NextEra Energy (NYSE: NEE) has a dividend yield of around 2.7% today. Income investors and those with a value bias probably won’t want to buy its shares, but if you like dividend growth stocks, the 10% annualized payout growth NextEra Energy has achieved over the past decade will probably get your juices flowing.

And if management is right, the future looks just as good as the past for dividend growth.

Why some people won’t like NextEra Energy

NextEra Energy has one major problem: Wall Street knows that this is a very well-run utility. That’s why the yield is 2.7%, which is below the 3% average for the utility sector, using the Vanguard Utilities Index ETF (NYSEMKT: VPU) as a proxy.

Sure, NextEra yields more than the 1.3% you would get from an S&P 500 Index fund, but it just isn’t a high yield stock. Dividend investors and those with a value bias — noting that the yield is at best middle of the road over the past decade — will probably want to look at utilities with higher yields.

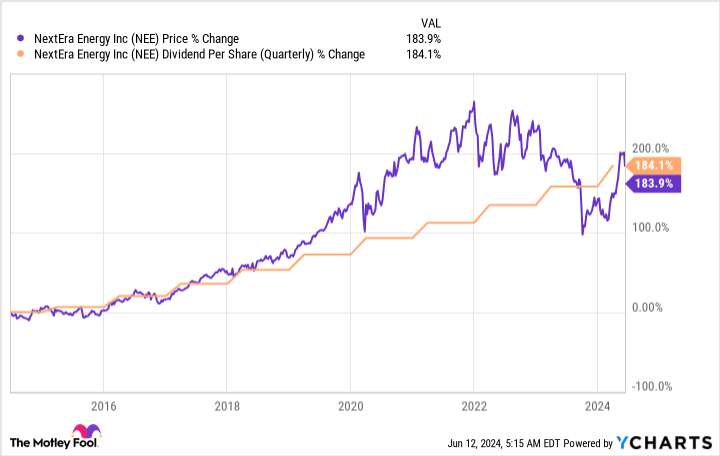

That said, the current dividend yield isn’t the reason to buy NextEra Energy. Dividend growth is the real story, with the dividend increasing by more than 180% over the past 10 years.

The stock has risen by almost the exact same amount over that span, as well, leading to a pretty impressive total return of more than 260%, with dividend reinvestment. That’s better than the S&P 500 index, which had a total return of around 225% over the same span. Step back for a second: NextEra, a utility company, beat the S&P 500!

But there’s another figure that you might find interesting: yield on purchase price. If you bought NextEra Energy in 2013 at its most expensive point, you would have paid $22.4375 per share, adjusted for a 4-for-1 stock split in 2020. The annualized dividend in the fourth quarter of 2013 was $0.66 per share, for a yield on purchase of roughly 2.9%.

At the end of the second quarter of 2024, the annualized dividend was $2.06 per share, which would mean your yield based on purchase price rose to a huge 9.2% or so in a little over a decade. If you like dividend growth, you’ll love NextEra Energy.

The future looks bright for NextEra Energy

NextEra Energy has achieved this dividend growth by building a large renewable power business atop its regulated utility operations in Florida. Clearly the business model has worked well based on the dividend growth.

And NextEra thinks the next few years will be just as good as the last decade. Right now, the company is calling for earnings growth of between 6% and 8% a year through at least 2027. That will lead to dividend growth of 10% a year through at least 2026.

What’s backing that outlook? Management expects electricity demand in the United States, driven by demand for renewable power, to increase materially in the years ahead.

Some numbers will help: Between 2000 and 2020, electricity demand expanded just 9%, but between 2020 and 2040, NextEra believes demand will increase by 38%. That’s a drastic change in what has historically been considered a pretty sleepy sector.

But the really important part of the story here is that NextEra Energy’s clean energy expertise, built over decades, positions it well to benefit from the push for renewable power that it expects. And if you buy NextEra today, you can benefit along with the company.

NextEra Energy is always expensive

If you bought the stock in 2013 when it had a 2.9% dividend yield, you would probably be a pretty happy dividend-growth investor today. But that yield is pretty close to the 2.7% yield today, which suggests that NextEra Energy has been an expensive stock to own for a very long time. However, if dividend growth is what you are after, this utility has proved that paying up for quality can work out very well over the long term.

Should you invest $1,000 in NextEra Energy right now?

Before you buy stock in NextEra Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NextEra Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool has a disclosure policy.

Is NextEra Energy Stock a Buy? was originally published by The Motley Fool

Credit: Source link