Investor Insight

With a portfolio of advanced stage exploration assets in the uranium, critical minerals and base metals space, AuKing Mining is poised to execute and accomplish its goals of becoming a mid-tier producer, creating significant shareholder value.

Overview

AuKing Mining (ASX:AKN) is an exploration and development company with a portfolio of exploration assets focused on uranium, copper and critical minerals, in Western Australia, Tanzania and British Columbia, Canada. The company aims to become a mid-tier copper, uranium and critical metals producer through the acquisition and development of near-term production assets.

AuKing’s portfolio of assets includes the Koongie Park copper-zinc project in Western Australia, the Mkuju uranium project in Tanzania, and the recently acquired Myoff Creek niobium-REE project in British Columbia, Canada.

The Company is led by an experienced management and board of directors supporting and executing on the company’s strategic goals of becoming a mid-tier producer through its diverse project portfolio.

Company Highlights

- AuKing Mining is an exploration and development company with a portfolio of exploration assets focused on uranium, copper and critical minerals.

- The company holds a diverse portfolio of advanced exploration assets in Western (Koongie Park), Tanzania (Mkuju) and British Columbia, Canada (Myoff Creek)

- Koongie Park has a mineral resource estimate totalling 21.1 Mt across three well-explored deposits – Onedin, Sandiego and Emull.

- AuKing is led by a highly experienced management team executing the company’s strategies to increase shareholder value.

Key Projects

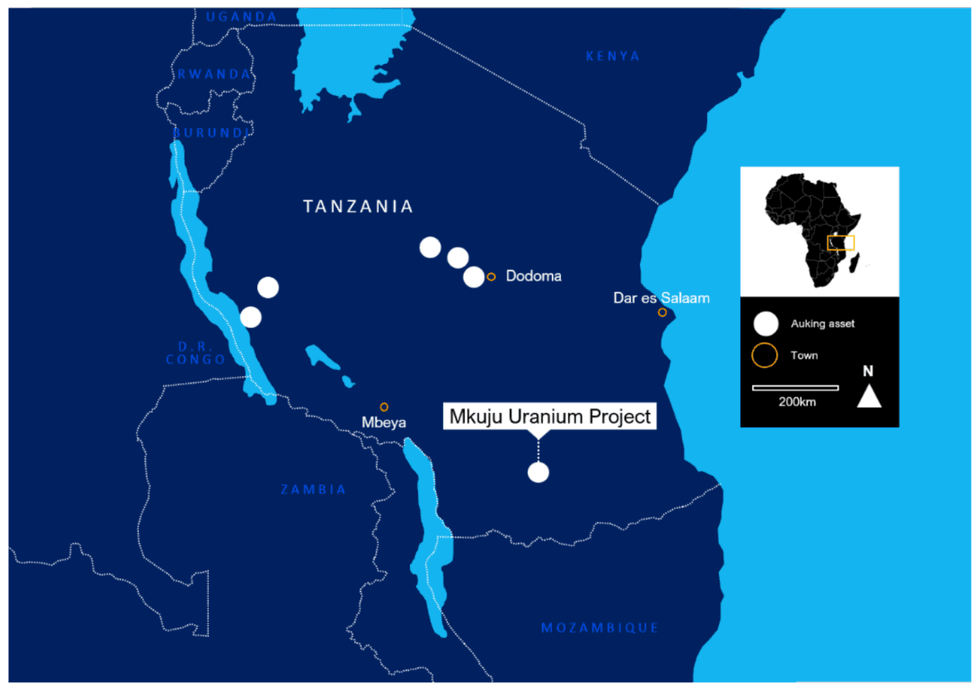

Mkuju Uranium Project (Tanzania)

Mkuju is situated immediately to the southeast of the world class Nyota uranium project that was the primary focus of exploration and development feasibility studies by then ASX-listed Mantra Resources Limited (ASX:MRU). Not long after completion of feasibility studies for Nyota in early 2011, MRU announced a AU$1.16 billion takeover offer from the Russian group ARMZ. The takeover was finalised in mid-2011.

