Joe Biden’s US government faces its highest borrowing costs since before the global financial crisis amid concerns that the Federal Reserve will keep interest rates higher for longer.

The yield on 10-year Treasuries rose to a 16-year high of 4.342pc amid recent evidence of a robust US economy.

The coupon on 30-year US bonds hit its highest level since April 2011, reaching 4.468pc. The yield on 10-year UK gilts has pushed five basis points higher today to 4.71pc.

It comes as investors keenly await comments from Federal Reserve chairman Jerome Powell on Friday at a meeting of central bankers at Jackson Hole in Wyoming that begins on August 24. He could offer clues on the outlook for interest rates.

Rick Meckler, partner at Cherry Lane Investments, said: “I don’t think the market is looking for some statement suggesting rate rises are over.

“But investors are looking for anything that can turn the near-term negative sentiment.”

Traders have bet there is an 89pc chance that the Fed will pause its interest rate increases in September, according to the CME Group’s Fedwatch tool.

Read the latest updates below.

06:43 PM BST

Ovo ordered to improve customer service after ‘serious concerns’ raised

Ovo has been ordered to improve its customer service after “serious concerns” were raised over unresolved complaints and waiting times.

Ofgem has set Ovo “clear expectations and improvement targets” to address outstanding complaints and reduce how long it takes for issues to be resolved.

The UK’s gas and electricity regulator launched compliance proceedings against the Bristol-based supplier after it was contacted by the Energy Ombudsman and Citizens Advice Scotland.

Ovo faces potential enforcement action and fines if it does not improve its complaint and referral processes.

An Ovo spokesman said: “Ofgem did not identify any non-compliance from Ovo on this matter.

“We continue to place serious emphasis on the support we provide to our customers and have assured Ofgem of this.”

06:21 PM BST

Net zero infrastructure group to delist from London’s group as losses surge

Renewable energy group Fulcrum Utility Services plans to delist from the London Stock Exchange as losses widen.

Fulcrum, which designs and builds renewable energy infrastructure, said it has reviewed the “advantages and disadvantages” of remaining on London’s Aim.

This included the company’s “limited prospects” of raising additional funds from investors, plus the significant costs and regulatory burden which listed businesses face.

Fulcrum said that delisting would help support the group’s return to profitability and help simplify the business.

Shareholders of the Sheffield-based company will vote on the proposals at next month’s general meeting.

Revenue sank 18pc to £50.6m in the year to March 31, while pre-tax losses ballooned 81pc to £25.7m.

Interim chief executive Lindsay Austin blamed the performance on “legacy issues and the difficult conditions that the group has operated in”.

05:51 PM BST

FTSE 100 closes at six-week low as housebuilders face downturn

Britain’s blue-chip index has closed at a six-week low after poor industry data and a major profit warning dragged down the UK’s largest housebuilders.

The FTSE 100 closed down 0.06pc to 7,257.82, reversing all opening gains from this morning’s rally.

The midcap FTSE 250 tumbled 1.09pc to 17,898.99, closing in the red for the seventh consecutive session.

It comes after data from website Rightmove showed asking prices for homes in Britain fell sharply this month amid as rising mortgage costs. Meanwhile, Crest Nicholson tumbled 14.4pc after the housebuilder lowered its annual profit expectations.

It saw more than half a billion pounds has been wiped off Britain’s largest housebuilders as traders reacted to concerns of a deepening downturn in the property sector. Housing stocks fell 3.54pc.

Michael Hewson, chief market analyst at CMC Markets UK, said: “A profit warning from UK housebuilder Crest Nicholson has reinforced the challenges facing the housing market in the months ahead with interest rates set to be hiked further next month.”

05:18 PM BST

London-based law firm drops hybrid working policy

London-based law firm Signature Litigation has reportedly scrapped working-from-home, becoming the latest company to order staff back to their desks.

The boutique firm, which specialises in complex commercial disputes and regulatory investigations, now requires staff to work from the office five days a week.

While Signature Litigation is returning to its pre-pandemic rules, the firm does allow for flexibility, according to trade publication The Lawyer.

The firm employs 63 lawyers and has offices in Paris and Gibraltar.

The move comes as City bosses rethink hybrid working policies introduced during the pandemic.

04:54 PM BST

Aviva testing artificial intelligence across UK business

British insurance group Aviva has begun piloting artificial intelligence across its business to offer customers a “quicker solution”.

The London-based provider is currently testing the technology in its insurance claims division, according to Adam Winslow, chief executive of Aviva UK and Ireland general insurance.

He told trade publication InsurancePost: “When storms happen a lot of customers contact us to check whether certain things are covered. There are a lot of people we use for those calls, but we can serve that need far more easily with AI.”

