This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

The International Court of Justice in an interim ruling ordered Israel to limit harm to Palestinians in Gaza in a politically explosive case brought by South Africa that alleges the country is committing genocide. The court stopped short however of granting South Africa’s request that Israel should “immediately suspend” its military operations. The case is seen as a test for international justice.

The FT revealed that Elon Musk’s xAI start-up was in talks to raise up to $6bn, as the Tesla and X chief looks to global investors to finance his challenge to Microsoft-backed OpenAI.

The International Energy Agency warned of gas price volatility as conflict in the Middle East and Ukraine created an “unusually wide range of uncertainty” in its forecasts. The US, the world’s biggest exporter of liquefied natural gas, paused approvals for new LNG export terminals under pressure from climate campaigners.

For up-to-the-minute news updates, visit our live blog

Good evening.

News today that the Federal Reserve’s preferred measure of US inflation fell below 3 per cent for the first time since 2021 caps a week of encouraging news for the US economy, raises the prospects of interest rate cuts and delivers a boost to President Joe Biden in his quest for re-election.

The core personal consumption expenditure index rose an annual 2.9 per cent in December, down from 3.2 per cent the previous month. The headline measure, including more volatile food and energy prices, held steady at 2.6 per cent. The core reading provides some reassurance that inflation is waning after disappointing readings from the more widely followed consumer price index.

Today’s data follows yesterday’s much stronger-than-expected growth figures for the final quarter of 3.3 per cent, capping off a “standout” performance for the year with growth of 3.1 per cent, confirming the US was the world’s fastest growing advanced economy in 2023.

Treasury secretary Janet Yellen said the strong GDP data did not raise “inflationary concerns” after some people expressed fears that demand would remain too strong to bring inflation back to the Fed’s target of 2 per cent without further rate rises.

As economics commentator Chris Giles notes, the Fed, ahead of its policy meeting next Wednesday, is probably in the best position among its central bank peers to cut interest rates because inflation is moderating without an economic downturn.

Business indicators also look benign for President Biden.

January’s PMI survey results for manufacturing and services, published on Monday, were better than expected as business benefited from improved operating conditions and cooling inflation.

US consumer confidence also appears to be healthy after hitting a five-month high in December, a factor confirmed by this week’s earnings update from Procter & Gamble. The household products bellwether reported unexpectedly strong growth in demand even after pushing through further price increases.

Government and Fed officials had been worried that companies were getting used to passing on large price rises to their customers, undermining their efforts to tame inflation.

Biden still has many obstacles to overcome in his bid for re-election, not least a “polycrisis” of political problems from the Middle East to Ukraine — as well as a resurgent Donald Trump, who now looks nailed on to be his opponent in November.

Biden has also struggled to convince Americans that the economy is back on track, despite indicators showing progress. He will though be encouraged by a new poll from Pew Research that shows — finally — that US voters are becoming more optimistic.

Need to know: UK and Europe economy

UK chancellor Jeremy Hunt’s hopes of offering big pre-election tax cuts have hit a snag: internal Treasury forecasts suggest he will have only limited scope for giveaways. Opposition leader Sir Keir Starmer accused the Conservatives of “trying to salt the ground” by leaving the next government with painful spending cuts and grim public finances. There was better news for Hunt in data showing UK consumer confidence hitting a two-year high in January.

Our new series on the infrastructure challenges facing the UK begins with a look at second-city Birmingham as an example of how chronic under-investment outside London and the south-east has contributed to regional inequality and poor productivity.

The European Central Bank held interest rates steady at 4 per cent, signalling that inflation was falling as expected. Central banks in Japan, Canada and Norway also left policy unchanged this week, with similar outcomes expected from the Fed and the Bank of England next week.

As we reported in Wednesday’s DT, the costs of nuclear power pose a huge headache for governments. Paris is now pressing the UK to help plug a multibillion-pound hole in the budget of projects being built in Britain by France’s electricity operator EDF.

Need to know: global economy

China said that Ian Stones, a British consultant who disappeared five years ago, was convicted in 2022 of “illegally providing intelligence” to overseas parties and sentenced to a five-year prison term.

“Opportunistic” Chinese shipping lines have been redeploying their vessels to serve the Red Sea and the Suez Canal as they try to exploit China’s perceived immunity from the Houthi attacks that have driven operators out of the area.

Arati Prabhakar, the White House science chief, said the US would work with China on the safety of artificial intelligence systems despite trade tensions. Agreement is sorely needed: the FT Magazine lays out how AI-aided disinformation could lead to disaster as fakes and forgeries swamp the world.

A political furore has broken out in South Korea over a $2,000 Dior handbag gifted to its first lady. Kim Keon Hee, wife of President Yoon Suk Yeol, received the bag from a Korean-American pastor, triggering an investigation into whether the presidential couple had been violating anti-bribery laws.

Need to know: business

Shares in LVMH surged after the world’s biggest luxury goods group reported better than expected quarterly sales, boosting hopes that the sector can avoid a slowdown in 2024. The decision on who succeeds ruling clan chief Bernard Arnault is still in the balance.

The US aviation regulator blocked Boeing expanding production of its most popular plane after a door panel blew out of a 737 Max 9 in mid-flight earlier this month. Boeing chief Dave Calhoun’s leadership is under increasing pressure. Airline profits are likely to be dented by the Max 9 groundings.

