In an episode of The Ramsey Show titled “Should I Pay Down My Mortgage Or Save For Retirement?”, a caller named Dan from Colorado sought advice on whether to prioritize paying down his mortgage or saving for retirement. At nearly 59 years old, Dan shared his complex financial history, including owning a business for 21 years, facing significant debt, and securing a stable job later in life.

Don’t Miss:

Dan’s situation is not unique. Many people in their late 50s struggle with debt repayment and retirement savings. Dan’s annual household income is approximately $145,000, and he has reduced his credit card debt from $92,000 to $5,000. However, he still owes $206,000 on his mortgage and has only $40,000 in retirement savings.

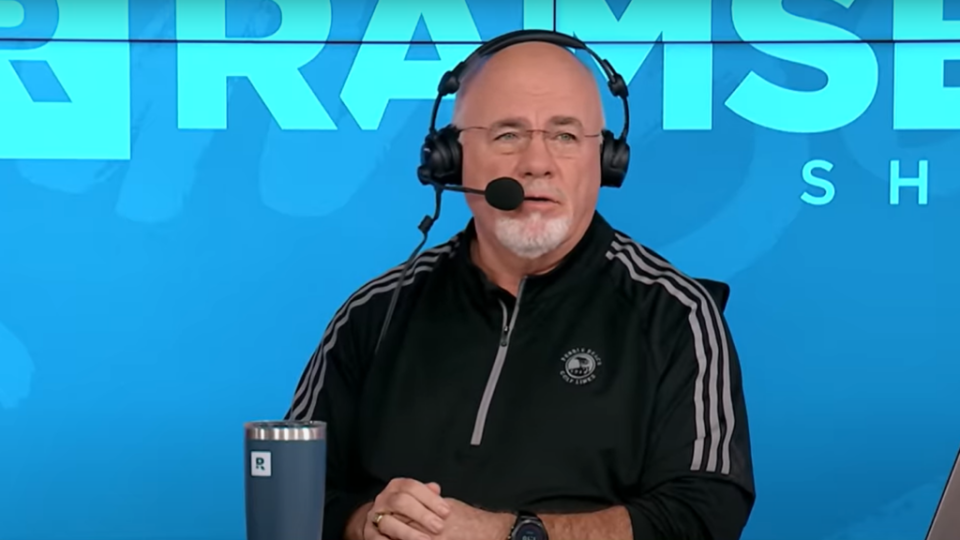

Dave Ramsey, a well-known financial advisor, provided a clear action plan for Dan. “Write a check today and pay off the credit card,” Ramsey advised, highlighting the need to cut up the credit card and stop relying on debt.

Next, Ramsey recommended building an emergency fund of three to six months of expenses. Dan mentioned he had started saving and had $7,000 set aside. Ramsey suggested increasing this to around $20,000 to provide a solid financial cushion.

After establishing the emergency fund, Ramsey advised Dan to save 15% of his income for retirement. This equates to about $20,000 annually. “If you will save twenty to thirty thousand dollars a year for 10 years, you’re gonna have about six or eight hundred thousand dollars,” Ramsey explained, illustrating the potential growth of Dan’s retirement fund.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

Ramsey highlighted the importance of aggressively paying down the mortgage. By living on a strict budget and allocating significant portions of their income toward the mortgage, Dan and his wife could be debt-free much sooner than anticipated. “Let’s take fifty [thousand dollars] and throw it at the house a year,” Ramsey suggested, projecting that the house could be paid off in about four years.

Finally, Ramsey stressed the need for disciplined spending and budgeting to achieve financial stability. “You guys have got to stop spending. You don’t have time to waste money,” he urged, emphasizing that strict budgeting and adherence to the baby steps would lead to long-term financial success.

Several factors come into play when considering whether to pay down a mortgage or save for retirement. Paying off your mortgage can lead to significant interest savings over time and provide the psychological benefit of being debt-free. For example, if you pay an additional $188 per month on a 30-year mortgage, you could pay it off in 20 years, saving around $27,216 in interest.

Trending: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

However, investing for retirement early can yield higher returns due to the power of compound interest. For instance, starting early allows investments to grow more substantially over time. A consistent investment of $10,000 annually with an average annual return of 8% can grow to nearly $2.8 million over 40 years.

For individuals like Dan, the decision can hinge on their financial situation and goals. If the mortgage interest rate is low and retirement savings are minimal, prioritizing retirement savings might be wiser to take advantage of compound interest and potential employer matches on retirement contributions. Conversely, if the psychological benefit of being debt-free is significant and the mortgage interest rate is relatively high, focusing on paying down the mortgage could be beneficial.

Ultimately, a balanced approach may work best for many. Paying off high-interest debts first, contributing to retirement savings, and making extra mortgage payments can provide a path to financial stability and growth. Consulting with a financial advisor can help tailor this approach to individual circumstances, ensuring both immediate financial security and long-term growth.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article ‘You Don’t Have Time To Waste Money!’ 59-Year-Old With Only $40,000 Saved Asks Dave Ramsey: Pay Down My Mortgage Or Save For Retirement? originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Credit: Source link