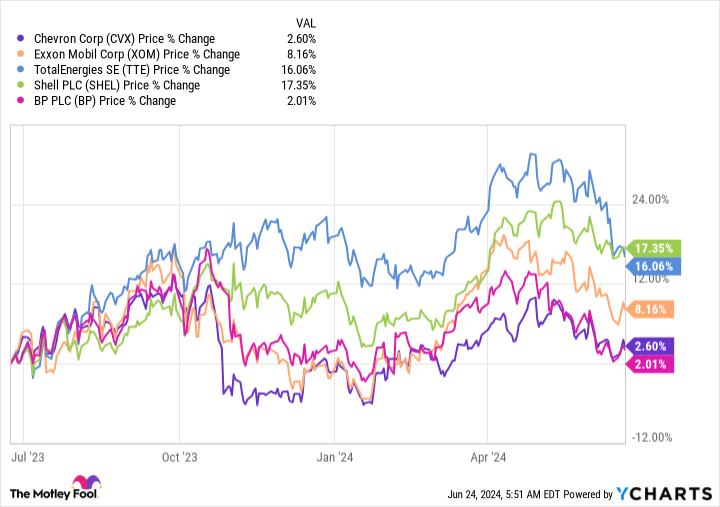

Chevron (NYSE: CVX) stock has been at the back of the pack performance-wise over the past year, with a gain of just 2%. ExxonMobil (NYSE: XOM) is up 8% over that span, and Shell (NYSE: SHEL) has gained around 17%. But don’t count Chevron out if you are looking at the energy sector. In fact, that laggard performance might actually make it the most attractive integrated energy stock you can buy today.

What’s Chevron’s problem?

The one word that should be on investors’ lips right now is probably “why.” As in, why is Chevron trailing other integrated energy companies by such a wide margin? One big part of the answer is that Chevron recently inked an agreement to buy Hess (NYSE: HES). But Hess is in a partnership with Exxon on a big capital investment in the oil space. Exxon is attempting to throw a wrench into Chevron’s acquisition by saying it can buy Hess out of that partnership.

That would make Chevron’s acquisition much less desirable and could even lead to the deal being canceled. Another problem here is that figuring out who’s right could lead to material delays and might require some legal wrangling, which would be costly. This uncertainty has left a cloud over Chevron’s stock, as investors generally don’t like uncertainty.

But that’s not all bad news, since it has left Chevron with a fairly large dividend yield of 4.2% relative to its closest peer Exxon, which is yielding just 3.4%. And while Exxon has increased its dividend for 42 years, it is hard to complain about Chevron’s impressive 37-year streak of annual dividend hikes. Simply put, they are both reliable dividend stocks.

Chevron is better prepared for adversity

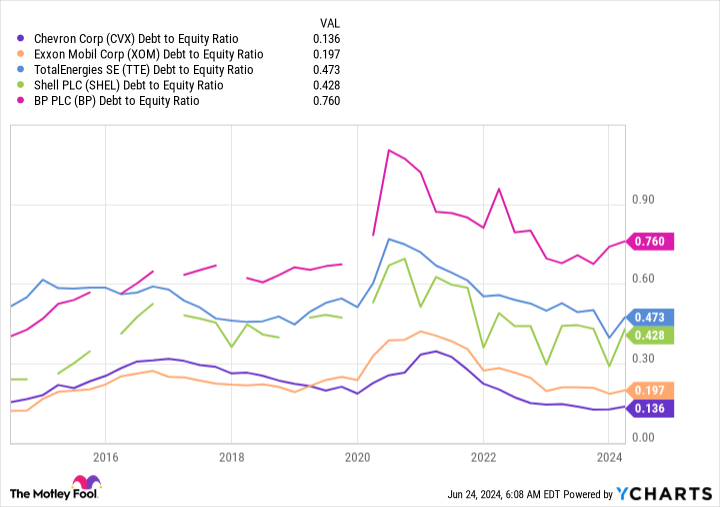

That said, while Exxon isn’t financially weak by any stretch of the imagination, Chevron is currently in a better financial position than any of its closest competitors. Notably, Exxon’s debt-to-equity ratio is roughly 0.2 times, while Chevron’s ratio is around 0.15 times. European peers make much greater use of leverage. Chevron has the strongest balance sheet among integrated energy majors. Leverage is important because the energy sector is highly cyclical and prone to dramatic price swings.

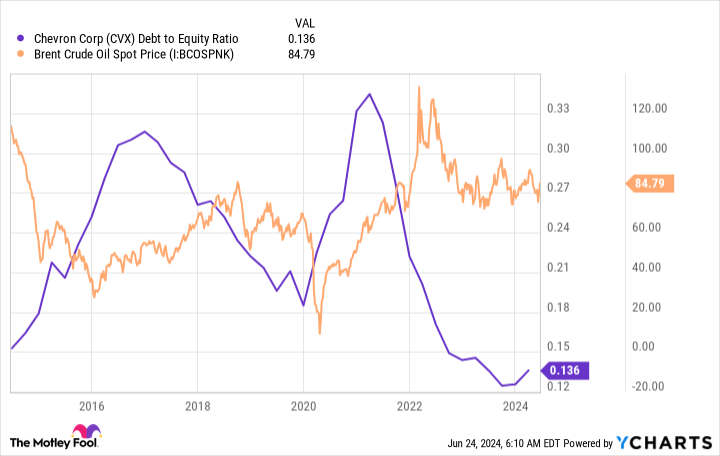

Basically, when oil prices fall, companies like Chevron tend to take on extra debt to keep funding their businesses. In the case of Chevron and Exxon, that cash is used to support the dividend. When oil prices improve, Chevron pays off the debt it took on, so it is prepared for the next industry downturn. The chart below shows this pretty clearly.

So, buying Chevron today will leave you owning the strongest company, financially speaking, in the energy sector. And it has a more attractive yield than its closest peer, Exxon. But there’s one more factor to consider, and that’s the Hess deal. Even if Chevron doesn’t end up acquiring Hess, it is large enough and financially strong enough to simply go out and find another company to buy. In other words, the negative sentiment here is largely based on a short-term issue.

Don’t be afraid to buy this industry laggard

At the end of the day, Chevron is a well-run energy company with a rock-solid financial foundation. Sure, there’s a very public negative hanging over the stock right now, but it won’t last forever, and Chevron is more than capable of dealing with the problem. For investors who want to own an energy stock and that think long-term, Chevron is probably the best place for $1,000 (or more) today.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,765!*

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $39,798!*

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $363,957!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of June 24, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.

The Best Energy Stock to Invest $1,000 in Right Now was originally published by The Motley Fool

Credit: Source link