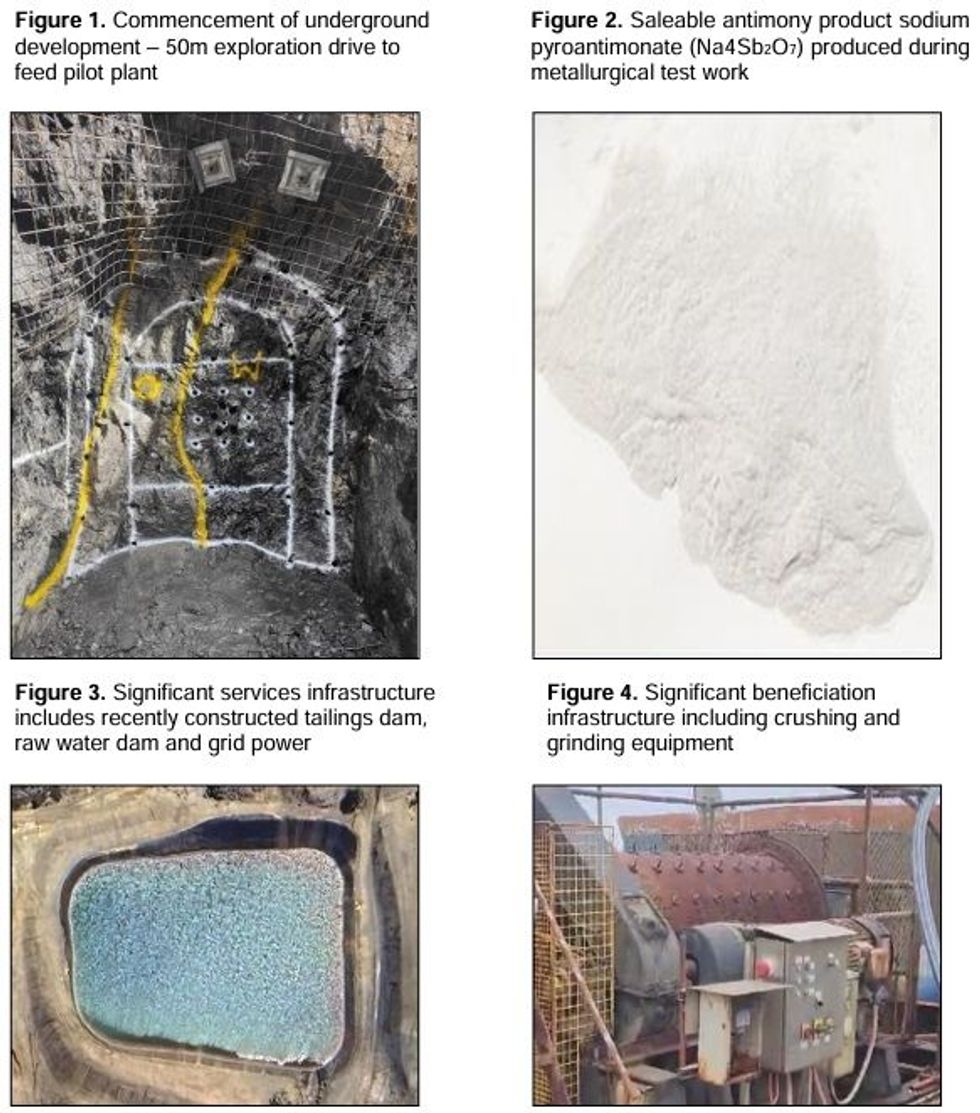

Lode Resources Ltd (ASX:LDR) (“Lode”, or the “Company”) is pleased to announce it has signed a heads of agreement to acquire 100% of the Montezuma Antimony Project located in Tasmanian’s premier West Coast Mining Province. This project includes a high-grade antimony-silver-lead deposit with initial development, advanced metallurgy, significant mining equipment and beneficiation infrastructure.

Highlights

- High-grade Montezuma antimony-silver-lead deposit defined by surface channel sampling, exploration adit face sampling and diamond drill core sampling.

- Surface grab samples grade up to 24.5% antimony (Sb) & 3,050 g/t silver (Ag)

- Diamond drill core samples grade up to 20.3% antimony (Sb) & 1,990g/t silver (Ag)

- Development face samples grade up to 21.4% antimony (Sb) & 2,478g/t silver (Ag)

- Development of portal box cut and commencement of exploration drive has produced stockpiled mineralisation. Representative bulk sampling of combined mineralisation/waste averaged 4.75% antimony (Sb) & 239 g/t silver (Ag) and representative bulk sampling of mineralisation only, averaged 9.02% antimony (Sb) & 769 g/t silver (Ag) reconciling well with corresponding face sampling.

- Metallurgical test work is well advanced with 90% recoveries of antimony achieved producing a saleable antimony product.

