With the Federal Reserve having raised short-term fed fund rates 11 times over the past 18 months, bringing them to a range between 5.25% and 5.5% – their highest levels in 22 years – these aggressive actions are yielding results. Inflation has continued to cool down throughout this year, with the annual growth of the consumer price index falling to 3% in June, marking its lowest point since March 2021.

However, despite these positive outcomes, billionaire investor Howard Marks is sounding a warning for U.S. companies. In a recent Bloomberg interview, the co-founder of $179 billion Oaktree Capital Management cautioned that these sky-high interest rate hikes are about to hit businesses hard. He anticipates that more companies are likely to default on their debt repayments as borrowing cash has become substantially more expensive.

“When you go through a period when it’s super easy to raise money for any purpose or no purpose, and you go into a period when it’s difficult to raise money even for a good purpose, clearly many more companies are going to founder,” Marks opined.

While Marks is worried about the economic impact of high-interest rates, his investment portfolio suggests he is well-positioned to navigate further economic challenges. Marks has substantial holdings in two high-yield dividend stocks, one of which offers a solid 11% yield.

In fact, it’s not only Marks who favors these names. Using the TipRanks database, we found that both are also rated as ‘Strong Buys’ by the analyst consensus. Let’s take a closer look.

Sitio Royalties Corp. (STR)

For our first Marks-endorsed name, we’ll get the lowdown on Sitio Royalties, a company that specializes in the management and monetization of mineral and royalty interests in the energy sector.

Its core business model revolves around acquiring and holding interests in oil, natural gas, and mineral rights, allowing the company to benefit from the production and exploration activities of energy companies. By leveraging its extensive knowledge of the energy industry, Sitio strategically invests in properties with significant resource potential, generating a steady stream of income through royalty payments.

Focusing on high-quality U.S. basins, to-date, the firm has notched over 190 acquisitions, with plenty of activity also taking place this year. On the recent Q2 earnings call, the company said that since the end of Q1, it had closed multiple accretive Permian Basin acquisitions for a total of $247.9 million. Sitio made these acquisitions with 27% equity and 73% cash.

The latest readout wasn’t wholly positive, however. While revenue increased by 50.2% year-over-year to $136.46 million, it fell short of consensus expectations by $8.84 million. Additionally, on account of a $25.6 million non-cash impairment charge, the company recorded a net loss of $3.0 million in the quarter, a $50.7 million drop compared to 1Q. The company also lowered its dividend payout from $0.50 per share to $0.40, although that still yields a nice 6.07%.

Meanwhile, Marks remains heavily invested here. He owns 12,935,120 STR shares, which currently command a market value of about $341 million.

Stifel analyst Derrick Whitfield is also on board and sees much to like about the firm. He writes, “In our view, Sitio offers investors exposure to the best geology in the Lower 48 while maintaining geographic and operator diversification. Qualitatively, Sitio offers investors scale and a differentiated focus on acquiring minerals in the core of major oil basins with the lowest cost of supply under quality operators. In our view, the company’s highly targeted acquisition strategy provides it with advantaged visibility into the prospects of near- and medium-term development irrespective of commodity volatility and political environment.”

“Quantitatively, we estimate Sitio can return 100% of its enterprise value by 2030, offering significant value now and potential upside in the future. Overall, the company’s technical expertise and ability to take advantage of accretive deals in the near term with ground game capital provide a differentiated investment opportunity,” Whitfield further added.

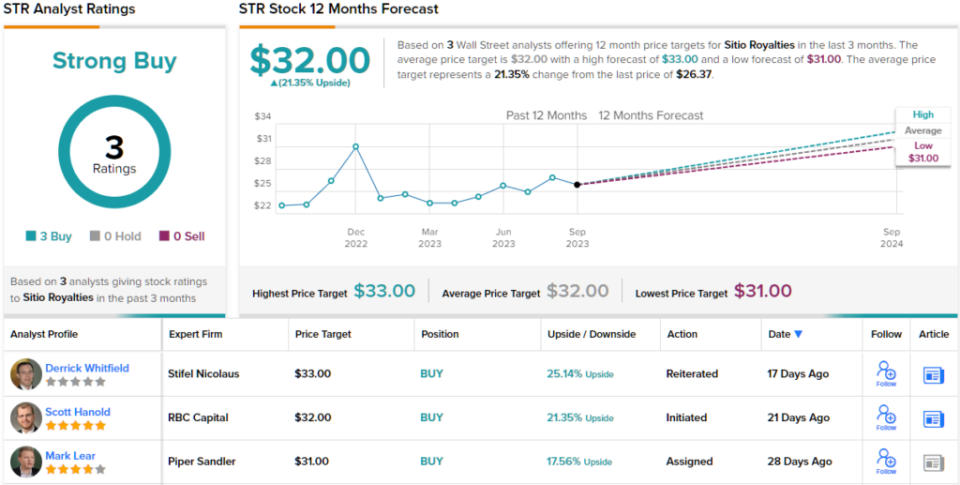

Accordingly, Whitfield rates the shares a Buy, while his $33 price target makes room for 12-month returns of 25%. Based on the current dividend yield and the expected price appreciation, the stock has ~31% potential total return profile (To watch Whitfield’s track record, click here)

