebo and Loki prospects. These 33 holes have discovered an additional combined 4.26 kilometers of ISR amenable uranium mineralised roll front trends increasing the total trend length for GTI’s projects in the Basin to 12.07 kilometers.

In February 2023, GTI Energy secured, by staking, approximately 3,500 hectares of unpatented mineral lode claims known as the Lo Herma project, about 16 kilometers from Cameco’s Smith Ranch-Highland ISR Uranium facility and Energy Fuels Nichols Ranch ISR plant. Lo Herma also lies within 97 kilometers of the companies leading the restart of uranium production in the USA, including Uranium Energy, Ur-Energy, Energy Fuels, Encore Energy and Peninsula Energy.

The company subsequently, secured a material historical data package for the project, which allowed GTI Energy to report a maiden uranium resource and exploration target update at the Lo Herma ISR project, including a cut-off grade of 200 parts per million (ppm) uranium oxide and a minimum grade thickness (GT) of 0.2 per mineralised horizon as 4.12 million tonnes of mineralisation at an average grade of 630 ppm uranium oxide for 5.71 million pounds (Mlbs) of uranium oxide contained metal. The inferred mineral resource estimate is 5.71 Mlbs uranium oxide at an average of 630 ppm.

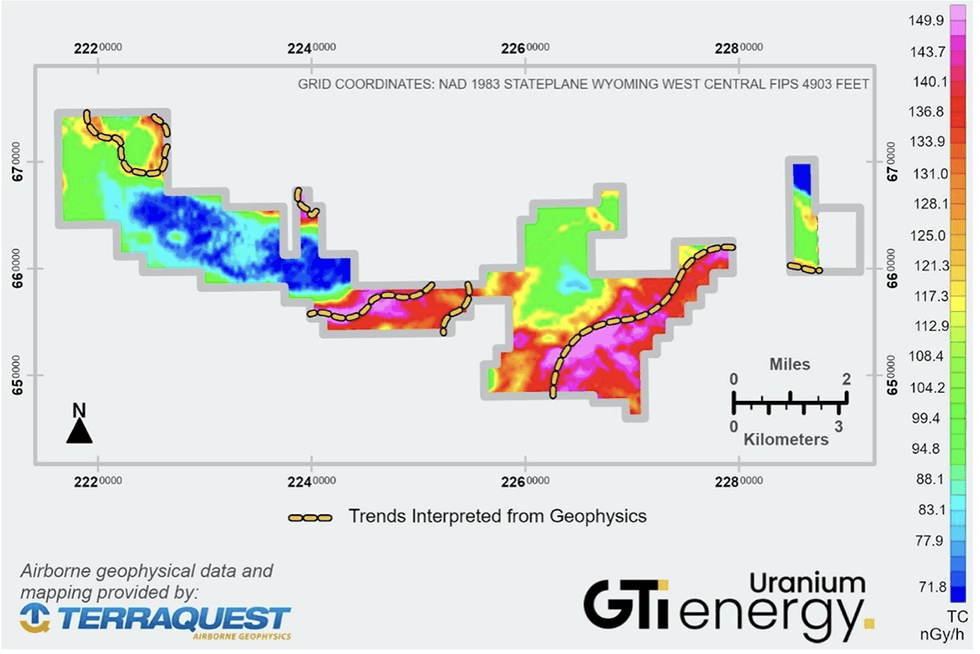

The company also completed collection of aerial geophysical data at its Lo Herma, Green Mountain and Loki West ISR uranium exploration projects in Wyoming. The survey was conducted using a twin-engine aircraft loaded with a suite of sensors that provide detailed radiometric, magnetic and electromagnetic data, allowing for correlation between the three products.

The airborne geophysical survey at its Green Mountain project consequently updated its drill plan with 16 potential drill holes. The permit application process is underway for the 2024 drill program which aims to test the validity of the historical Kerr McGee drill hole maps, as well as the interpreted mineralised regions as determined from the airborne geophysical survey.

Henry Mountains Uranium Project

GTI’s uranium/vanadium projects in Utah are considered suitable for conventional mining and are located on the east flank of the Henry Mountains, covering 3,860 acres. The permits host historical production, open underground workings and have an exploration permit in place. The projects saw significant work from 2019 to 2021 including two drill programs totaling 52 drill holes and geophysical logging of an additional 76 historical drill holes. GTI subsequently elected to prioritise work at its newly acquired Wyoming ISR projects until such time as activity and investment in the region improves. The company’s projects lie within ~100 miles of Energy Fuels’ (NYSE American: UUUU) (TSX: EFR) White Mesa Mill and within a few miles of Anfield Energy’s (TSX.V: AEC) Shootaring (Ticaboo) mill site. The owners of both of these mills are actively pursuing mill re-starts.

