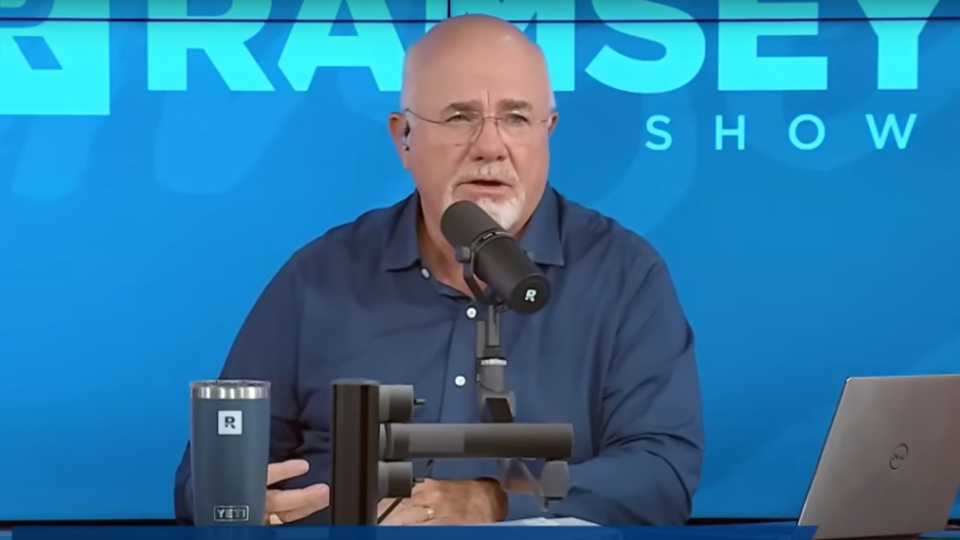

Getting married results in a union that stretches beyond a romantic partnership. It typically means the commingling of finances, and when that happens there’s always room for gray areas — and that’s exactly what Dave Ramsey heard about when chatting with Chaz, a soon-to-be-married man from Orlando, Florida.

Chaz, a 24-year-old with zero debt and a nest egg in the bank, explained his predicament to Ramsey.

“My fiance has some debt, and once we get married do you recommend that I use up most of my nest egg to pay off her debt?” he asked. “Or should we keep that nest egg in the bank and keep pursuing paying off that debt now that we have both incomes?”

This is a common question and concern for anyone with plans to get married. Once the knot is tied, the lines between “mine” and “yours” become blurry, at best.

Chaz went on to explain that he has roughly $34,000 in the bank while his fiancee has just north of $17,000 in debt.

Don’t Miss:

When Chaz explained that he had enough money to wipe the debt clear but also liked the idea of keeping the money in the bank, Ramsey jumped in.

“No, you do,” he said. “All of the mistakes you have made come with you; all of the mistakes she has made come with her — and then the preacher will say, ‘now you are one … mistake.'”

Ramsey ended the call by providing clear advice.

“When you get home from the honeymoon, write a check to pay off her student loan. Period, no question about it.”

Even with the government forgiving student loans for millions of borrowers, there are many more saddled with this debt and looking for a way to manage it as they move forward after graduation — and that often means getting married.

In the United States, there is $1.75 trillion in student loan debt, including both federal and private loans. That breaks down to $28,950 owed per borrower on average.

With numbers like those, it’s natural for one or both people entering a marriage to carry some amount of student loan debt.

Anyone in this situation should discuss their debt and plans for paying it off with their soon-to-be spouse. Doing so early in the relationship goes a long way in avoiding financial trouble and associated arguments in the future.

Consulting a financial adviser before marriage is one of the best steps to take. An adviser can review both individuals’ finances, answer questions and help personalize a strategy for paying down debt after getting married.

Read Next:

*This information is not financial advice, and personalized guidance from a financial adviser is recommended for making well-informed decisions.

Chris Bibey has written about personal finance and investment for the past 15 years in a variety of publications and for a variety of financial companies. He is not a licensed financial adviser, and the content herein is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. While Bibey believes the information contained herein is reliable and derived from reliable sources, there is no representation, warranty or undertaking, stated or implied, as to the accuracy or completeness of the information.

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article ‘All Of The Mistakes She Has Made Come With Her’ — Dave Ramsey Gets Real When Advising Man On Whether To Pay Off Fiance’s Debt originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Credit: Source link