Borrowers may be dreading that student loan payments are restarting next month, but that shouldn’t keep them from preparing now.

“The time to be thinking about repaying your student loan debt is today, not waiting until the last moment,” Justin Draeger, president and CEO of the National Association of Student Financial Aid Administrators (NASFAA), told Yahoo Finance Live (video above). “So reaching out, contacting your federal student loan servicer, logging into your account, and thinking about making payment arrangements now.”

Draeger noted that there are several payment options available to borrowers who may be struggling, such as deferments, forbearances, and income-driven repayment (IDR) plans.

The Department of Education is promoting its newest IDR plan called Saving on A Valuable Education, or SAVE plan. It improves on a previous plan by lowering monthly payments, providing faster forgiveness for some, and preventing balances from growing due to unpaid interest. So far, 4 million borrowers have been enrolled.

It “will save students and families a significant amount of money if their income is not in a place where they can make payments,” Draeger said.

To get a better understanding of which repayment plan will help them the most, borrowers should log into their accounts on StudentAid.gov and use the federal loan calculator to compare plans, Draeger said. They can also reach out to their federal student loan servicer.

Read more: Can you change your student loan repayment plan?

But they should be patient.

“Federal student loans are being onboarded for 20 million borrowers after a 3.5-year pause. Wait times are expected to be significant,” he said, noting that the federal government has provided an on-ramp for payments.

For 12 months, borrowers won’t be penalized for late, missed, or partial payments. Borrowers don’t have to take any action to qualify for the program.

“So if they’re not able to get through, they do have a significant amount of time to try to get through and get their payments figured out,” Draeger said.

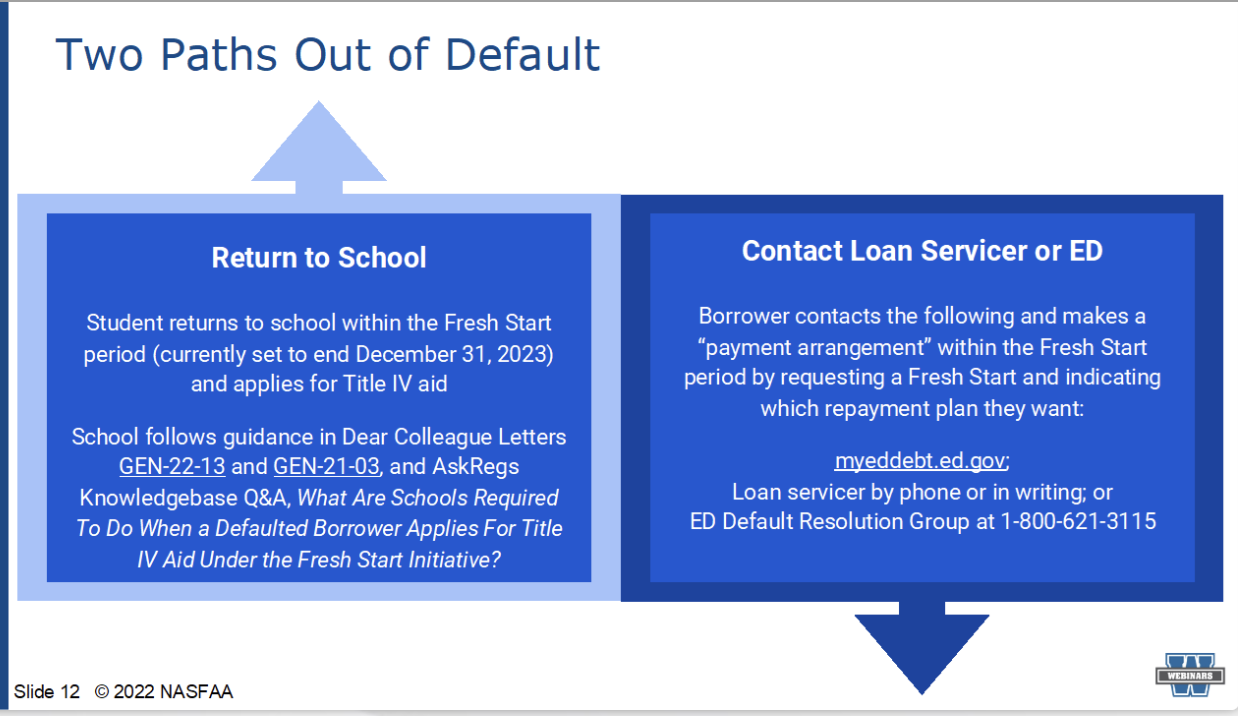

For borrowers who have defaulted on their student loans, there are two ways out of default and one is returning to college and having financial aid administrators enroll them in the Fresh Start program to get their accounts in good standing.

Borrowers in Fresh Start can move from their default loan servicer to a regular loan servicer, making them eligible for forbearance, deferment, and income-driven repayment (IDR) plans, where a monthly payment of $0 counts as payment.

Default borrowers have until Dec. 31 to apply for Fresh Start.

“Being in federal student loan default comes with a lot of negative consequences, but Fresh Start gives the opportunity to come out of default,” Draeger said. “They just need to contact their loan servicer or their collector and let them know they want this Fresh Start. If they go back to school, the process of going back to school will take them out of federal student loan default, and they will once again be eligible for federal student aid.”

Another key source of help: financial aid administrators, especially for new borrowers. Financial aid offices are tasked with exit interviews on loan repayments when borrowers graduate college.

Accredited institutions that offer Federal Pell Grants, federal student loans, and federal work study have promised the federal government to abide by all federal regulations and help students navigate repayment and other “complex systems even after they’ve left,” Draeger said.

“Schools are held accountable for how many borrowers end up defaulting on their student loans and have a vested interest, not just altruistically, but a financial interest in helping students navigate their loans successfully and repay them successfully.”

Read more: Student loan issues? Here’s how to file a complaint with the Department of Education

Ronda is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government. Follow her on Twitter @writesronda.

Click here for the latest personal finance news to help you with investing, paying off debt, buying a home, retirement, and more

Read the latest financial and business news from Yahoo Finance

Credit: Source link

![Don’t wait ‘until the last moment’ to figure out payments, expert warns [Video]](https://s.yimg.com/ny/api/res/1.2/cRqeUXEgQ_UYp9yrcSI07Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyNDI7aD04Mjc-/https://media.zenfs.com/en/aol_yahoo_finance_433/9581b3601038134a224e62e75a7f8c56)