ORLANDO, Florida, Sept 20 (Reuters) – With oil prices at their highest this year and eyeing $100 a barrel again, the last thing U.S. consumers, businesses and policymakers need is another inflationary headache.

The fledgling auto workers strike, if it lasts and broadens out, could be just that.

Most economists reasonably focus on the temporary blow to U.S. economic output or payrolls from a lengthy strike across the sector. And the economy could contract almost one full percentage point in the fourth quarter, according to Morgan Stanley economists, which would cut their full-year 2023 GDP growth call to 1.4% from 1.7%.

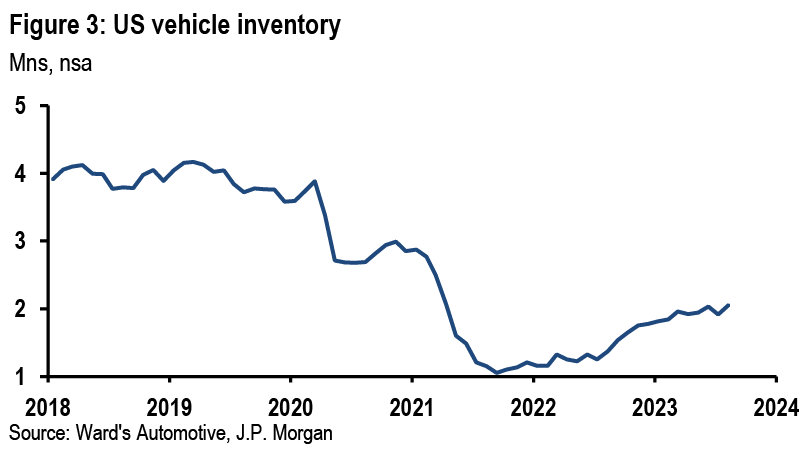

But the potential effect on new and used car prices, at a time when inventories remain historically low, combined with a significant wage settlement, could also move the inflation dial.

This is a worst-case scenario for the Fed. Policymakers and market participants won’t need reminding of the role supply shocks and shortages of chips, parts and other inputs had in driving inflation to the highest in over 40 years after the pandemic.

Soaring used car prices had an outsized impact on U.S. inflation, in particular. That dynamic has reversed over the last year, but disinflationary base effects are fading and could quickly flip to being inflationary in the event of a damaging strike.

Michael Feroli, chief U.S. economist at JP Morgan, is wary. A prolonged nationwide strike could put already-low inventory under heavy strain, posing “significant” upside risk to auto prices.

“Such an outcome will present another wrinkle for the ongoing disinflation as it would halt the recent streak of soft readings in the CPI component for motor vehicles,” he and his team wrote on Friday.

Reuters Image Acquire Licensing Rights

STEP ON THE GAS…

The transportation group accounts for around 16% of the U.S. Consumer Price Index, and around half of that is the new and used motor vehicles index.

The annual rate of used cars and trucks price inflation reached a record high 45% in June 2021, according to one measure from the Bureau of Labor Statistics, while Cox Automotive’s Manheim index of used vehicle prices rose at a peak annual rate of 54% in April that year.

Both have been showing annual deflation since late last year, contributing to the slowdown in broader consumer price inflation across the country, but the rate of price declines has been slowing.

The United Auto Workers strike against the ‘Detroit Three’ automakers General Motors, Ford and Stellantis entered its fifth day on Tuesday. It is the first time ever the union strike has been across all three automakers simultaneously.

Fewer than 13,000 of the UAW’s 150,000-strong workforce are involved in the strike over pay and benefits, which is currently centered on one U.S. assembly plant at each company.

If no agreement is reached, that could quickly spread in numbers and locations. Detroit’s Big Three accounted for 43% of new cars sold in the U.S. last year, according to Cox Automotive, so the disruption is potentially huge.

JP Morgan analysts also warn that a significant wage settlement – the UAW is looking for a 40% increase over four years – will present an upside risk for inflation across the sector as some of that will be passed onto consumers.

Reuters Image Acquire Licensing Rights

Reuters Image Acquire Licensing Rights

…AND WIPE THAT TEAR AWAY

Others are more sanguine.

Using the 2019 auto workers strike as a proxy, Morgan Stanley’s Ellen Zentner and team estimate that higher prices for new vehicles could add 0.02 percentage points to monthly CPI. UBS economists reckon new and used car prices will rise “marginally” and that the overall impact on inflation will be “limited.”

Fed officials will hope so. This comes just when the grind higher in oil is starting to bite – crude futures are up 30% in the last three months and for the first time since December the year-on-year price change is positive.

That is, oil is once again inflationary, not deflationary.

The timing could not be worse. Annual inflation has plummeted this year and by some measures now has, or is close to having, a “2” handle – the central bank’s 2% goal is within sight.

The American public is getting more confident that the inflation scare is over too. The University of Michigan’s preliminary five-year consumer inflation expectations index for September fell to 2.7%, the lowest since April 2021 and the one-year outlook fell to 3.1%, the lowest since March 2021.

(The opinions expressed here are those of the author, a columnist for Reuters.)

By Jamie McGeever; Editing by Andrea Ricci

Our Standards: The Thomson Reuters Trust Principles.

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

Credit: Source link