In addition, Western Uranium & Vanadium (CSE:WUC) (OTCQX:WSTRF) has announced the purchase of a mill site in Green River Utah and work to design and permit the facility for processing uranium and vanadium. The plant, which will be located ~80 miles from GTI’s projects, is intended to process feed from Western’s recently restarted Sunday Mine Complex over 160 miles away. Western advised of a mine operations restart at Sunday in February 2024. Western stated its new “mineral processing plant” will recover uranium, vanadium and cobalt from ore from Western’s mines and that produced by other miners. Western said, on February 13, 2024, it expects the plant to be licensed and constructed for annual production of 1 million pounds U3O8 and 6 million pounds of V2O5, with initial production in 2025.

Based on the renewed interest in exploration, mining, and processing of uranium ore in this region, GTI is currently evaluating potential paths for further exploration, resource development, or other value creating activities with its Utah projects.

Management Team

Nathan Lude – Non-executive Chairman

Nathan Lude has broad experience working in the asset and fund management, mining, and energy industries. Lude is the founding director of Advantage Management, a corporate advisory firm. Lude has previously held directorships with ASX-listed mining companies.

Currently, he is the executive director of ASX-listed Hartshead Resources (ASX:ANA). Lude has grown a large business network across Australia and Asia, establishing strong ties with Australian broking firms, institutions, and Asian investors.

Bruce Lane – Executive Director

Bruce Lane has significant experience with ASX-listed and large industrial companies. Lane has held management positions in many global blue-chip companies as well as resource companies and startups in New Zealand, Europe and Australia. He holds a master’s degree from London Business School and is a graduate member of the Australian Institute of Company Directors. Lane has led a number of successful acquisitions, fund raising and exploration programs of uranium and other minerals projects during the last 15 years most notably with ASX listed companies Atom Energy Ltd & Stonehenge Metals Ltd & Fenix Resources Ltd (FEX).

James (Jim) Baughman – Executive Director

James Baughman is a highly experienced Wyoming uranium geologist and corporate executive who will help guide the company’s technical and commercial activities in the US. Baughman is the former president and CEO of High Plains Uranium (sold for US$55 million in 2006 to Uranium One) and Cyclone Uranium.

Baughman has more than 30 years of experience advancing minerals projects from grassroots to advanced stage. He has held senior positions (i.e., chief geologist, chairman, president, acting CFO, COO) in private and publicly traded mining & mineral exploration companies during his 30-year career.

He is a registered member of the Society of Mining, Metallurgy, Exploration and a member of the Society of Economic Geologists with a BSc in geology (1983 University of Wyoming) and is a registered professional geologist (P. Geo State of Wyoming). Baughman is a registered member of the Society of Mining, Metallurgy, and Exploration (SME) and a qualified person (QP) on the Toronto Stock Exchange (TSX) and Australian Stock Exchange (ASX).

Petar Tomasevic – Non-executive Director

Petar Tomasevic is the managing director of Vert Capital, a financial services company specializing in mineral acquisition and asset implementation. He has worked with several ASX-listed companies in marketing and investor relations roles. Tomasevic is fluent in five languages. He is currently appointed as a French and Balkans language specialist to assist in project evaluation for ASX-listed junior explorers. Most recently, he was a director at Fenix Resources (ASX:FEX), which is now moving into the production phase. He was involved in the company’s restructuring when it was known as Emergent Resources. Tomasevic was also involved in the company’s Iron Ridge asset acquisition, the RTO financing, and the development phase of Fenix’s Iron Ridge project.

Matt Hartmann – President of US Operations

Matt Hartmann is an executive and technical leader with more than 20 years of international experience and substantial uranium exploration and project development experience. He first entered into the uranium mining space in 2005 and followed a career path that has included senior technical roles with Strathmore Minerals and Uranium Resources. He is also a former principal consultant at SRK Consulting where he provided advisory services to explorers, producers and prospective uranium investors. Hartmann’s ISR uranium experience has brought him through the entire cycle of the business, from exploration, project studies and development, to production and well field reclamation. He has provided technical and managerial expertise to a large number of uranium ISR projects across the US including, Smith Ranch – Highland ISR Uranium Mine (Cameco), Rosita ISR Uranium Central Processing Plant and Wellfield (currently held by enCore Energy), the Churchrock ISR Uranium project (currently held by Laramide Resources), and the Dewey-Burdock ISR Uranium project (currently held by enCore Energy).

Matthew Foy – Company Secretary

Matthew Foy is an active member of the WA State Governance Council of the Governance Institute Australia. Foy has more than 14 years of experience in facilitating ASX-listing rule compliance. His core competencies are in the secretarial, operational, and governance disciplines for publicly listed companies. Foy has a working knowledge of the Australian Securities and Investments Commission and Australia Stock Exchange reporting. He has document drafting skills that provide the basis for valuable contributions to the boards on which he serves.

Credit: Source link