Enterprise Product Partners (NYSE: EPD) has been a model of consistency over the years, and its second-quarter results continue to demonstrate this. However, the company is in the process of looking to take growth to a higher level over the next few years through a number of growth projects.

Let’s take a closer look at the midstream company’s Q2 results, distribution, long-term prospects, and whether now is a good time to buy the stock.

A consistent performer

The key to Enterprise’s success over the years has been consistency, which has helped the pipeline company increase its distribution for 26 straight years through various ups and downs in the energy markets.

For Q2, the Enterprise saw its total gross-operating margin increase nearly 11% to $2.4 billion. Its adjusted earnings before interest, taxes, depreciation, and amortization ( EBITDA ), meanwhile, climbed 10% to nearly $2.4 billion.

It generated distributable cash flow of $1.8 billion, and its adjusted free cash flow (FCF) was $814 million. Its FCF was lower compared to a year ago as the company increased its capital expenditures (capex) on new growth projects.

Enterprise slowed down its growth projects during the pandemic but last year started to ramp them up once again. Projects, of course, take time to be built and ramp up, and so the impact from this increased spending will accelerate over time.

The company plans to spend $3.5 billion to $3.75 billion in growth capex this year and another $3.25 billion to $3.75 billion next year after spending about $3.5 billion in 2023. That compares to growth capex of only $1.4 billion in 2022.

It currently has $6.7 billion in projects that are under construction, with most set to be completed sometime in 2025 or beyond. The company also just announced that it will expand its Enterprise Hydrocarbons Terminal in the Houston Ship Channel. The project will add additional propane and butane export capabilities, with phase one of the project set to be completed in the second half of 2025 and the second phase to begin service in the first half of 2026.

Enterprise has become very focused on the export markets, and this project will only add to its strong liquefied petroleum gas (LPG) export position. The company is also looking to get into the oil export market with its proposed Sea Port Oil Terminal (SPOT) project.

Over the past five years, Enterprise has averaged about a 13% return on invested capital, so these growth projects should provide meaningful growth to the company in the years ahead. At a similar return, the approximately $10.5 billion in growth capex spent between 2023 to 2025 should lead to about $1.4 billion in incremental annual gross-operating margin for the company. That would equate to about 15% growth from the $9.4 billion in gross-operating margin it generated in 2023.

Continued distribution growth ahead

Enterprise declared a quarterly distribution of $0.525 per unit for Q2. That was a 5% increase year over year and a 2% increase sequentially. The stock now has a forward yield of about 7.2%

It had a distribution-coverage ratio of 1.6 times in the quarter based on its distributable cash flow, showing that its distribution is well covered.

It ended the quarter with leverage of 3 times. It defines leverage as net debt adjusted for equity credit in junior subordinated notes (hybrids) divided by adjusted EBITDA. This leverage is considered low in the midstream space given the strong cash flow these companies generate.

The company also spent $40 million buying back stock in the quarter. Enterprise has about $1 billion left on its $2 billion repurchase plan.

With a strong balance sheet and robust coverage ratio, Enterprise looks well positioned to continue to steadily increase its distribution even as it increases its capex to help fuel future growth.

Is it time to buy the stock?

Enterprise has a long history of being one of the most consistent performers in the midstream space and is just beginning to see growth pick up. It has one of the most attractive integrated systems in the U.S. and should be a strong beneficiary of increased power-consumption demand related to artificial intelligence (AI), as well as export demand.

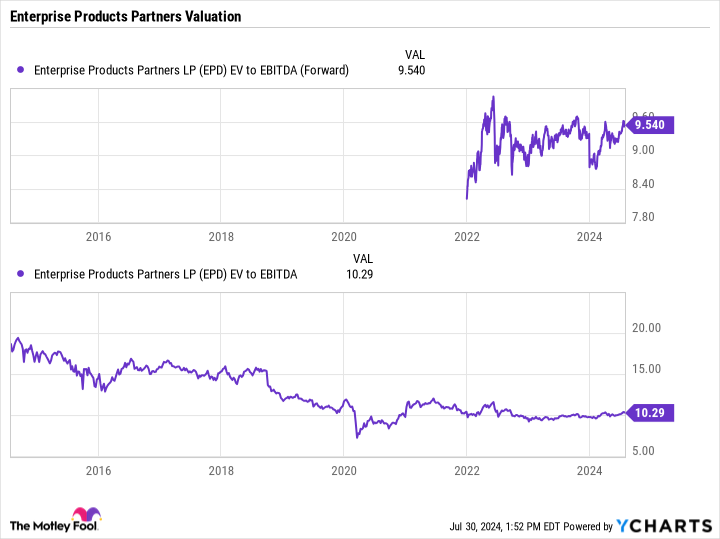

The company trades at a forward-enterprise value-to-adjusted-EBITDA (EV/EBITDA) multiple of about 9.5. This compares to a trailing EV/EBITDA multiple of over 15 before the pandemic, while the midstream sector as a whole traded at a 13.5-plus multiple between 2011 and 2016 when the companies were generally in worse financial shape.

Note that midstream companies are often valued using an EV/EBITDA multiple because it takes into consideration their debt levels and takes out noncash depreciation.

Overall, now looks like a great time to buy Enterprise’s stock given its attractive valuation compared to historical levels, consistent performance over the years, and the uptick in growth the company should see in the coming years.

Should you invest $1,000 in Enterprise Products Partners right now?

Before you buy stock in Enterprise Products Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enterprise Products Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 29, 2024

Geoffrey Seiler has positions in Enterprise Products Partners. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Consistent Enterprise Product Partners Looks Ready to Kick Growth Up a Notch was originally published by The Motley Fool

Credit: Source link