During the latter part of 2023, AuKing Mining completed a Stage 1 exploration program at Mkuju which comprised a combination of rock chip, soil geochemistry sampling, shallow auger drilling and initial diamond drilling. Some very encouraging results were obtained from this program which have formed the basis for a proposed 11,000m drilling program that is about to commence at Mkuju. Results included:

Auger drilling:

MKAU23_020 3m @ 1,273ppm U3O8 incl 1m @ 3,350ppm U3O8

MKAU23_045 3m @ 250ppm U3O8 incl 1m @ 410ppm U3O8

Soil samples:

MKGS006 510ppm U3O8

MKGS017 8,800ppm U3O8

MKGS056 960ppm U3O8

Rock chip samples:

MKGS056 2,250ppm

MKGS057 800ppm U3O8

Mkuju project location

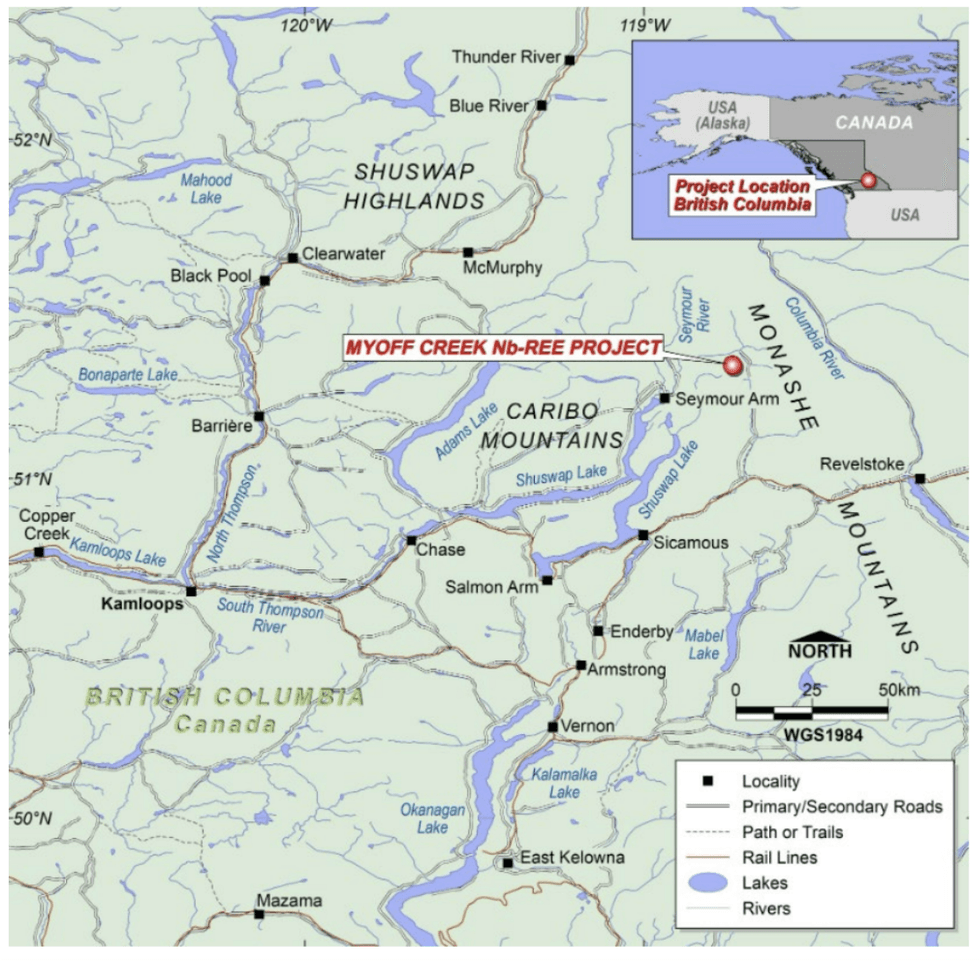

Myoff Creek Niobium-REE Project (British Columbia, Canada)

In July 2024, AuKing Mining completed the acquisition of the Myoff Creek niobium/REE project in British Columbia, Canada, known for its rich mineral deposits. The site offers excellent accessibility with well-maintained road infrastructure. The project highlights near-surface carbonatite mineralization that spans an area of 1.4 km by 0.4 km with high-grade historic drilling intercepts that include 0.93 percent niobium and 2.06 percent total rare earth oxides.

There is significant potential to expand the current target area as it remains open at depth and along strike.

