BTC tends to rally after softer-than-expected CPI releases, 10x said.

The Fed will eventually signal more rate cuts, the research firm added.

ETF inflows resumed Wednesday as U.S. inflation came in lower-than-expected.

10x Research continues to advocate bitcoin even as the leading cryptocurrency trades under pressure following the Fed’s hawkish interest rate projections.

On Wednesday, the U.S. central bank left the benchmark borrowing cost unchanged in the range of 5.25%- 5.5% as expected. However, it predicted just one rate reduction this year, down from three in March. Given the softer-than-expected CPI release early in the day, the Fed’s new rate prediction likely spooked markets, sending bitcoin lower.

The leading cryptocurrency by market value has pulled back to $67,400 since the Fed released rate projections, reversing the post-CPI jump to $70,000, CoinDesk data show.

Still, 10x Research maintains a positive outlook on bitcoin, expressing confidence that the rally will soon resume.

“Our recommendation remains unchanged: to stick with the winners (Bitcoin) and avoid others (such as Ethereum). Our previous analysis has shown that a lower CPI number tends to lift Bitcoin prices, and we anticipate this trend will continue,” Markus Thielen, founder of 10x Research, said in a note to clients on Thursday.

The U.S. consumer price inflation rate was flat in May, missing the consensus estimate for a 0.1% rise and down from 0.3% in April. The year-on-year rate was 3.3%, matching estimates and down from April’s 3.4%.

Per Thielen, the slowdown in inflation has historically attracted huge inflows into the U.S.-listed spot bitcoin exchange-traded funds. Provisional data from Farside Investors show the ETFs amassed $100 million on Wednesday, snapping a two-days outflows streak.

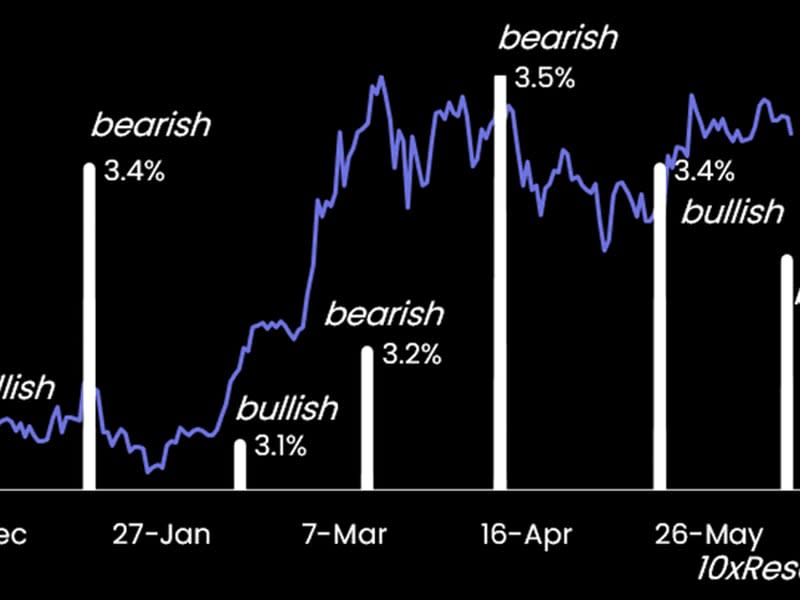

Thielen explained that the ETF flows dried after the debut on Jan. 11 as December CPI came in higher, weakening the case for Fed rate cuts. The flows resumed in February, pushing bitcoin higher.

“ETF flows turned positive at the end of January but only started to accelerate slightly ahead of the CPI data release on February 13. But when inflation again increased to 3.2% on March 12, Bitcoin ETF inflows stopped as the market priced out the narrative of 2-3 rate cuts,” Thielen noted at the end of May.

Thielen expects the Fed to signal more rate cuts later this year as inflation has already peaked.

Credit: Source link