Bitcoin Layer-2 (L2) solutions have recently garnered significant attention within the crypto community. However, a new report highlights potential challenges regarding their long-term viability.

Layer-2 solutions aim to enhance the Bitcoin blockchain’s scalability and speed by processing transactions off the main chain. Despite their promise, these solutions might encounter issues related to high data posting costs.

High Data Costs Could Hinder Bitcoin Rollups’ Long-Term Viability

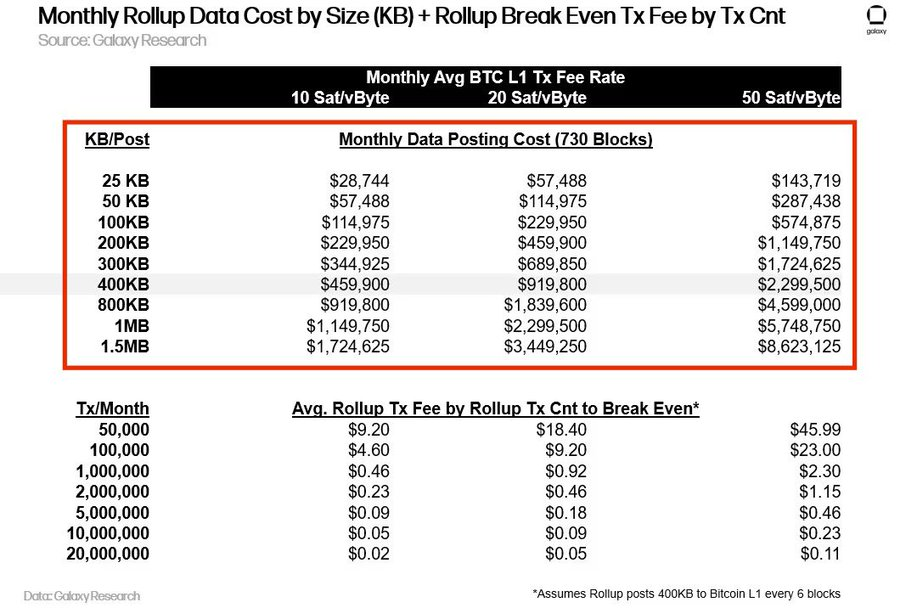

According to Galaxy Research, Bitcoin rollups, which rely on Bitcoin for data availability, may struggle with elevated data posting costs. The limited 4MB blockspace on the Bitcoin network creates a scarcity that could impact these solutions.

Rollups often need to post ZK-Proof outputs and state differences every 6-8 blocks. Each transaction can use up to 400KB (0.4MB) of blockspace, potentially consuming 10% of a full block. This high usage could lead to substantial costs if rollups utilize the entire 4MB.

For context, Galaxy Digital noted that the Taproot Wizards team’s first 4MB Bitcoin transaction (block 774,628) incurred a fee of $147,000. So, for these activities to be sustainable, the L2 solutions must generate significant revenue from transaction fees. However, a higher revenue requirement could increase transaction fees, possibly making them unaffordable for some users.

Alex Thorn, the head of research at Galaxy Research, explained that competition for Bitcoin blockspace might drive up Layer-1 (L1) transaction fees, affecting all users, including rollups. He furthered that a rollup posting its data to Bitcoin directly could be spending an average of $27.6 million annually or more.

“Our research suggests there are 65 such projects currently in development, but both blockspace & fee markets make it impossible for them all to launch. Only the strongest [will] survive,” Thorn stated.

Read more: A Beginner’s Guide to Layer-2 Scaling Solutions

Considering this, Galaxy Digital predicted that Bitcoin rollups might seek partnerships with Bitcoin miners for guaranteed block inclusion or use fee rate derivatives and alternative mining deals to manage volatile fee spikes. Some Bitcoin L2s could explore Layer-3 environments for transaction execution and combine L2s with Bitcoin L1 for data availability.

Meanwhile, Alexei Zamyatin, co-founder of Build on Bob, disagrees with the concerns raised. He argues that rollups might avoid these issues by using Optimistic Rollups, which could offer a more scalable solution with less frequent data posting on the main chain.

“Bitcoin rollups will likely have to use optimistic verification. Posting data to L1 is great but it’s a vanity metric if this explodes costs,” Zamyatin asserted.

Read more: Layer-2 Crypto Projects for 2024: The Top Picks

Despite these concerns, the popularity of Bitcoin L2s continues to rise. In the second quarter of 2024 alone, Bitcoin L2s collectively raised $94.6 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Credit: Source link