After a gangbusters runup last year, the stock markets are still on an upward trajectory. The tech-heavy NASDAQ is up almost 25% year-to-date, and the broader S&P 500 index has gained 17%. These solid results are underpinned by several sets of positive economic data released recently – resilient jobs numbers, a slowing pace of inflation, and better-than-expected Q1 earnings.

According to John Stoltzfus, chief investment strategist from Oppenheimer, this background suggests that the current bullish trend still has some wind left, and potential to run higher. He backs that opinion with an upward revision to Oppenheimer’s year-end S&P target, to 5,900, or nearly 6% from current levels.

Stoltzfus lays out his case for a strong year-end in clear prose: “This is our third price target for year 2024, which began with a 5,200 price target for this year which we initiated last December 11. S&P 500 earnings results over the most recent three quarterly reporting seasons (Q3 ‘23, Q4 ‘23, and Q1 ‘24) and economic data that has provided evidence of resilience underpinned by the Fed’s mandate-sensitive monetary policy remains at the core of our bullish outlook for stocks.”

Oppenheimer analyst Brian Schwartz, rated by TipRanks in the top 2% of Wall Street stock experts, is taking the next step, and following the bullish outlook for the S&P with some solid recommendations, picking out two stocks to buy in this environment. According to the latest data from TipRanks, both stocks are Buy-rated; let’s take a closer look and find out why this 5-star analyst sees them as such compelling choices.

Braze (BRZE)

The first Oppenheimer pick we’ll look at here is Braze, a New York-based cloud software company offering its users a customer engagement platform. Braze bills its platform as a full-service, data-based tool for marketers to enhance the customer engagement process. The company works with enterprise customers, large and small, including such names as Canva, Burger King, and Intuit. Marketers can use the platform to collect and gather data, take a wide range of actions on that data, and develop creative engagements with their customers in real time. Braze uses AI technology to power the platform, allowing for greater personalization, better customer outreach, and improved outcomes.

Some numbers will show that Braze has a solid foundation and upbeat prospects. The company claims more than 2,100 customers as of April 30 this year, dealing with 6.5 billion active users over the platform. In the calendar year 2023, there were more than 2.6 trillion messaging and other canvas actions taken on the Braze platform. All of this activity generates a sound revenue stream for Braze.

In its fiscal first quarter (ended on April 30), the company realized a 33% year-over-year increase in revenue as the top line figure landed at $135.5 million, also beating the forecast by $3.81 million. At the bottom line, the company runs a net quarterly loss – but the 5-cent non-GAAP EPS loss was a nickel better than had been anticipated.

Nevertheless, despite the strong results, Braze stock is down 28% year-to-date, although analyst Brian Schwartz thinks there’s a specific reason for that and notes that its underlying strength bodes well for the long term. “While BRZE shares have been under pressure YTD as investors have avoided customer engagement software suppliers because of a tough operating environment, we remain positive on the long-term business trajectory,” he said. “We expect Braze to continue leveraging its differentiated next generation data streaming architecture and platform time to value to win enterprise customers and support growth… In our view, Braze is well-positioned to benefit from increasing customer channel adoption, momentum landing larger enterprise deals, and growing AI product offering. The company’s growing international sales capacity, platform innovation and extensibility, and strong leadership team are laying a foundation for durable growth and improved profitability.”

Along with this outlook, Schwartz gives BRZE shares an Outperform (Buy) rating, with a $60 price target to indicate his confidence in a 58% gain on the 12-month horizon. (To watch Schwartz’s track record, click here.)

