Carl Icahn is one of the most famous investors in history. Throughout the 1980s and 1990s, he became known as a corporate raider, buying up big stakes in companies in an attempt to force change. Over the decades, he has accumulated a multibillion-dollar fortune.

Icahn has never shied away from making big bets. Right now, he has nearly his entire fortune — some $6.3 billion — tied up in a single stock. Shares are currently priced at historic lows, possibly making this a lucrative way to bet alongside a legendary billionaire investor.

Billionaire Carl Icahn is betting on himself

It should come as no surprise that Carl Icahn has the majority of his money tied up in a company named after himself: Icahn Enterprises (NASDAQ: IEP). Incorporated in 1987, Carl Icahn has long used Icahn Enterprises as his main investment vehicle. He currently owns more than 80% of the company, a stake worth roughly $6.3 billion. In essence, Carl Icahn is fully in control of Icahn Enterprises, and the company’s stock price is a direct result of his long-term decision-making abilities.

Icahn Enterprises is a conglomerate business. That means it’s a conglomeration of disparate businesses, much of which have nothing to do with each other. As of last quarter, the net asset value of these businesses totaled around $4.8 billion. Some of that net asset value is comprised of various real estate assets, as well as a handful of industrial and automotive businesses. Around two-thirds of the value, however, is tied up in just two things: a stake in CVR Energy, an oil refiner, and a holding interest in Carl Icahn’s investment funds, which operate separately from the company. So, while Carl Icahn has diversified the operation somewhat, it is heavily reliant on the performance of both CVR Energy and his investment funds.

Carl Icahn is likely well aware that Icahn Enterprises has concentrated its bets. These bets seem to represent the two areas in which he has the highest conviction. With a long-term track record of producing multibillion-dollar fortunes, investors can instantly bet alongside Carl Icahn simply by purchasing shares of Icahn Enterprises.

One problem that doesn’t make very much sense

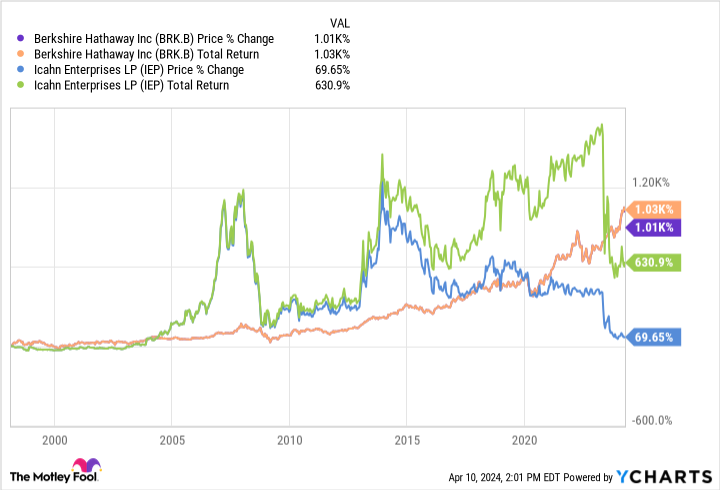

It’s a reasonable strategy to invest alongside legendary billionaire investors. Just look at Berkshire Hathaway. Patient investors who trusted Warren Buffett have compounded double-digit annual returns for decades. But Icahn Enterprises isn’t Berkshire Hathaway. Not even close. Since 1998, Berkshire Hathaway stock has risen more than 1,000% in value. Icahn Enterprises stock, meanwhile, has added just 69% in value. The company, however, has paid a regular stream of big dividends. Those dividends close the gap significantly, with Icahn Enterprises delivering a 630% total return over that period. But there’s still no denying that Berkshire Hathaway has proven a superior long-term investment with far less volatility. Plus, if you had reinvested your Icahn Enterprises dividends back into Icahn Enterprises stock, your total returns would have been well below 630%.

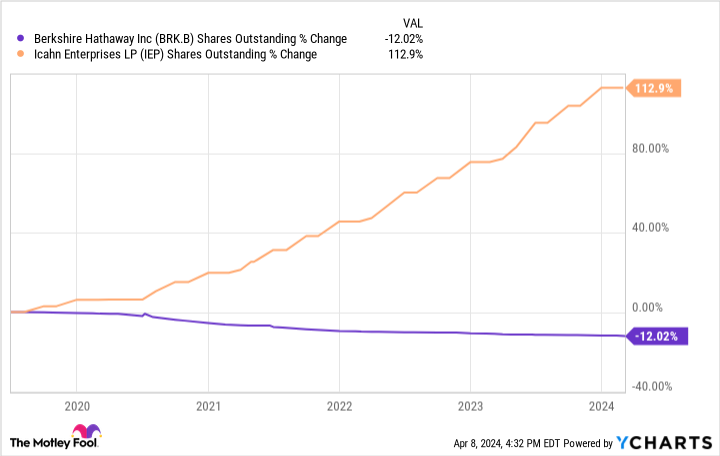

Why, then, does Icahn Enterprises stock seem to trade at a premium to Berkshire Hathaway? On a price-to-book basis — a very simple metric that gauges how much the market is willing to pay for a company’s assets — Icahn Enterprises currently trades at 2.3 times book value. Berkshire, meanwhile, trades at just 1.6 times book value. There’s even reason to believe that Berkshire’s price-to-book multiple is overinflated, given that the company has repurchased tens of billions of dollars in shares over the years. Those repurchases created a lot of shareholder value, but due to accounting rules, they have suppressed the company’s true book value. Icahn Enterprises, meanwhile, has been issuing new shares hand over fist. Over the last five years, its share count has exploded by 112%.

It’s hard to justify buying Icahn Enterprises over Berkshire Hathaway, especially given the premium valuation. Looking at Icahn Enterprises’ portfolio of businesses, it’s hard to argue that anything should be valued above book value. The value of the company’s interest in Carl Icahn’s investment funds, for example, went from $4.2 billion last year to just $3.2 billion today. Its stake in CVR Energy, meanwhile, which should be valued near book value since it’s a publicly traded asset, has fallen in value from $2.2 billion to only $2 billion over the same time period. The rest of Icahn Enterprises’ assets aren’t faring much better. One of its automotive businesses, for example, entered bankruptcy last summer.

Carl Icahn is betting huge sums of money on Icahn Enterprises, but that’s likely because he has to. The company’s value would likely collapse if he suddenly tried to sell all his shares. Because shares trade at an inexplicable premium to Warren Buffett’s Berkshire Hathaway, investors are likely better off betting with that billionaire than this one.

Should you invest $1,000 in Icahn Enterprises right now?

Before you buy stock in Icahn Enterprises, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Icahn Enterprises wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of April 8, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

Billionaire Investor Carl Icahn Is Betting $6.3 Billion on This 1 Stock was originally published by The Motley Fool

Credit: Source link