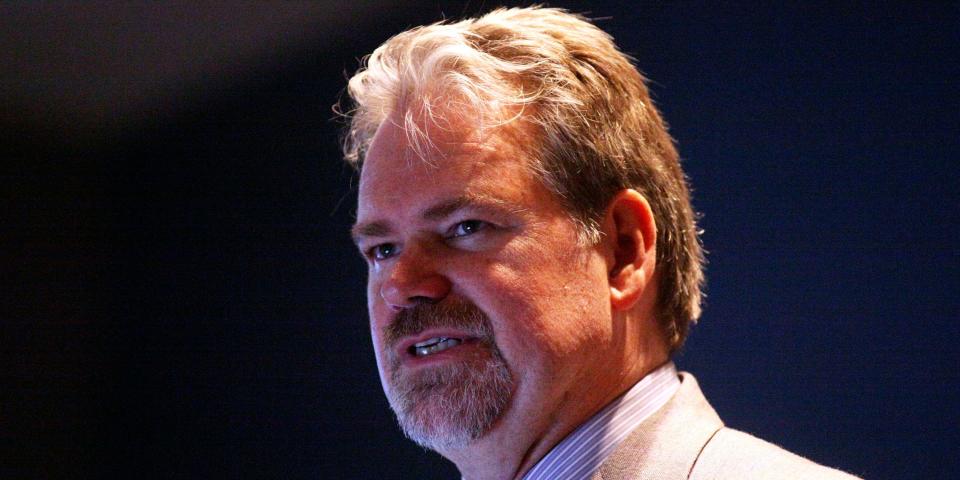

Nvidia stock has formed a bubble, and should it pop, that could trigger a total market crash, the investing legend Rob Arnott says.

He classed the chipmaker company as a “textbook story of a Big Market Delusion” due to its sky-high valuation.

“Would Nvidia’s popping bring down the whole market? “It’s very possible,” Arnott said.

Nvidia’s stocks have formed an asset bubble following this year’s stunning rally — and should it pop, that could trigger a broader market crash, investing legend Rob Arnott says.

The Research Affiliates founder classed the semiconductor stock, which more than tripled in value this year thanks to AI hype, as a “textbook story of a Big Market Delusion,” Bloomberg reported.

“Would Nvidia’s popping bring down the whole market? It’s very possible,” Arnott said.

Several market commentators have rang the alarm on Nvidia as it surges to sky-high valuations, driven by investor excitement over artificial intelligence. Traders view leading the chipmaker as well positioned to take advantage of a widely expected demand surge for AI-related high-end computing equipment.

Some experts have said the company’s stock price is ridiculously high and its valuation is simply unrealistic. Nvidia’s shares have rallied 232% so far this year, outperforming all other S&P 500 index constituents by a big margin.

The stock’s price-to-earnings ratio is about 117, compared with 26 for the whole S&P 500 index.

“Overconfident markets paradoxically transform brilliant future business prospects into even more brilliant current stock price levels,” he said in a separate note, cited by Bloomberg. “Nvidia is today’s exemplar of that genre: a great company priced beyond perfection,” Arnott added.

He said investors were piling into Nvidia because of its market cap size of $1.2 trillion which makes it a “safe play.”

It’s not, however, “too big to fail,” but Nvidia is “too big to succeed,” Arnott said.

“The risk that we’re wrong, that Nvidia’s off to incredible things and will go up another 10-fold in the coming 10 years is possible,” he said. “I would say it’s not plausible, and therefore I’m comfortable calling it a bubble,” he added.

Read the original article on Business Insider

Credit: Source link