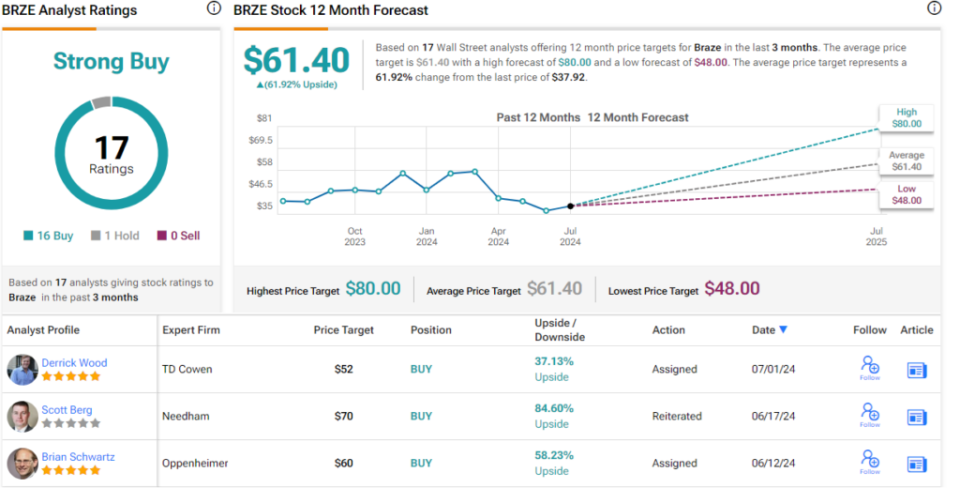

Overall, Braze has a Strong Buy consensus rating from the Street, based on 17 recent analyst reviews that include 16 Buys to just 1 Hold. The shares are priced at $37.92 and their average price target, of $61.40, implies a 62% gain in the year ahead, slightly more bullish than the Oppenheimer view. (See Braze’s stock forecast.)

Clearwater Analytics Holdings (CWAN)

Next up on our Oppenheimer-backed list is a fintech company, Clearwater Analytics. This firm operates on the popular software-as-a-service (SaaS) model, offering its customers a variety of tools for data analytics. The company’s solutions include automated aggregation of investment data; accounting, compliance, performance, and risk reporting; and data reconciliation. The company’s products report on more than $7.3 trillion in client assets every day, and are used by insurers, asset managers, pension plans, government agencies, and nonprofits. Clearwater is trusted by investment professionals worldwide to deliver accurate and timely data-driven results.

Data analysis is a service in high demand, especially among fintech professionals, and Clearwater has leveraged that demand to beat the forecasts on its revenue and earnings in recent quarters. In the most recent quarter reported, 1Q24, the company’s top line came to $102.7 million, a company quarterly record that was also up 21% year-over-year and was $2.16 million better than had been anticipated. Clearwater’s quarterly earnings came to 10 cents per share in non-GAAP measures, beating the forecast by a penny per share.

The company finished Q1 with a sound balance sheet, featuring $296.5 million in cash and other liquid assets on hand – more than offsetting the $47.9 million in total debt. The company had a free cash flow in Q1 of $8.6 million, an increase of 38.3% from the prior-year period.

In his coverage of Clearwater for Oppenheimer, analyst Schwartz has had a rethink recently, the result of which has been an upgrade for the stock from Perform (Neutral) to Outperform (Buy). Explaining his new stance, Schwartz writes, “Our struggle with Clearwater over the past 18 months has largely been tied to valuation which already projected much of the future success into the stock. During this time, investor sentiment has materially shifted away from expectations of high revenue growth rates for the foreseeable future, and expectations have become more reasonable. Bottom Line: CWAN has a durable growth story and a defensible moat in the AI era as a system of records and Verticals leader. We also see the business in position to reaccelerate growth next year from expansions strength and deliver upside to estimates. These items look underappreciated and should catalyze multiple expansion when more apparent.”

Schwartz complements his upgrade on this stock with a $25 price target that suggests a one-year upside potential of 33%.

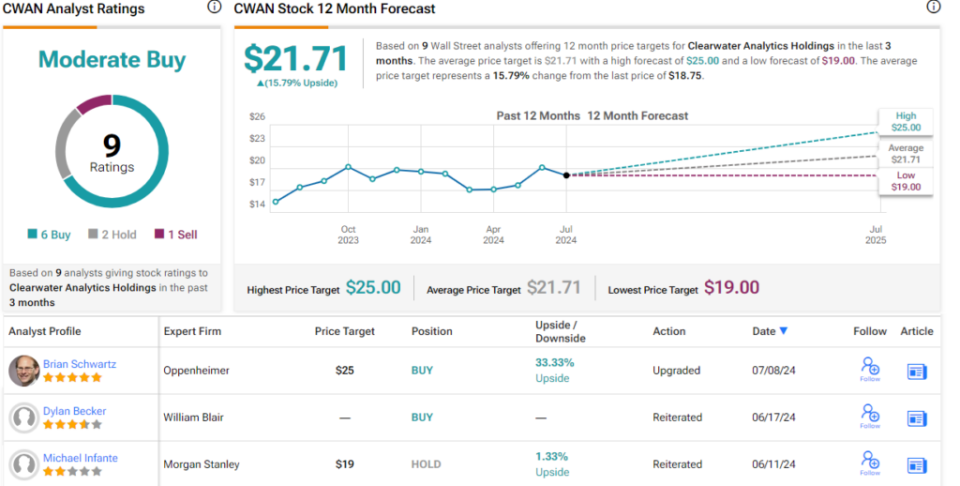

Clearwater has picked up 9 recent analyst reviews, with a breakdown of 6 Buys, 2 Holds, and 1 Sell giving the shares a Moderate Buy consensus rating. The stock’s $18.75 price and $21.71 average price target together imply an upside of 16% over the coming months. (See Clearwater’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Credit: Source link