“It is about matching a customer with a policy and the documentation to say what is and isn’t covered.”

While Aviva is exploring how AI can be used for administrative tasks, Mr Winslow said that humans will still be needed for “empathetic work” that requires emotional support.

04:28 PM BST

Handing over

That is your lot from me today. The ever-dependable Adam Mawardi will take things from here.

Some say he is worth his weight in gold, although that might not be the highest compliment on today’s prices:

04:22 PM BST

US government faces shutdown as row over spending deepens

The US government faces another federal shutdown later this year, Goldman Sachs has warned, with Republicans at loggerheads over “root canal” spending cuts.

A lack of consensus in Congress over annual spending bills will likely bring the American political system to a halt, the investment bank warned, leading to a hit of 0.2 percentage points per week to the nation’s economy.

It comes as members of the hardline House Freedom Caucus are pushing to cut spending to the fiscal 2022 level of $1.47trn (£1.16trn), which would be $120bn less than President Joe Biden and House Speaker Kevin McCarthy agreed to in their May debt ceiling compromise which averted a potentially disastrous default on US debts.

With Republicans also seeking higher spending on defence, veterans benefits and border security, analysts say the hardline target would mean cuts of up to 25pc in areas such as agriculture, infrastructure, science, commerce, water and energy, and healthcare.

Representative Don Bacon, a centrist Republican from Nebraska, said: “The reductions are so deep. They want to make everything a root canal.”

Goldman’s chief US political economist Alec Phillips said: “The federal government looks more likely than not to temporarily shut down later this year.”

04:07 PM BST

US long-term Treasury yields highest in 12 years

The yield on 30-year US Treasury bonds has hit its highest level since April 2011 amid concerns that interest rates could remain higher for a longer period of time.

The coupon hit 4.468pc, and was last up 8.5 basis points to 4.464pc.

It comes as recent evidence of a robust US economy stokes concerns the Federal Reserve could keep rates higher for longer.

Investors are now keenly waiting for comments from Federal Reserve chairman Jerome Powell on Friday at a meeting of central bankers at Jackson Hole in Wyoming that begins on August 24.

The yield on 30-year UK gilts has risen four basis points to 4.91pc.

03:56 PM BST

Bitcoin slump deepens amid bond sell-off

Bitcoin added to losses racked up during the digital token’s worst week since November last year as the prospect of higher-for-longer borrowing costs sapped demand for riskier investments across global markets.

The largest digital asset fell 0.2pc toward £20,000, trading near a two-month low after shedding more than 10pc last week. Smaller coins like Ether and XRP also slid.

Longer term UK gilts and US Treasury yields are around multi-year highs as part of a global bond selloff.

The surging yields come as traders fear a prolonged period of high interest rates to choke inflation. Such a backdrop would restrain liquidity and pose a challenge for riskier assets like stocks and crypto.

Top central bankers are due to meet in Jackson Hole this week for the Federal Reserve’s annual symposium. Fed Chair Jerome Powell’s comments due on Friday will be closely examined for clues about the policy outlook.

Tony Sycamore, a market analyst at IG Australia, said: “The market potentially is hoping there is going to be some dovish rhetoric coming out of Jackson Hole. I don’t think they are going to be dovish.”

Mr Sycamore expects the S&P 500 stock index to drop another 2pc to 3pc amid a climb in the 10-year US Treasury yield past 4.33pc, with Bitcoin extending its decline to about $25,000 (£19,638).

03:38 PM BST

Gas price volatility to ‘remain over next few years,’ warn economists

Gas prices remain 9.5pc higher today after surging as much as 18pc earlier amid the threat of strikes at plants in Australia.

Up to 10pc of the world’s liquified natural gas exports could be disrupted if strikes go ahead, with unions setting a deadline of Wednesday for an agreement in pay talks with Woodside Energy.

The looming threat of walkouts comes as workers at Chevron plants in Australia also began voting on potential strikes last week.

The possibility of walkouts sent gas prices soaring as much as 40pc when the news first broke earlier this month.

Kieran Tompkins, commodities economist at Capital Economics, said the volatility “serves as a reminder that natural gas markets are still carrying the scars of Russia’s invasion of Ukraine”. He added:

We think that an environment of more volatile prices is set to remain a feature of natural gas markets over the next few years.

However, major investments in new LNG export terminals will raise global export capacity from 2025, which should help volatility return closer to historic norms.

03:20 PM BST

US markets would rebound in event of US federal shutdown, says Goldman Sachs

Any losses in the private sector from a US federal government shutdown would be made up in the quarter after the closure, Goldman Sachs predicts.

