The semiconductor industry is in recovery mode this year, thanks to the growing demand for chips from multiple applications such as smartphones, personal computers (PCs), and data centers. But there is one particular niche within this industry that is enjoying a bigger boost than the broader semiconductor market.

The Semiconductor Industry Association is expecting the global semiconductor market to record 16% revenue growth this year. However, the market for memory chips is expected to clock much faster growth than the semiconductor space. Market research firm Gartner is expecting a 66% jump in memory spending this year.

Micron Technology has been benefiting big time from this surge in memory sales, as is evident from its latest quarterly results. Shares of the memory specialist have gained 54% in 2024, and a potential acceleration in its growth could help it soar further. However, there is another memory stock that has clocked healthy gains of 42% so far this year and that could get a nice shot in the arm when it releases its quarterly results later this month — Lam Research (NASDAQ: LRCX).

Let’s look at the reasons why.

Artificial intelligence is boosting memory demand

On its latest earnings conference call, Micron Technology management pointed out that the demand for memory that’s deployed in artificial intelligence (AI) chips — known as high-bandwidth memory (HBM) — is booming. More specifically, Micron management pointed out that its HBM capacity “is sold out for calendar 2024 and 2025, with pricing already contracted for the overwhelming majority of our 2025.”

The chipmaker is anticipating its HBM revenue to increase from “several hundred million dollars” in fiscal 2024 to “multiple billions of dollars” in fiscal 2025. Such solid demand for HBM explains why memory manufacturers such as Micron are looking to expand their production capacities. For instance, Micron’s peer SK Hynix has commissioned the construction of a new facility to meet surging HBM demand.

Hynix is anticipating HBM production capacity to more than double in 2024, and a similar scenario is set to unfold at Samsung. What’s more, Samsung is expecting to double HBM capacity again in 2025. All this bodes well for Lam Research, which gets most of its revenue from selling memory manufacturing equipment.

More specifically, 44% of Lam’s revenue comes from selling memory equipment. So the strong demand for memory chips should ideally translate into more business for Lam. This is why the company is set to report year-over-year growth when it releases its quarterly results this month.

Lam Research’s return to growth could translate into more upside

Lam Research has guided for revenue of $3.8 billion for the quarter that ended on June 30, which is also its final quarter of fiscal 2024. This would translate into year-over-year growth of 19%. For comparison, Lam’s revenue in the first nine months of fiscal 2024 fell 22% year over year to $11 billion. The company struggled due to an oversupply in the memory industry, which was triggered by weak smartphone and PC demand last year.

However, the advent of AI is driving a turnaround in both these markets. Sales of AI-enabled smartphones and PCs are set to take off remarkably in the coming years, and that should create the need for more memory chips. Micron, for instance, points out that it is witnessing a 50% to 100% increase in memory capacity in AI smartphones this year, compared to last year’s models. Meanwhile, AI-enabled PCs are expected to sport 40% to 80% more DRAM (dynamic random-access memory) content.

Not surprisingly, spending on DRAM memory equipment is anticipated to increase at a compound annual growth rate of 17% through 2027, according to industry association SEMI. Meanwhile, spending on NAND flash storage could jump at an even more impressive rate of 29% during the same period.

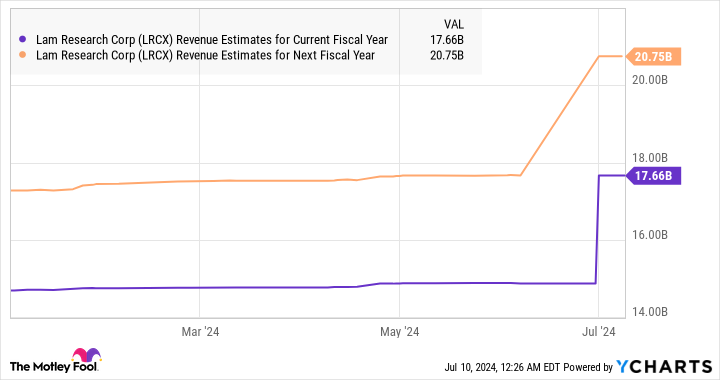

All this explains why analysts are expecting Lam Research to report healthy growth from fiscal 2025, which has just begun. Lam’s estimated top line of $14.9 billion for fiscal 2024 points toward a 15% drop from the preceding year.

Wall Street could reward the acceleration in Lam’s growth with more upside on the stock market, especially if it reports a solid set of results later this month. The developments in the memory market indicate that Lam could indeed deliver impressive results that could beat expectations. Its guidance could also turn out to be solid, thanks to the potential jump in spending on memory equipment.

That’s why now may be a good time to buy this AI stock, as its upcoming quarterly report could give it a shot in the arm.

Should you invest $1,000 in Lam Research right now?

Before you buy stock in Lam Research, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lam Research wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 8, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lam Research. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.

Up 42% in 2024, This Artificial Intelligence (AI) Stock Could Get a Big Boost in July was originally published by The Motley Fool

Credit: Source link