HERE AuKing’s exploration team has completed a recent site visit to Myoff Creek and have identified the need for a detailed airborne radiometric survey to be undertaken across the tenure area. This survey is expected to commence in Q4 of 2024 and will include coverage of the area where historical drilling identified significant niobium/REE results – thereby providing a “marker” for potential mineralization across the rest of the Myoff Creek area.

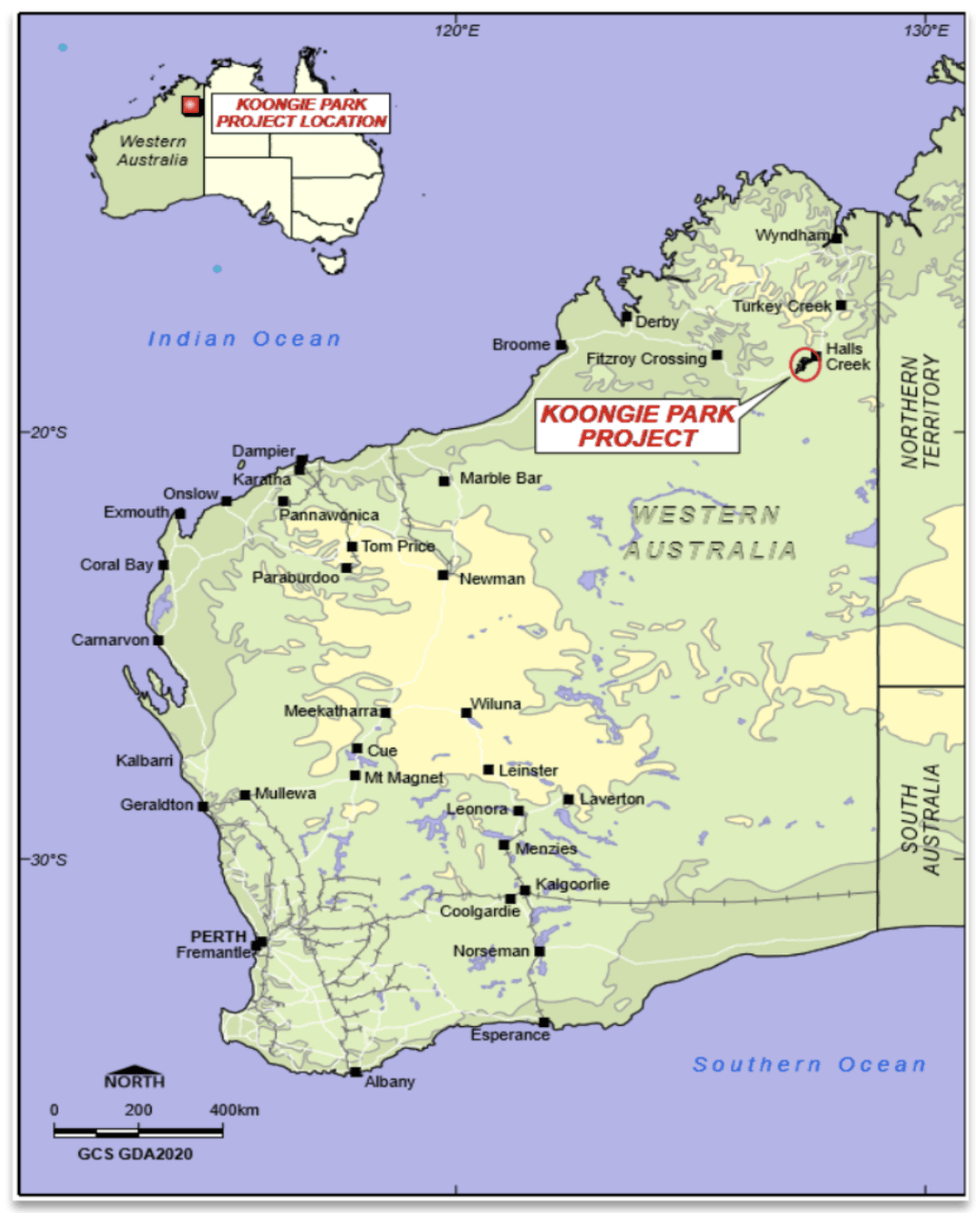

Koongie Park Copper-Zinc Project

Koongie Park project lies within the highly mineralized Halls Creek Mobile Belt. The area also hosts the Savannah (Sally Malay) and Copernicus nickel projects, the former Argyle diamond mine and the Nicolsons gold mining operation of Pantoro Limited. Koongie Park is located about 25 kms southwest of the regional centre of Halls Creek on the Great Northern Highway in northeastern Western Australia.

