Legendary investor Warren Buffett is well known for making sensible decisions, and one of his favorite oil companies, Occidental Petroleum (NYSE:OXY), stands poised for a potentially significant boost from Republican challenger and former President Donald Trump. Following a disastrous debate performance by current President Joe Biden, the Democrats are in big trouble.

It’s not just about serious concerns about Biden’s ability to handle another year – let alone a second term – in the White House. Rather, in the debate, he let Trump get away with divisive language. For example, when the former president spoke about undocumented workers taking jobs away from communities of color, the phrasing Trump used was not in the most professional or respectable manner.

Therefore, Biden suffered a double penalty: first, for poor performance, and second, for not challenging Trump’s statements. The latter point may have led to a normalization of controversial talking points. And that normalization may offer an easier path to the White House for Trump and down-ballot Republicans.

From an opportunistic standpoint, that’s bad news for Democrats and good news for Occidental Petroleum. By logical deduction, I am bullish on OXY stock.

OXY Stock Could Potentially Rise on a Second Trump Administration

While there’s more to OXY stock than merely as a beneficiary of political tailwinds, it’s difficult to ignore the potential. Previously in the race, the two candidates from opposing major parties appeared to be neck and neck, with Trump possibly having the slight advantage. Following the debate, momentum is clearly on the side of the Republicans.

That’s good for the broader hydrocarbon industry and specifically OXY stock. First, Buffett knows how to pick out great ideas in both bullish and bearish cycles. True, as The Wall Street Journal pointed out, there’s more to his game than just picking stocks. However, let’s not kid ourselves: the reason people care about Buffett’s portfolio is because he’s so good at investing.

Second, OXY stock primarily falls under the exploration and production component of the hydrocarbon value chain. Also known as upstream, this segment is going to be especially critical because of the current geopolitical climate. Tensions in Europe and the Middle East suggest that global oil supply chains could be disrupted. If so, the world would need more reliable sources of oil, and that’s where Occidental could enter the stage.

Further, Trump himself stated that he would scrap President Biden’s clean energy policies, specifically revolving around EVs and wind energy. That’s basically music to the ears of oil and gas upstream enterprises. True, that’s not an exclusive benefit to OXY stock. However, it’s quite possible that with the Buffett connection and the Republicans’ rising dominance in the political race, Occidental should be one of the top beneficiaries.

Recently, Buffett’s industrial conglomerate Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) has been ramping up its stake in OXY stock. While the Oracle of Omaha’s decisions in the market don’t represent the be-all, end-all, it’s still a considerable confidence boost to retail investors that he’s specifically picking Occidental over other upstream players.

Trust the Obvious Narrative

Of course, there’s nothing particularly exciting about OXY stock in the narrative sense. It’s not contrarian in the least. In my opinion, it’s a rather obvious investment. Still, obvious doesn’t mean bad. Sometimes, the crowded idea is the sensible one.

Since we’re on the topic of politics, let’s look at the lobbying of oil and gas companies during election cycles. According to information compiled by Statista, hydrocarbon companies have spent about $27.88 million so far this year lobbying Republicans. The amount spent toward lobbying Democrats? A miserly $4.04 million.

To be fair, the amount of lobbying dollars from the hydrocarbon industry collectively has declined since 2020. However, the ideological trend remains the same: the fossil-fuel sector spends more money targeting Republicans than Democrats. So, make no mistake: the oil industry, at large, wants Trump to win.

Interestingly, analysts may be factoring this reality into their forward projections. For Fiscal 2024, they only see Occidental’s revenue landing at $29.25 billion. That’s up a mere 1.1% from last year’s tally of $28.92 billion. However, they anticipate that Fiscal 2025 sales could hit $32.4 billion, up 10.8%.

Now, OXY stock trades at 2.18x trailing-year sales. Between the first quarter of 2023 to Q1 2024, this metric averaged 1.91x. However, with the latest political rumblings, a Republican administration could make the Fiscal 2025 sales target very feasible.

In reality, then, OXY stock is trading at 1.69x projected 2025 sales. And because of the political situation, that’s a realistic multiple, making OXY relatively undervalued. No wonder Buffett is buying it hand over fist.

Is Occidental Petroleum a Buy, According to Analysts?

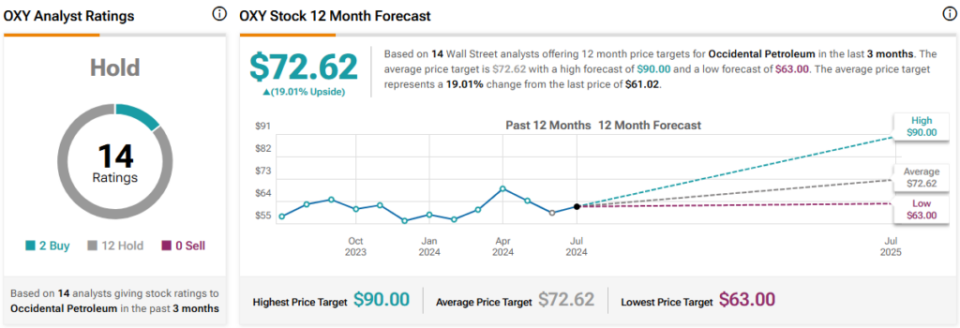

Turning to Wall Street, OXY stock has a Hold consensus rating based on two Buys, 12 Holds, and zero Sell ratings. The average OXY stock price target is $72.62, implying 19% upside potential.

The Takeaway: Political Winds Suddenly Make OXY Stock Exceedingly Attractive

With the political winds clearly benefiting Donald Trump and the Republicans, hydrocarbon exploration firm Occidental Petroleum should enjoy a powerful catalyst. Historically and currently, conservatives have long aligned themselves with oil and gas companies. Further, Warren Buffett’s stake in OXY stock gives it an air of confidence. As well, the idea could be undervalued due to the political landscape.

Disclosure.

Credit: Source link