Bill Gates is one of the wealthiest people in the world, with an estimated net worth of over $125 billion. Today, the former head of Microsoft runs one of the largest charitable foundations in the world.

Not surprisingly, Microsoft is the foundation’s largest holding at over 30% of its portfolio. However, after increasing its stake in Berkshire Hathaway (NYSE: BRK.B) (NYSE: BRK.A) by over 40% in the second quarter, the conglomerate is now the Gates Foundation’s second-largest position at over 20% of its portfolio, surpassing Waste Management.

The Gates Foundation was not out buying Berkshire stock on the open market. Instead, the shares were gifted to the foundation by Warren Buffett. However, this could very well be the last donation of Berkshire stock to the foundation, as Buffett and Gates’ friendship has cooled recently. Meanwhile, Buffett has said the foundation will no longer receive any donations after his death. That’s a change of heart, as gifts to the charitable organization were originally in his will.

Despite the drama between Gates and Buffett, let’s look at why the Gates Foundation is likely to keep Berkshire as a core position moving forward, and why investors should hold the stock as a core position as well.

Instant diversification

One of the first things that stands out about Berkshire’s stock is that investors are getting instant diversification, both through the conglomerate’s variety of fully owned businesses and through Berkshire’s large investment portfolio.

The company’s foundation is built on its various property and casualty (P&C) insurance holdings, led by Geico and General Re. Insurance accounted for about 40% of Berkshire’s operating profits last year, but that can fluctuate greatly from year to year. What Buffett has long liked about the insurance industry is the float, which is the money insurance companies hold that has not yet been paid out in claims.

In fact, many property and casualty insurers are unprofitable in their underwriting, having higher expenses and claim payouts than they take in through money from premiums. This metric is called the combined ratio, and any number over 100% indicates that a company was unprofitable from its insurance underwriting. Last year, the P&C industry’s net combined ratio was 101.7%, which was actually an improvement from 102.5% the prior year.

However, insurance companies make most of their money by investing their float. Most invest in high-grade bonds, but due to having one of the best investors of all time, Berkshire uses its float to support its huge stock investment portfolio. That said, most years Berkshire turns an underwriting profit as well. Last year, it was an impressive $5.4 billion.

In addition to its insurance and stock holdings, Berkshire owns and operates a range of businesses in various sectors. One of the biggest businesses it owns is railroad BNSF, which accounted for over 13% of its operating income last year and 19% in 2022. Berkshire has also built up a nice energy transmission and utility portfolio. In addition, it owns companies in the manufacturing, retail, apparel, media, and construction spaces.

Overall, Berkshire offers investors a top-run insurance business with a unique investment strategy that sets it apart from any other company in the world.

Solid succession plan in place

What Buffett has created over the past several decades with Berkshire is unique. But the Oracle of Omaha won’t be around forever (he will celebrate his 94th birthday at the end of August).

Buffett can’t be replaced by one individual, which is why when he is gone, Berkshire will hand his duties to several individuals. Vice Chairman Ajit Jain will take over Berkshire’s insurance operations, while Greg Abel will be responsible for Berkshire’s non-insurance businesses. Meanwhile, Todd Combs and Ted Weschler have been under Buffett’s tutelage over the past decade, with both managing a portion of Berkshire’s investment portfolio. Abel, however, will be responsible for all capital allocation and investment decisions.

Buffett has given these individuals direct responsibilities over the years as he has stepped back a bit, so there should be a relatively seamless transition when he eventually passes. While he won’t be replaceable, he has created a unique insurance-backed investment model that will endure long after his death.

A great core holding

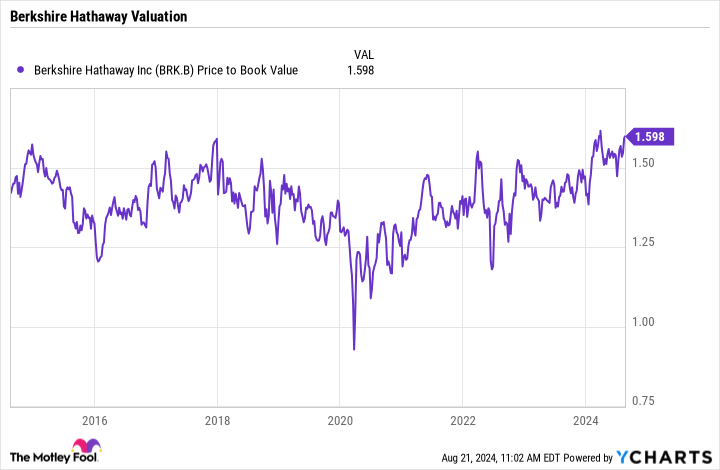

P&C insurance companies are typically valued on a price-to-book (P/B) ratio basis, and by that metric Berkshire’s stock is a bit pricey, trading at 1.6x. In the past, Buffett would look to buy back Berkshire stock when it was below 1.1 times and later 1.2 times P/B, although he later changed course believing the metric didn’t reflect the underlying value of Berkshire’s assets.

While Berkshire’s valuation might be a little pricey by that metric compared to where it has traded historically, the one thing the stock has shown is that it is a long-term winner with a business model that just continues to create value. Even when Buffett is gone, I don’t see that changing.

Berkshire stock should continue to be a core holding for both billionaires like Bill Gates and individual investors alike.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of August 22, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Microsoft. The Motley Fool recommends Waste Management and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaire Bill Gates Has 20% of His Foundation’s Portfolio in This Stock — and It’s Not Microsoft was originally published by The Motley Fool

Credit: Source link