The bond market is flashing a warning sign for stocks for the first time since 1999, according to BofA.

The bank highlighted widening credit spreads in CCC-rated bonds.

BofA recommends investors improve their bond credit quality and favor value stocks over mega-cap tech.

A reliable indicator in the bond market is sending a warning signal to stocks for the first time since 1999, according to Bank of America.

The bank highlighted in a Tuesday note that price action in risky high-yield bonds is not confirming the record rally in the stock market.

“High yield bonds marched with US stocks in recent years, but lately the lowest-quality companies are lagging, even while equity benchmarks rely on a handful of heavy hitters,” Bank of America said.

Since the start of the year, the S&P 500 has surged nearly 19%, while the iShares High Yield Corporate Bond ETF is up 4%.

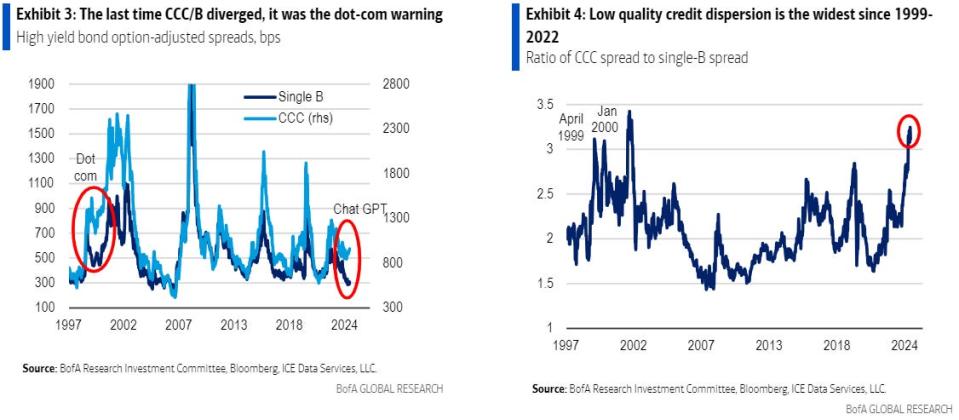

But what’s even more worrying, according to the bank, is that in the depths of the bond market, ultra-risky bonds are diverging from their less-risky counterparts.

Bank of America said that the lowest quality CCC-rated corporate debt is displaying the widest divergence from safer B-rated bonds in 25 years.

“Junk bond spreads are warning like it’s 1999,” the bank said. “In 1999, the ratio of CCC to B spreads rose above 3x almost exactly one year before the dot-com market peaked.”

The dot-com bubble peak in March 2000 was followed by a 30-month-long bear market decline that led to a 78% drop in the Nasdaq 100.

The warning sign from the bond market, combined with the ongoing uncertainty over when companies might experience a profit boost from AI, leads Bank of America to have a cautious view on investing.

The bank said investors should shore up their risk in the bond market by “moving up in credit quality” and favor value stocks over mega-cap tech names.

“We expect US households to take profits on megacap tech in H2’24. Credit markets are not confirming the equity rally and investors are getting impatient with AI,” Bank of America said.

Read the original article on Business Insider

Credit: Source link