Trading volumes hit an all-time high of $394 million on March 19 as memecoin traders descended on Coinbase’s Layer 2 network.

Activity on Base, the Ethereum Layer 2 network developed by Coinbase, has surged since March 14, with the blockchain processing more than one million transactions per day for the last week.

The spike in activity is probably due to memecoin traders and bots, according to Michael Silberling, a data analyst at Optimism Labs.

“Base saw a rush of activity from transactors that were ~seemingly not fee sensitive,” he wrote on X. “The rush seems to be from more automated actors, targeting memecoins / likely arbitrage.”

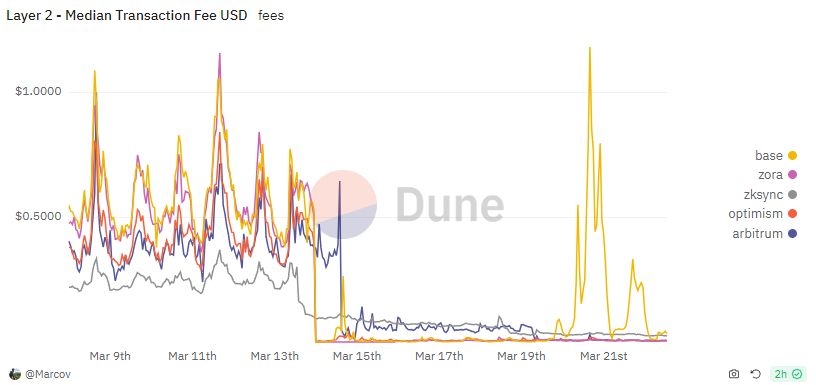

Because memecoin traders are less cost-sensitive than most users, this led to an increase in base fees.

The spike in activity followed the mainnet deployment of Ethereum’s Dencun upgrade, which went live on March 13 and drastically reduced transaction costs on Layer 2s. Still, because of the increased activity, Base also had a spike in transaction costs in spite of the Dencun upgrade’s overall reduction.

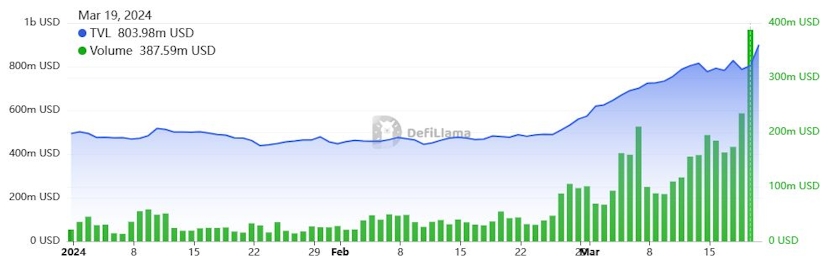

Meanwhile, the total value locked (TVL) on Base has nearly doubled in the past month to $900 million as of March 20, according to DeFiLlama. The increase is mainly attributable to Aerodrome, the leading decentralized exchange on the network, whose TVL is up 180% to $340 million in that span after securing an investment from the Base Ecosystem Fund, led by Coinbase Ventures.

DEX trading volumes are also on the rise, hitting a record $394 million on March 19. Data from DexScreener shows that most of the activity is being driven by memecoins like DEGEN and NORMIE.

Prominent NFT artist XCopy released an open edition called ‘Mutatio’ on March 19. It was minted more than one million times, making it the biggest driver of activity over the 24 hours it was open.

Start for free

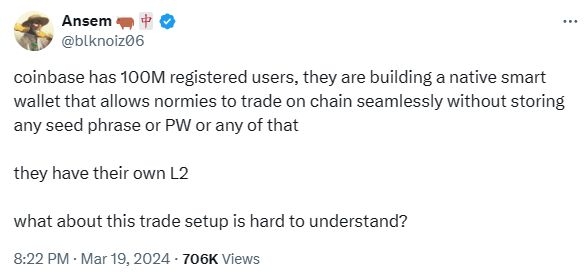

Looking ahead, calls for a ‘Base season’ are starting to intensify.

“Probably time to run back much of the gambling we just did on Solana but on Base this time,” wrote 0xSisyphus.

Credit: Source link