As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at personal care stocks, starting with e.l.f. (NYSE:ELF).

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as “the lipstick effect” by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

The 13 personal care stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 1.1%. while next quarter’s revenue guidance was 7.5% below consensus. Stocks–especially those trading at higher multiples–had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and personal care stocks have had a rough stretch, with share prices down 10.2% on average since the previous earnings results.

e.l.f. (NYSE:ELF)

e.l.f. Beauty (NYSE:ELF), which stands for ‘eyes, lips, face’, offers high-quality beauty products at accessible price points.

e.l.f. reported revenues of $321.1 million, up 71.4% year on year, exceeding analysts’ expectations by 9.8%. Overall, it was a mixed quarter for the company with an impressive beat of analysts’ earnings estimates but underwhelming earnings guidance for the full year.

“Fiscal 2024 marked our strongest year of net sales growth on record, a continuation of the exceptional, consistent, category-leading growth we’ve delivered,” said Tarang Amin, e.l.f.

e.l.f. scored the biggest analyst estimates beat and fastest revenue growth, but had the weakest full-year guidance update of the whole group. The stock is up 28.2% since reporting and currently trades at $199.52.

Is now the time to buy e.l.f.? Access our full analysis of the earnings results here, it’s free.

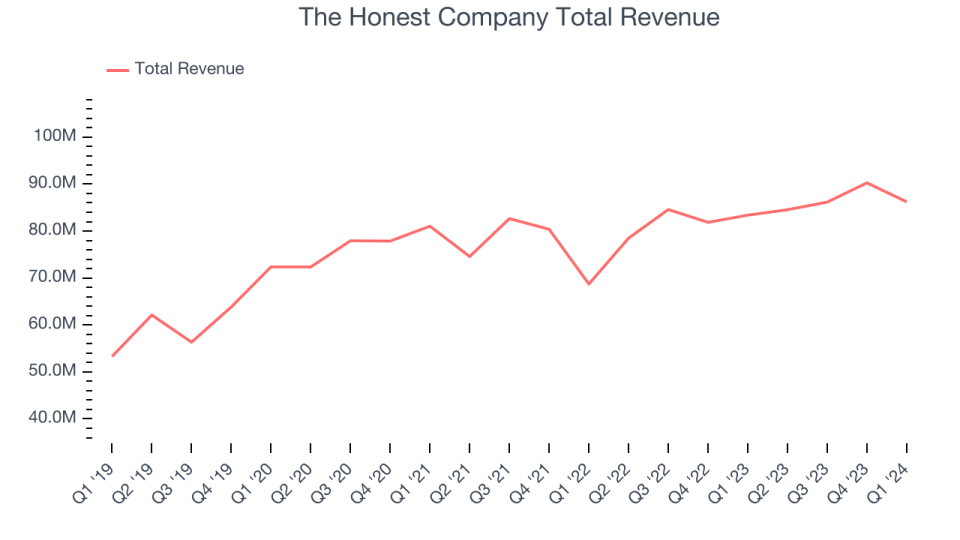

Best Q1: The Honest Company (NASDAQ:HNST)

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ:HNST) sells diapers and wipes, skin care products, and household cleaning products.

The Honest Company reported revenues of $86.22 million, up 3.4% year on year, outperforming analysts’ expectations by 3.5%. It was a stunning quarter for the company with an impressive beat of analysts’ earnings estimates and an impressive beat of analysts’ gross margin estimates.

The stock is flat since reporting and currently trades at $2.94.

Is now the time to buy The Honest Company? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Medifast (NYSE:MED)

Known for its Optavia program that combines portion-controlled meal replacements with coaching, Medifast (NYSE:MED) has a broad product portfolio of bars, snacks, drinks, and desserts for those looking to lose weight or consume healthier foods.

Medifast reported revenues of $174.7 million, down 49.9% year on year, in line with analysts’ expectations. It was a weak quarter for the company with revenue guidance for next quarter missing analysts’ expectations and underwhelming earnings guidance for the next quarter.

Medifast posted the slowest revenue growth in the group. As expected, the stock is down 47.3% since the results and currently trades at $18.73.

Read our full analysis of Medifast’s results here.

Nature’s Sunshine (NASDAQ:NATR)

Started on a kitchen table in Utah, Nature’s Sunshine Products (NASDAQ:NATR) manufactures and sells nutritional and personal care products.

Nature’s Sunshine reported revenues of $111 million, up 2.2% year on year, in line with analysts’ expectations. Looking more broadly, it was a weaker quarter for the company with a miss of analysts’ earnings estimates.

Nature’s Sunshine pulled off the highest full-year guidance raise among its peers. The stock is down 23.7% since reporting and currently trades at $14.52.

Read our full, actionable report on Nature’s Sunshine here, it’s free.

BeautyHealth (NASDAQ:SKIN)

Operating in the emerging beauty health category, the appropriately named BeautyHealth (NASDAQ:SKIN) is a skincare company best known for its Hydrafacial product that cleanses and hydrates skin.

BeautyHealth reported revenues of $81.4 million, down 5.7% year on year, in line with analysts’ expectations. Looking more broadly, it was a mixed quarter for the company with an impressive beat of analysts’ earnings estimates but revenue guidance for next quarter missing analysts’ expectations.

The stock is down 49.9% since reporting and currently trades at $1.8.

Read our full, actionable report on BeautyHealth here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Credit: Source link