Binance, the world’s leading cryptocurrency exchange, has recently announced a significant milestone – surpassing $100 billion in user funds. This achievement is the first since the implementation of proof-of-reserve disclosures in November 2022.

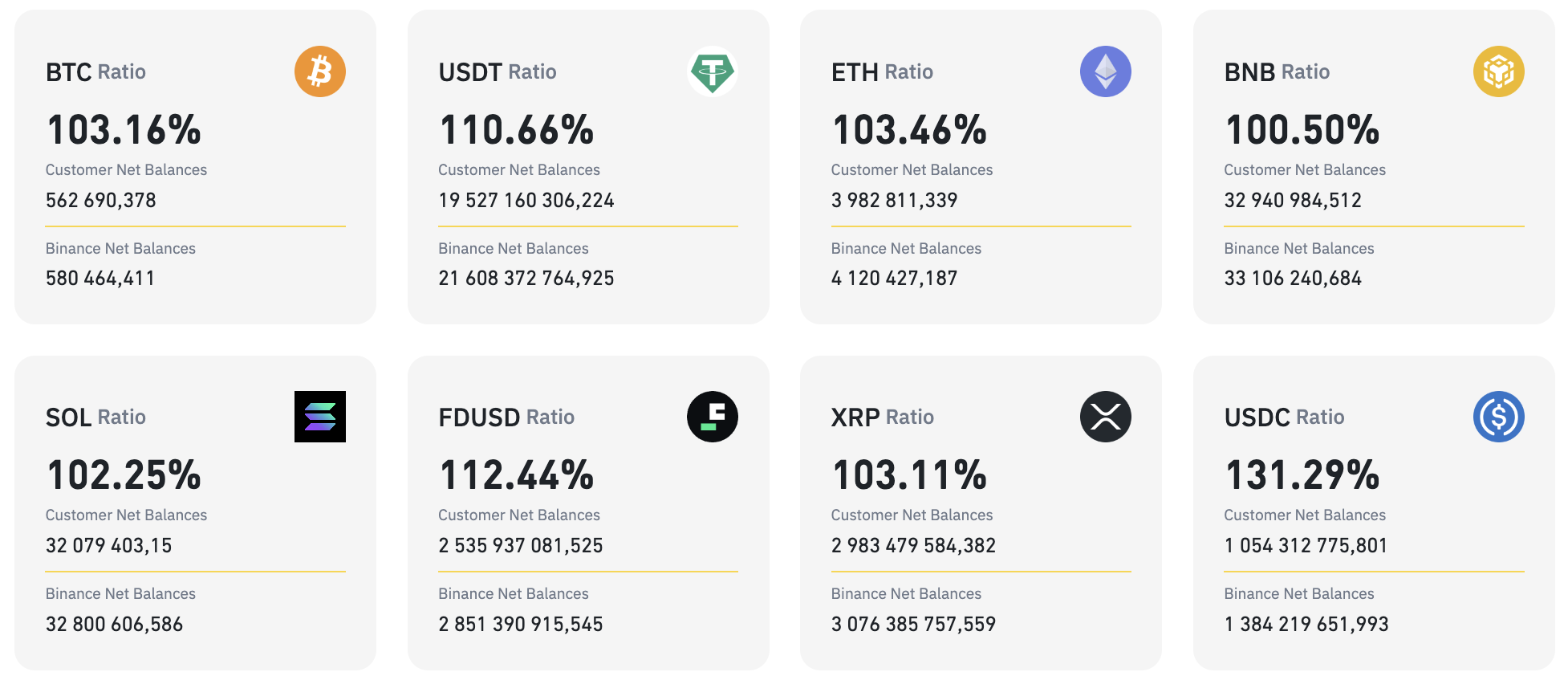

A breakdown of the funds reveals Bitcoin as the dominant asset, with over 562 million BTC held by users on the exchange. Binance maintains a coverage ratio of 103.16%, highlighting its commitment to ensuring the security and integrity of user assets. Other prominent cryptocurrencies such as USDT, Ethereum (ETH) and BNB also contribute substantially to the platform’s asset pool.

Notable among the holdings is Shiba Inu (SHIB), with users entrusting approximately $1.9 billion worth of the cryptocurrency to Binance. This reflects the growing popularity of SHIB and its integration into Binance’s diverse ecosystem.

Too big to fail?

Binance’s achievement of surpassing $100 billion in user funds reaffirms its position as a key player in the cryptocurrency industry. With a focus on transparency, security and innovation, the exchange continues to attract users worldwide.

At the same time, as its platform grows, Binance is also attracting increased attention from regulators. Recall that in February of this year, the court approved a plea bargain for the exchange, according to which it must pay a fine of $4.3 billion. As part of the deal, the company must monitor compliance via an independent firm for five years.

Meanwhile, U.S. prosecutors have asked that the former Binance CEO remain in the country until the sentencing hearing on April 30.

Credit: Source link