The UK car industry gave an upbeat assessment of its future after securing £24bn of new investment last year, more than the combined total for the past seven years. After years of curtailed spending owing to Brexit uncertainty and political instability, Nissan, Jaguar Land Rover, Tata and BMW all made big announcements.

For electric-car maker Tesla the message was quite different. The company’s shares plunged after warning that sales growth would be “notably lower” this year because of flagging demand, intensifying competition and high interest rates.

Slowing demand in China for electric vehicles meanwhile has led to a steep drop in lithium prices, a key battery component. They are now at their lowest level since 2020.

Bollywood is banking on another star-studded blockbuster to extend its box office revival that has lifted revenues to all-time highs and pulled the giant entertainment industry out of a historic slump after a series of pandemic-era flops.

The streaming wars are over and Netflix won. That’s the view of the Lex column (for Premium subscribers only), which says streaming remains an expensive business with low revenue per subscriber.

Science round up

The major drought that hit the Amazon rainforest last year was mainly due to climate change rather than naturally occurring weather patterns, according to a new study.

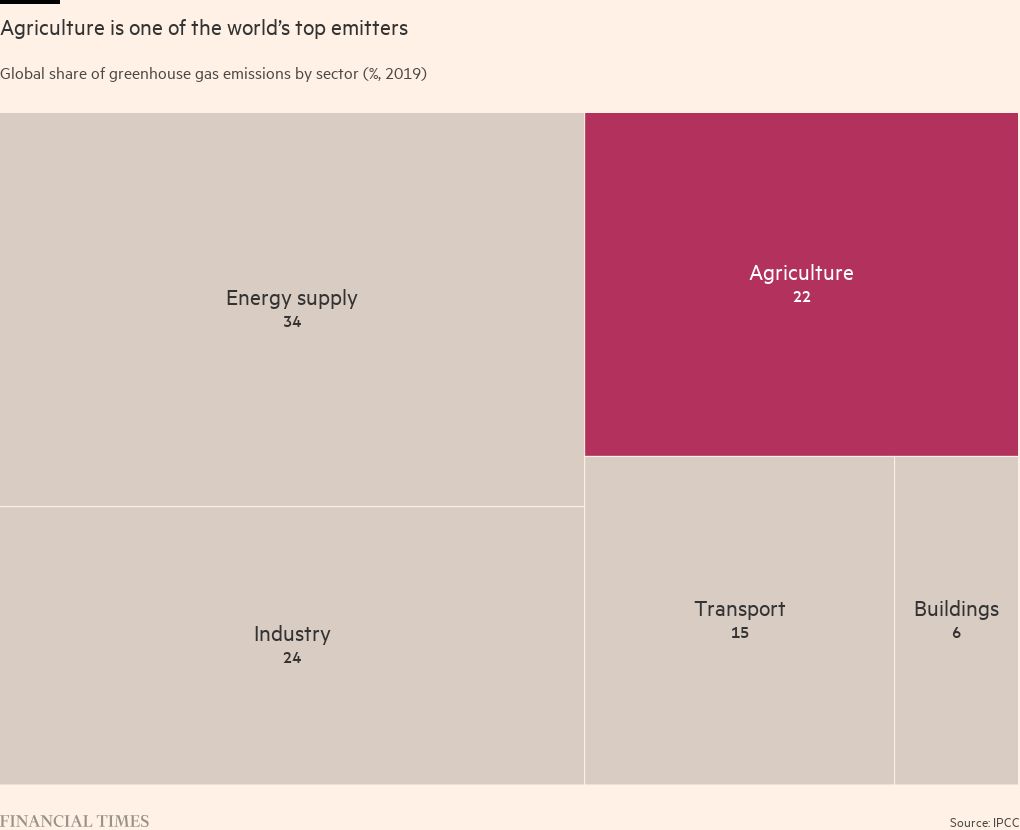

“Regenerative agriculture” — improving soil quality by better stewardship and planting more diverse temporary pasture — is being touted as an effective way of cutting greenhouse gas emissions. A Big Read assesses whether the claims stack up.

New research shows carbon credits from cookstove emissions, used by companies including Shell and British Airways to justify their own pollution, are largely worthless.

A commercially available blood test has boosted hopes of early diagnosis of Alzheimer’s. The disease, a type of dementia, is currently diagnosed through invasive and expensive tests such as a lumbar puncture to release spinal fluid or through a tomographic scan.

The first malaria vaccination campaign for children backed by the World Health Organization began this week in Africa. Nearly 30mn jabs will be administered in up to 12 countries in the coming months, beginning with a medicine developed by UK pharma company GSK.

The UK is hoping to secure a major new vaccines investment by AstraZeneca with a possible state aid package worth tens of millions of pounds, in a potentially huge boost to the country’s life sciences sector.

The chair of the G7-backed group urged governments and business to invest as much on preparing for other potential pandemics as they have on Covid-19 research to avoid costly lockdowns. Nine other high-risk pathogens have been identified as threats by the World Health Organization.

Some good news

US researchers have high hopes that a new drug, originally developed as a potential cancer treatment, could shrink kidney cysts. Polycystic kidney disease affects more than 12mn people around the world, with many patients needing dialysis or a kidney transplant by the time they reach their 60s.

Recommended newsletters

Working it — Discover the big ideas shaping today’s workplaces with a weekly newsletter from work & careers editor Isabel Berwick. Sign up here

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

Credit: Source link