Arafura Rare Earths (ASX:ARU,OTC Pink:ARAFF) said on Wednesday (January 15) that it has signed a binding term sheet for its Nolans rare earths project with the National Reconstruction Fund Corporation (NRFC).

The term sheet is for a AU$200 million investment to support the development of Nolans. The money brings total public funding for Nolans to AU$1 billion, with AU$840 million committed by the federal government in March 2024.

The NRFC investment will happen through the issue of unsecured convertible notes, which hold a conversion period of seven years and a non-convertible period of two years. Their total tenor is 15 years.

At the NRFC’s election during the conversion period, the convertible notes will convert into fully paid Arafura shares at a fixed price, which will be set at a level 40 percent higher than the reference price.

The reference price will be based on a future equity raise needed to fund and develop Nolans.

This equity raise is expected to be announced when Arafura makes its final investment decision for Nolans.

“This deal has been months in the making and de-risks the equity funding required for the development of Nolans,” said Arafura Managing Director Darryl Cuzzubbo, adding that it highlights the project’s strategic importance.

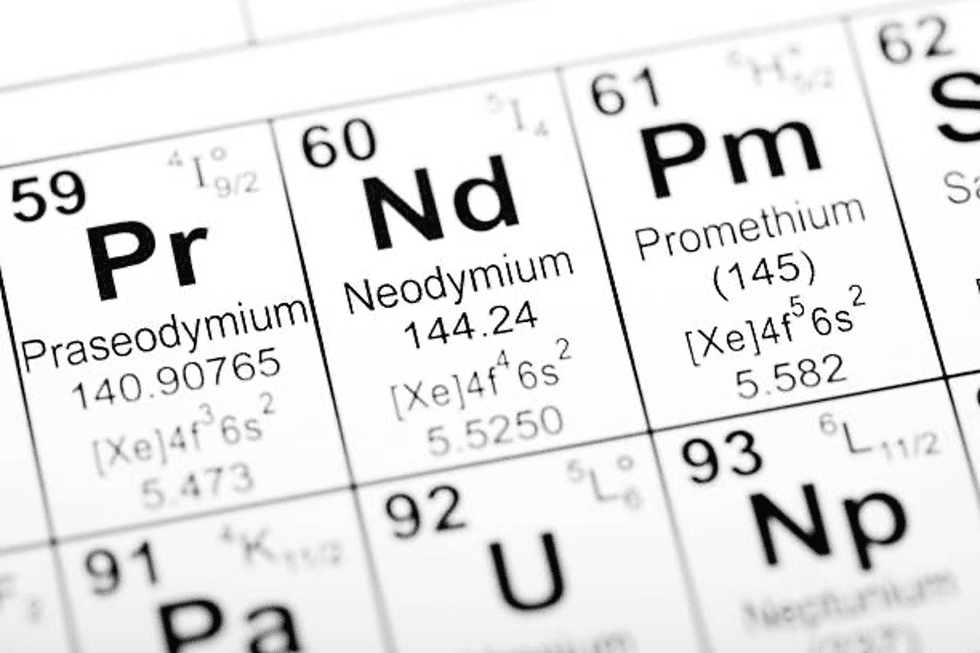

Located 135 kilometres north of Alice Springs in Northern Territory, the Nolans project is positioned to become a major supplier of neodymium and praseodymium to the high-performance permanent magnet market.

Arafura said the project benefits from its location and proximity to transport, water and energy infrastructure.

“Rare earth minerals are strategically important resources that are crucial to modern economies and the global transition to net zero,” commented NRFC Chairman Martijn Wilder AM.

“Arafura’s Nolans Project demonstrates the enormous contribution that Australia can make to the global supply of rare earth minerals and the considerable opportunities for Australia to add value to the raw materials that it mines.”

The issue of the convertible notes is still subject to certain conditions, including finalisation and long-term documentation between Arafura and the NRFC, and shareholder approval.

Arafura’s share price ended the week up just over 25 percent, closing at AU$0.14 on the ASX.

Don’t forget to follow us @INN_Australia for real-time updates!

Securities Disclosure: I, Gabrielle de la Cruz, hold no direct investment interest in any company mentioned in this article.

From Your Site Articles

Related Articles Around the Web

Credit: Source link