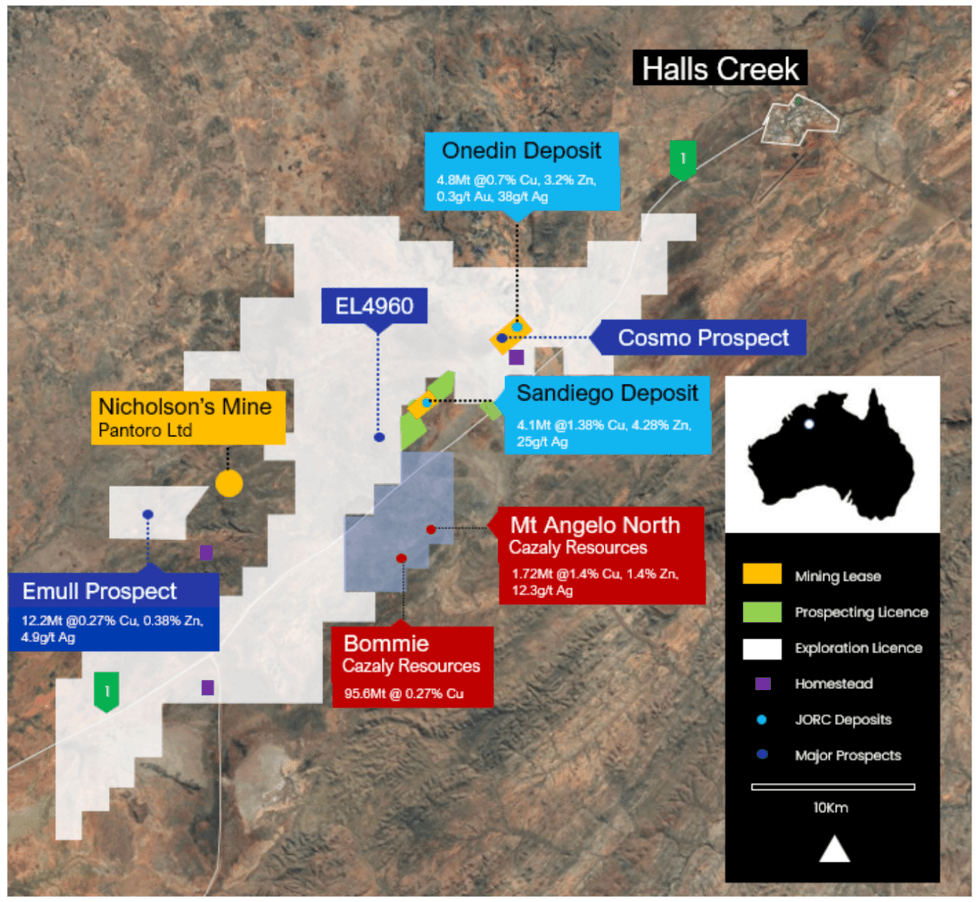

AuKing owns 100 percent interest (subject to a 1 percent net smelter royalty) in Koongie Park and has received significant historical exploration and drilling since the 1970s. The project contains three deposits of note: Onedin and Sandiego copper-zinc-gold deposits, and the Emull copper deposit.

Onedin and Sandiego are both in advanced exploration stages with a total mineral resource estimate of 4.8 Mt and 4.1 Mt, respectively, containing copper, zinc, gold, silver and lead. The Sandiego prospect boasts a scoping study (released in June 2023) that highlights an 11-year life of mine with a processing capacity of 750 ktpa and pre-production capex of $135 million for a 2.5 year payback. Economics highlight a pre-tax NPV of $177 million and 40 percent IRR.

Koongie Park and neighboring project holdings

The Emull base metal deposit has received significant drilling by previous owner Northern Star Resources several years ago and subsequently by AuKing in 2022. The deposit has a maiden resource estimate of 12.2 Mt, containing copper, zinc, lead and silver, with significant upside potential as more drilling is performed.

