Financial headlines about artificial intelligence (AI) dominated 2023, with the “Magnificent Seven” stocks of Microsoft, Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), Apple, Tesla, Meta Platforms, Amazon, and Nvidia garnering most of the attention.

Microsoft kicked off the AI arms race following a $10 billion investment in OpenAI, the developer of ChatGPT. Not long after, Alphabet debuted its own large language model (LLM) called Bard. Let’s just say the initial reaction from Bard was underwhelming, given the chatbot didn’t exactly provide accurate answers to basic questions during its public unveiling.

Nevertheless, as ChatGPT continued to gain momentum in the public eye, Alphabet doubled down and kept working. Earlier this month, Alphabet unveiled its latest installment in generative AI, called Gemini.

Make no mistake about it — Alphabet’s Gemini release is a calculated chess move during otherwise tumultuous times at OpenAI and the potential repercussions for Microsoft. Could now be a buying opportunity in Alphabet stock before the company begins reaping the benefits of its new AI product?

Is Gemini better than ChatGPT?

If you’re wondering whether Alphabet just leapfrogged Microsoft and asking which generative AI application is more powerful, welcome to the club. This is, quite literally, the billion-dollar question. According to research at Goldman Sachs, generative AI has the potential to increase gross domestic product (GDP) by $7 trillion over the next decade — a theme that is sparking interest across Wall Street.

A couple of months ago, it was revealed that famed hedge fund manager Bill Ackman took a sizable stake in Alphabet. During a fireside chat with CNBC’s Scott Wapner, Ackman spoke about his bullish thesis on Alphabet. The bottom line is that Ackman is attracted to Alphabet’s ecosystem, which stems across Google Search, productivity applications such as Gmail, video website YouTube, and the company’s growing cloud business. In his view, Alphabet is uniquely positioned to integrate artificial intelligence across its entire suite of services, thereby becoming invaluable for end users.

The obvious undercurrent of Gemini is that it could further boost the demand for Alphabet’s various products, making it appear lucrative and validating Ackman’s hypothesis. But I’d caution investors to zoom out and really consider the full picture here.

Like Alphabet, Microsoft also has a compelling ecosystem. Per the company’s latest earnings report, Microsoft experienced more demand for its AI applications than it was expecting. And while OpenAI has helped fuel growth in Microsoft’s Azure cloud segment, the real opportunities may just be getting started.

Given the tailwinds pushing both Alphabet and Microsoft, I think it’s a little early to declare one generative AI application as superior. For investors seriously considering a position in Alphabet, analysis beyond AI potential is required.

Alphabet’s valuation looks really attractive

There are several ways to assess a stock when it comes to valuation. One measure that can be useful is looking at a company’s forward price-to-earnings (P/E) multiple benchmarked against a set of peers.

The chart above illustrates that Alphabet’s forward P/E of 23 is the lowest among its Magnificent Seven cohorts. Of note, Microsoft’s forward P/E of 33 is well above Alphabet, thereby signaling the markets are applying a premium to the Windows developer.

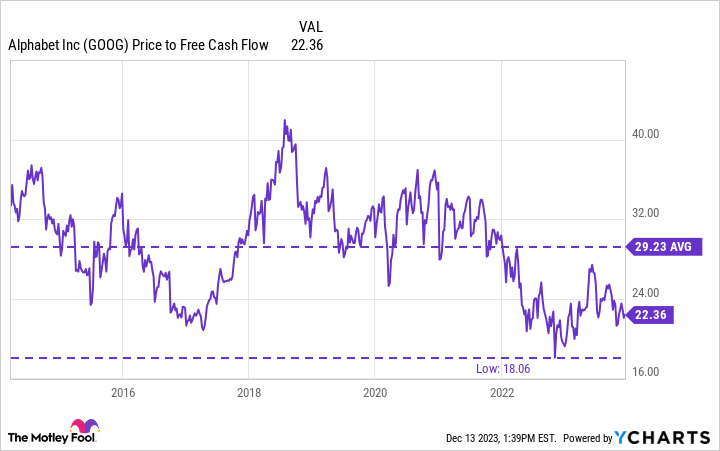

Going beyond forward P/E, the chart below illustrates the company’s price-to-free-cash-flow ratio over the last decade. At a multiple of 22.4, Alphabet stock is trading at a massive discount to its 10-year average, and quite close to its low point of 18.1. This looks like yet another sign that the markets are discounting Alphabet stock and its robust business model. In fact, the company’s consistent free cash flow generation is what provides Alphabet with the financial flexibility to invest in new growth areas such as AI.

Should you buy Alphabet stock?

Alphabet stock looks quite cheap at its current trading levels, especially compared to its competition. The secular tailwinds fueling artificial intelligence coupled with the company’s institutional support are reasons to be optimistic. However, given the company’s sheer dominance in its core online advertising business and its contribution to help fund other growth drivers, like the cloud and AI, don’t seem to be appreciated. This most likely stems from the fact that some believe ChatGPT will begin replacing Google Search, putting Alphabet in an existential crisis.

If the valuation analysis above shows anything, it may imply that the thesis that Microsoft is going to dethrone Alphabet in online search is shortsighted. Given Alphabet is the home of the world’s top two most visited websites (Google and YouTube), advertisers are keen to utilize these platforms. And since 2024 is the beginning of a new election cycle, research suggests that it could be a record year for political advertising campaigns — a theme that should benefit Alphabet greatly.

Moreover, it’s clear that the addressable market for artificial intelligence is not only large, but still evolving. As applications and use cases multiply, there will likely be several winners. As the stock trades at historically low levels, now could be a unique opportunity to begin dollar-cost averaging into Alphabet. Both the near-term and long-term pictures look strong, and investors should take advantage of the discounted trading multiples right now.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of December 11, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Goldman Sachs Group, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

Alphabet Just Said “Checkmate” to Microsoft, but Here’s Why Investors Could Be the Real Winners was originally published by The Motley Fool

Credit: Source link