- R&D funding discussions are ongoing with local and international institutions including those representing major western governments.

- Montezuma Antimony Project acquisition complements Lode’s antimony exploration portfolio in the New England Fold Belt, NSW’s most prolific antimony province. Together, these assets create a formidable Antimony division within Lode.

- Also compliments Lode’s high-grade Silver portfolio with assays due shortly from the Webbs Consol Silver project where drilling at the Castlereagh prospect has been completed.

- Montezuma Antimony Project acquisition terms include:

- $50,000 non-refundable cash deposit payable within 2 business of execution of the HOAie 22 October 2024; plus

- $200,000 cash payable on completion of the Proposed Acquisition; plus

- 10,000,000 fully paid ordinary shares in the Company at a deemed issue price of $0.10per share on completion of the Proposed Acquisition subject to 12-month escrow; plus

- Up to 6,000,000 fully paid ordinary shares in the Company at a deemed issue price of $0.10 per share upon satisfaction of certain performance hurdles by the Sellers (key terms are outlined in Annexure 1) and subject to 12-month escrow.

- The fully paid ordinary shares will be issued under listing rule 7.1 using the Company’s existing capacity.

Proposal to Acquire Montezuma Antimony Project

The Montezuma Antimony Project includes a high-grade antimony-silver-lead deposit with initial development, advanced metallurgical test work and significant beneficiation infrastructure.

Montezuma Antimony Project Deposit

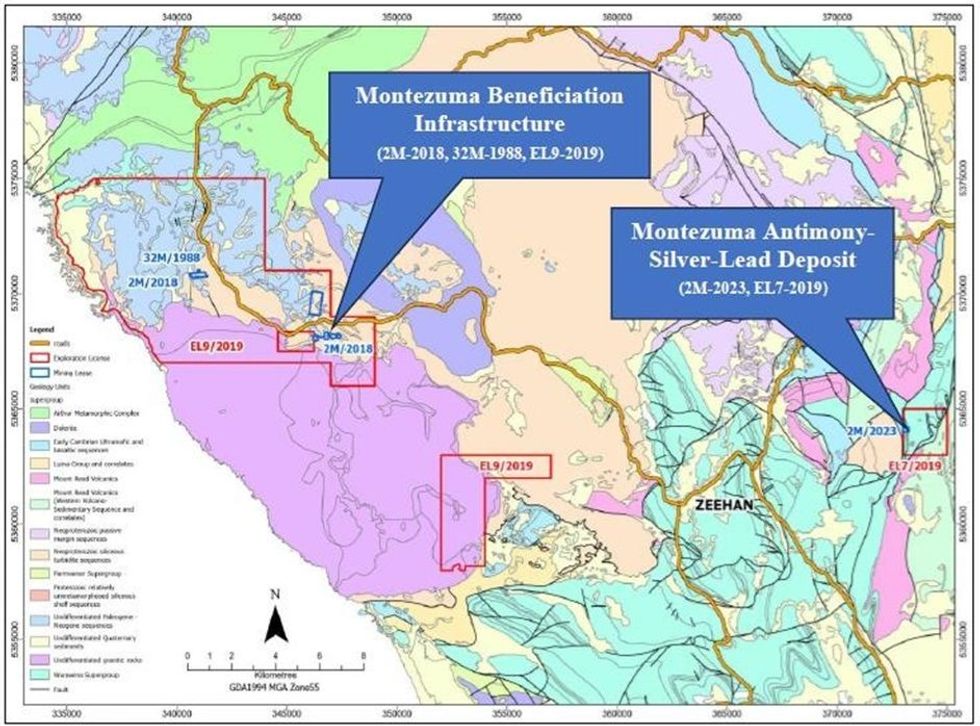

The Montezuma Antimony Project deposit (2M-2023, EL7-2019) is located between well-known mining centres such as Rosebery (Zn,Cu,Pb), Renison Bell (Sn), Henty (Au) and Zeehan(Pb,Ag). Access is via the Zeehan township located 14km to the west.

The Montezuma antimony-silver-lead deposit is a structurally controlled lode, emplaced primarily within the well-known Motezuma fault and hosted by a sequence of turbidites. Antimony and lead are contained within Jamesonite, a lead-iron-antimony sulphide mineral (Pb4FeSb6S14) and is a late-stage hydrothermal mineral forming at moderate to low temperatures. This project is also prospective for copper, zinc and gold.

The Montezuma antimony-silver-lead deposit is defined by surface sampling of the exposed mineralised structure over 50m strike length, development face sampling and 13 diamond drill holes which have intercepted high-grade mineralisation down to a depth of 80m. The Montezuma antimony-silver-lead deposit remains open to the north, south and at depth.

Click here for the full ASX Release

This article includes content from Lode Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Credit: Source link