The arrival of artificial intelligence into the mainstream is a boon for the cloud computing industry. AI needs enormous amounts of data and computing power to execute tasks, both of which are readily available in a cloud environment.

Two prominent businesses benefiting from AI and its impact on the cloud computing market are Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG) and Super Micro Computer (NASDAQ: SMCI), commonly known as Supermicro.

Here’s how these two tech companies are reaping the rewards from the AI-driven cloud computing boom, and if you had to choose just one to invest in, which might prove the better long-term investment.

Alphabet’s multifaceted cloud business

Alphabet is perhaps best known for its ubiquitous Google search engine. But it also has a thriving cloud computing business called Google Cloud.

This division is experiencing rapid growth. In the first quarter, Google Cloud generated $9.6 billion, which is a 28% increase from 2023’s $7.5 billion. It is now the third-largest cloud vendor in the world.

Google Cloud offers several benefits to its business clients. Like all cloud offerings, customers can use it to augment or replace existing IT infrastructure, such as servers.

Moreover, Alphabet makes its proprietary AI platform available to clients through Google Cloud, so they can create their own AI systems and apps. Instacart uses this feature to improve its customer service workflows.

In addition, according to CEO Sundar Pichai, “Our Cloud business is now widely seen as the leader in cybersecurity.” Its AI-powered cybersecurity features are why Pfizer adopted Google Cloud.

Super Micro Computer’s focused approach to cloud computing

Supermicro provides computer servers and storage solutions, the exact components critical to cloud computing. It focuses on high-performance computing products to cater to the needs of AI-optimized clouds in particular.

Supermicro offers customers an array of options using a modular approach the company calls its “Building Block Architecture.” This approach allows it to quickly customize products to meet the technical requirements of its clientele.

The sudden AI-spurred demand for Supermicro’s offerings led to massive sales growth for the company. In its fiscal Q3, ended March 31, Supermicro achieved revenue of $3.9 billion, a 200% increase year over year.

The company expects its outsized sales to continue. Supermicro is forecasting revenue of at least $5.1 billion for its fiscal fourth quarter. That’s more than double the $2.2 billion in Q4 sales generated in the previous fiscal year.

Supermicro added to its ability to grow revenue through an expanded product line. Its offerings now encompass additional IT infrastructure needs, such as power and liquid cooling systems.

Deciding between Alphabet and Super Micro Computer

The cloud computing market is expected to see multiyear growth thanks to AI, rising from $588 billion last year to $2.3 trillion by 2032. This growth makes both Alphabet and Supermicro compelling investments for the long term.

However, deciding which stock is the better buy can be challenging. In this duel of cloud companies, several factors favor Alphabet.

The Google parent offers a more diversified business. It has a thriving digital advertising operation, where it’s a market leader. Ad sales comprised $61.7 billion of the company’s $80.5 billion in Q1 revenue.

Alphabet is also a market leader in online search. Thanks to Google’s popularity, Alphabet has a trove of data to feed into and strengthen its AI platform.

Also, Supermicro battles in a competitive space with rivals including Dell Technologies and Hewlett Packard Enterprise.

Competition has led to pricing pressure, causing a decline in Supermicro’s gross margin to 15.6% in fiscal Q3 from 17.7% in the prior year. Supermicro expects its gross margin to decline further in fiscal Q4.

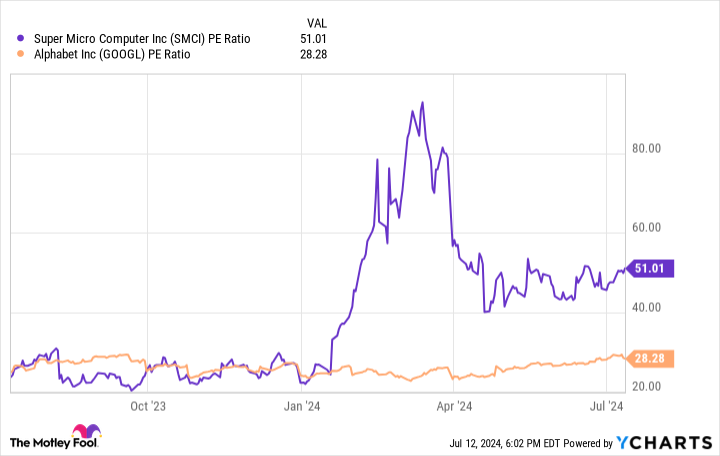

Another factor to consider is valuation. Using the price-to-earnings ratio (P/E ratio), a widely used metric to assess a stock’s value, Alphabet is the winner. This chart shows that Supermicro’s valuation has soared in 2024.

While Supermicro’s P/E ratio has come down in recent months, shares remain pricier than Alphabet’s.

In addition, Supermicro is not cash-flow positive. It spent $2.7 billion over the past three quarters building up its product inventory. This resulted in negative free cash flow (FCF) of $1.6 billion in fiscal Q3.

Alphabet isn’t burdened with maintaining an inventory of goods to sell, helping it to generate prodigious FCF of $16.8 billion in Q1. Over the trailing 12 months, the company’s FCF was $69.1 billion.

Its tremendous FCF allows Alphabet to comfortably afford a dividend. Supermicro doesn’t offer a dividend.

While both companies are enjoying rising revenue thanks to growth in the cloud computing sector, given Alphabet’s market-leading products, strong FCF, more diversified business, and better stock valuation, Alphabet is the superior investment at this time.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 15, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Robert Izquierdo has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet and Pfizer. The Motley Fool recommends Instacart. The Motley Fool has a disclosure policy.

Better Cloud Computing Stock: Alphabet vs. Super Micro Computer was originally published by The Motley Fool

Credit: Source link