Board and Management Team

Peter Tighe – Non-executive Chairman

Peter Tighe started his career in the family-owned JH Leavy & Co business, which is one of the longest established fruit and vegetable wholesaling businesses in the Brisbane Markets at Rocklea. As the owner and managing director of JH Leavy & Co, Tighe expanded the company along with highly respected farms and packhouses that have been pleased to supply the company with top quality fruit and vegetables for wholesale/export for over 40 years. Tighe has been a director of Brisbane Markets Limited (BML) since 1999 and is currently the deputy chairman. BML is the owner of the Brisbane Markets site and is responsible for the ongoing management and development of its $400 million asset portfolio. As the proprietor of the site, BML has over 250 leases in place including selling floors, industrial warehousing, retail stores and commercial offices. BML acknowledges its role as an economic hub of Queensland, facilitating the trade of $1.5 billion worth of fresh produce annually, and supporting local and regional businesses of the horticulture industry.

Tighe (with his wife Patty) owns Magic Bloodstock Racing (MBR), a thoroughbred horse racing and breeding company. MBR has acquired many horses which are trained and raced across Australia and around the world including “Winx”, one of the greatest thoroughbreds of all time winning more than $26 million in prize money.

Paul Williams – Managing Director

Paul Williams holds both Bachelor of Arts and Law Degrees from the University of Queensland and practised as a corporate and commercial lawyer with Brisbane legal firm HopgoodGanim Lawyers for 17 years. He ultimately became an equity partner of HopgoodGanim Lawyers before joining Eastern Corporation as their chief executive officer in August 2004. In mid-2006, Williams joined Mitsui Coal Holdings as general counsel, participating in the supervision of the coal mining interests and business development activities within the multinational Mitsui & Co group. Williams is well-known in the Brisbane investment community as well as in Sydney and Melbourne and brings to the AKN board a broad range of commercial and legal expertise – especially in the context of mining and exploration activities. He also has a strong focus on corporate governance and the importance of clear and open communication of corporate activity to the investment markets.

ShiZhou Yin – Non-executive Director

ShiZhou Yin holds a Master of Professional Accounting degree and is a Chinese-certified public accountant and a senior accountant. From September 1994 to September 2010, Yin served successively as accountant of Beijing No. 2 Water Pipe Factory, audit manager and audit partner of Yuehua Certified Public Accountants Firm, and senior partner of Zhongrui Yuehua Certified Public Accountants Co.

From April 2017 to the present time, Yin has been vice-president, chief financial officer and secretary of the board of JCHX Group Co..

Yin has also been the chairman of the board of supervisors of JCHX Mining Management Co. (Shanghai Stock Exchange Code: 603979) since May 2017. JCHX Mining Management is one of China’s largest mining services companies with operations around the world and has a share market capitalization of approx. US$5 billion.

Chris Bittar – Exploration Manager (MGeoSc, MComm (Finance), BMSc)

Chris Bittar was previously senior project geologist at Pantoro Limited’s Norseman Project in Western Australia, where he supervised the planning and execution of near-mine exploration and resource development programs as part of the Definitive Feasibility Study program at Norseman.

Prior to his Pantoro role, Bittar held senior geologist roles with Millennium Minerals (Nullagine Gold project) and Pilbara Minerals (Pilgangoora Lithium project), and exploration geologist roles with Sumitomo Metal Mining Oceania and Northern Minerals (Browns Range rare earths project in WA). In these roles, Bittar gained extensive experience in taking projects from greenfield exploration to resource development and up to mine-ready feasibility study stage. This experience included supervision of multiple drilling campaigns, geological interpretation, data management and project reporting. Bittar has also maintained a strong commitment to company safety policies and procedures.

Paul Marshall – Chief Financial Officer and Company Secretary

Paul Marshall is a chartered accountant with a Bachelor of Law degree, and a post Graduate Diploma in Accounting and Finance. He has 30 years of professional experience having worked for Ernst and Young for 10 years, and subsequently twenty years spent in commercial roles as company secretary and CFO for a number of listed and unlisted companies mainly in the resources sector. Marshall has extensive experience in all aspects of company financial reporting, corporate regulatory and governance areas, business acquisition and disposal due diligence, capital raising and company listings and company secretarial responsibilities.

Credit: Source link