The broader technology sector has received a big boost in the past year and a half thanks to the emergence of artificial intelligence (AI), which explains why the Nasdaq-100 Technology Sector index has gained an impressive 83% since the beginning of 2023. However, not all tech stocks have benefited from this surge; Snowflake (NYSE: SNOW) is one such example.

Shares of the company, which provides a cloud-based data platform, have gained only 5% since the beginning of last year. Snowflake’s latest results for the first quarter of fiscal 2025 (for the three months ended April 30, 2024) didn’t do much to inspire investor confidence either as the stock fell more than 5%.

However, a closer look at Snowflake’s results indicate investors may have overreacted.

Snowflake is looking to capitalize on a fast-growing market

Snowflake’s revenue for fiscal Q1 increased 33% year over year to $829 million, which was well past the consensus estimate of $787 million. However, the company’s adjusted earnings fell 6% year over year to $0.14 per share and missed the $0.18-per-share estimate. Snowflake lowered its full-year margin guidance. It is now forecasting a non-GAAP (adjusted) operating margin of 3% for the year compared to the earlier forecast of 6%.

Investors may have pressed the panic button on account of the weaker margin projection. However, the company is making a smart move by ramping up investments in AI infrastructure, a strategy that will dent its margins in the short run but could open new growth opportunities. CFO Mike Scarpelli said: “We are lowering our full year margin guidance in light of increased GPU-related costs related to our AI initiatives. We are operating in a rapidly evolving market, and we view these investments as key to unlocking additional revenue opportunities in the future.”

Snowflake is purchasing graphics processing units (GPUs) so that it can build AI-focused services such as Snowpark, Cortex, Document AI, and its own large language model (LLM). Cortex, for instance, gives Snowflake customers access to multiple LLMs so that they can build AI applications such as chatbots using their own data without having to invest in expensive hardware.

Chief Executive Officer Sridhar Ramaswamy points out that Snowflake is witnessing “an impressive ramp in Cortex AI customer adoption since going generally available.” More than 750 Snowflake customers are already using Cortex since it was made generally available on May 7. The company ended the previous quarter with a total customer base of just over 9,800, which means a nice chunk of its customer base has adopted its AI-focused offerings in a short period.

This bodes well for Snowflake as its strategy of adding AI services to its cloud data platform will encourage its existing customers to spend more money, while also attracting new customers into the company’s fold. After all, the AI-as-a-service market that Snowflake is targeting is expected to clock annual growth of almost 37% through 2029, generating $72 billion in revenue at the end of the forecast period.

The good part is that Snowflake is already witnessing healthy growth in its customer base, while also winning a bigger share of their wallets, and AI could accelerate this trend.

These metrics point toward a bright future

Snowflake’s customer count increased 21% year over year in the previous quarter. Even better, the number of customers who have generated more than $1 million in product revenue for the company increased at a greater pace of 30% year over year. Moreover, Snowflake’s dollar-based net retention rate stood at an impressive 128%. This is a sign of higher spending by its existing customers, as this metric compares the money spent on the company’s offerings in a quarter to the spending by the same customer cohort in the year-ago period.

This combination of an improvement in Snowflake’s customer base and higher customer spending explains why its remaining performance obligations (RPO) jumped 46% year over year to $5 billion. That was an improvement over the 41% growth in RPO in the preceding quarter. According to Snowflake, RPO represents “the amount of contracted future revenue that has not yet been recognized.”

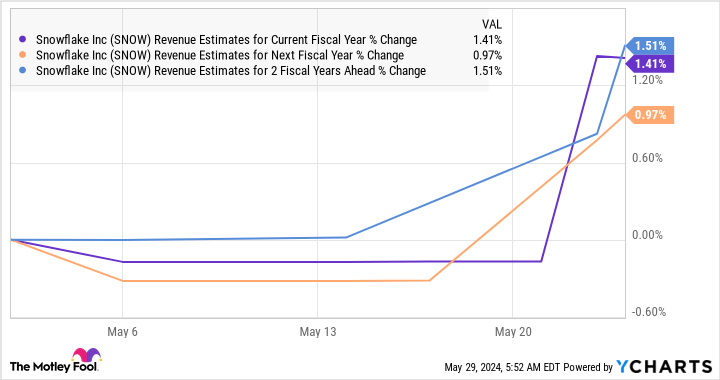

The fact that Snowflake’s RPO growth has accelerated, and that the metric is growing at a faster pace than its revenue, suggests that its future revenue pipeline is improving. Not surprisingly, Snowflake has raised its full-year product revenue guidance to $3.3 billion from the earlier estimate of $3.25 billion. What’s more, analysts have also raised their growth expectations from Snowflake following its latest results.

Savvy investors, therefore, should consider taking advantage of Snowflake’s underperformance as AI could help this tech stock regain its mojo.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 28, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Snowflake. The Motley Fool has a disclosure policy.

Prediction: This Tech Stock Could Make a Big Move Thanks to Artificial Intelligence (AI) was originally published by The Motley Fool

Credit: Source link