Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

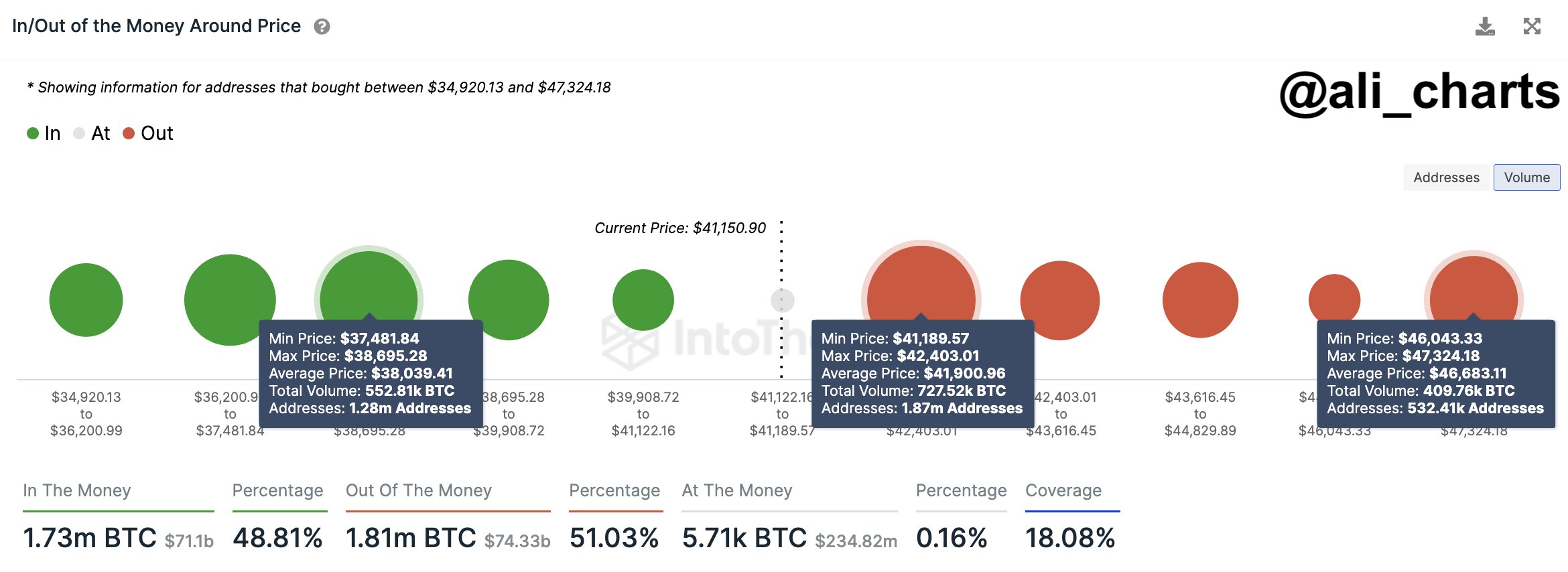

In a recent analysis, renowned crypto analyst Ali Martinez sounded the alarm as Bitcoin (BTC) slipped below a critical supply zone, ranging from $41,200 to $42,400.

Martinez, utilizing on-chain data from IntoTheBlock, highlighted that 1.87 million addresses, holding a substantial 730,000 BTC, were accumulated in this precarious territory.

The downturn has raised concerns about potential sell-offs as holders may seek to cut losses, increasing selling pressure. Martinez forewarns of a potential decline to the next demand zone, situated between $37,500 and $38,700, where 1.28 million addresses hold 553,000 BTC.

Despite these warnings, a twofold situation emerges. Martinez’s analysis reveals that buyers in profit are concentrated at levels approximately 7% below current market levels.

The question then arises: If holders at a loss begin selling, triggering a pullback to $38,700, will buyers show interest in this chaotic market where unexpected “black swan” events are always a possibility?

Gap

Adding to the cautionary outlook, another market indicator, the Bitcoin futures chart on the CME, points toward a potential fall. A gap, ranging from $39,640 to $40,325 per BTC, was formed in early December, and such gaps are generally expected to be closed, according to common sense.

If history repeats itself, this gap could be filled as part of a bearish move, reinforcing the possibility of a descent to the $37,500 mark.

Bulls are holding tight, but the looming challenges may put their resilience to the ultimate test.

Credit: Source link