Overall, two other analysts have recently chimed in with STR reviews, and both are also positive, making the consensus view here a Strong Buy. The $32 average target is only slightly lower than Whitfield’s objective and represents upside of 21% from current levels. (See STR stock forecast)

Oaktree Specialty Lending (OCSL)

Next up on our Marks-backed list, we have Oaktree Specialty Lending. As its name implies, this business development company (BDC) operates in the world of specialty finance and lending, primarily focusing on providing customized financing solutions to middle-market companies in various industries.

As its name also suggests, it is managed by Oaktree Capital Management, founded by Howard Marks, who took over the BDC in October 2017. Marks’ holdings here stand at 1,852,456 shares, representing over $37.4 million at the current share price.

The company’s investment portfolio encompasses a wide range of debt instruments, including senior secured loans, subordinated debt, and equity co-investments, allowing it to tailor its financing offerings to meet the specific needs of its clients. OCSL has a diverse mix of companies in its portfolio, with software leading the way at 18%, followed by specialty retail at 5.2% and real estate management at 4.4%.

On the financial side, given an increase in non-accrual investments, its credit metrics suffered in the recently reported fiscal third quarter (June quarter). Although total investment income rose by 61.5% year-over-year to $101.9 million, the figure just missed Street expectations – by $0.73 million. Adj. EPS of $0.62 also slightly missed the analysts’ forecast by $0.01.

Nevertheless, that still managed to cover the main appeal here: a very juicy dividend. The quarterly payout currently stands at $0.55, offering a yield of ~11%.

While cognizant of the issues that slightly marred the Q2 performance, KBW analyst Ryan Lynch points out why this stock deserves a closer look.

“OCSL generated a strong operating ROE of 12.6% and a healthy net income ROE of 9.7%, despite a small uptick in nonaccruals,” Lynch explained. “While OCSL has added a few non-accruals over the past two quarters, we have confidence in the strength of their platform and historical underwriting… Oaktree has a strong, deep, and successful track record navigating and investing in challenging times, which bodes well for navigating this uncertain environment.”

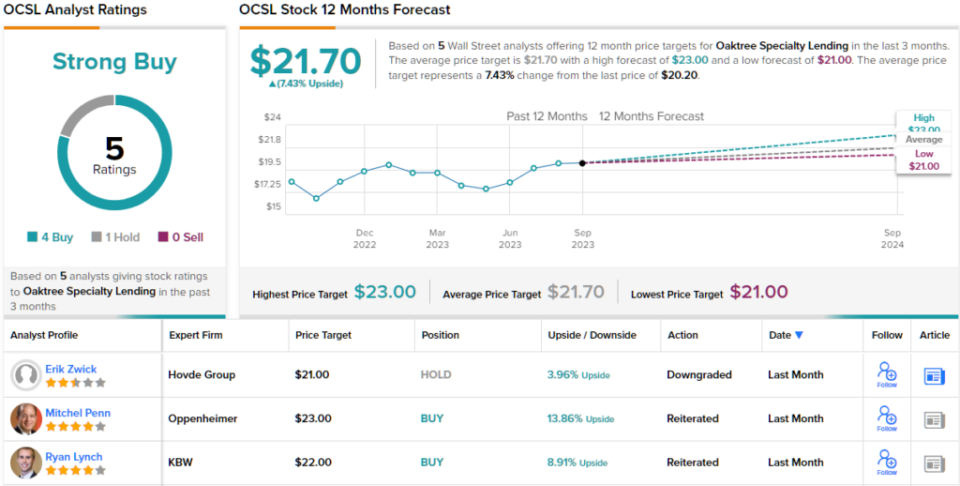

These comments underpin Lynch’s Outperform (i.e., Buy) rating on OCSL, which is backed by a $22 price target. The figure suggests shares will climb ~9% higher in the months ahead. (To watch Lynch’s track record, click here)

Overall, OCSL shares garner a Strong Buy consensus rating, based on 3 Buys vs. 1 Hold. While the $21.38 average target implies only modest gains of 6% for the year ahead, with the addition of an ~11% yield, that figure rises to a more respectable 17%. (See OCSL stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Credit: Source link