Stock markets ended either flat or higher during the prolonged closures experienced in 1995-96, 2013 and 2018-19.

Goldman’s chief US political economist Alec Phillips said:

Markets have not reacted strongly to prior shutdowns.

However, in each instance equity prices were lower at some point in the days following the start of the shutdown than when it began.

03:00 PM BST

Bond investors warned of ‘trouble ahead’ over climate change

Bond investors have been warned to brace for “trouble ahead” over climate change and that they cannot rely on credit ratings to give them a fair assessment of the risks they are exposed to as a result of wildfires and extreme weather caused by global warming.

The Institute for Energy Economics and Financial Analysis said that all of the big three credit ratings companies — Moody’s, S&P Global and Fitch — have issued warnings but these have gone largely unnoticed.

Hazel Ilango, an energy finance analyst at IEEFA the US-based non-profit organisation said that inside the industry, “alarm bells have been sounding for months”.

IEEFA notes that in June, S&P warned that climate change is becoming a “significant” driver affecting credit worthiness, but acknowledged that “very few climate-related rating actions” had taken place since early 2022.

Fitch has warned that about 20pc of corporates face downgrades next decade due to climate change, while Moody’s has said that credit risks linked to environmental, social and governance factors are rising.

However, Ms Ilango said he warnings went largely unheeded, which “is concerning”.

According to IEEFA, failure to gradually reflect the impact of climate change in credit ratings will expose issuers to bigger, sudden losses further down the road.

The warning comes as extreme weather dominates news headlines, with large swaths of North America, Europe, Asia and Africa afflicted by everything from floods, to drought to wildfires.

02:34 PM BST

Wall Street gains at the opening bell

US markets increased at the opening bell after a bruising August so far for investors.

The Dow Jones Industrial Average has increased 0.1pc to 34,529.82 ahead of this week’s annual gathering of central bankers at Jackson Hole, Wyoming, with Federal Reserve Chairman Jerome Powell due to speak Friday.

The S&P 500 has gained 0.3pc to 4,383.55 while the Nasdaq Composite was up 0.5pc to 13,360.66 after the opening bell.

02:19 PM BST

More than half of Premium Bond savers have not won a penny

More than 13m Premium Bond savers have not won a single prize in nearly two decades, figures reveal.

Madeline Ross has the details.

Premium Bonds are Britain’s favourite savings product with more than 22m customers investing more than £121bn. But millions of savers would be better off putting their money elsewhere.

Data from National Savings and Investments (NS&I) reveals that 62pc of Premium Bond savers have not won a single prize since May 2004.

Premium Bonds do not pay guaranteed interest, but instead each £1 bond is entered into a monthly prize draw to have the chance to win anything between £25 and £1m tax-free. The savings product will offer its best rates since 1999 when it rises to 4.65pc from September adding £66m to the NS&I’s monthly prize pot.

The figures, obtained via the Freedom of Information Act, show that the average prize winner had £38,874 stashed away. The average holding of a saver who has not won in nearly 20 years is just £106.

This chart shows the odds of winning on Premium Bonds.

02:01 PM BST

Biden ‘considers meeting’ with MBS at G20

US President Joe Biden is considering meeting with Saudi Crown Prince Mohammed bin Salman on the sidelines of next month’s G20 summit, it has been reported.

A meeting between the two leaders in New Delhi, India, could give a push to the talks the White House has been holding with the Saudi government for a deal which includes US security guarantees for Riyadh, and a normalisation agreement between Saudi Arabia and Israel, according to Axios.

01:38 PM BST

Driverless car company forced to cut ‘robotaxi’ fleet after collision

Dozens of driverless cars have been taken off the road in San Francisco after a “robotaxi” crashed into a fire engine last week.

Our technology editor James Titcomb has the latest:

Cruise, the driverless car subsidiary of General Motors, has been ordered to reduce the size of its self-driving fleet in the city by half after the collision.

The company had around 100 vehicles operating during the day and 300 at night, when there is less traffic, so will have 50 and 150 respectively under the reductions.

The order to shrink down operations follows a collision between a Cruise cab and a fire engine that had its sirens on last Thursday.

Read how it happened.

01:12 PM BST

Pound has peaked and will come under renewed pressure, says HSBC

The pound has peaked and will come under pressure in the coming months as the housing market stumbles and consumer resilience fades, according to HSBC.

Our economics editor Szu Ping Chan has the details:

The bank has joined a growing chorus of City analysts who are becoming increasingly bearish on sterling, which has been the best-performing G10 currency this year.

Dominic Bunning, head of European foreign exchange research at HSBC, said weak retail sales data last week raised alarm bells over the sustainability of sterling’s rally, which saw the pound hit $1.31 in July.

Mr Bunning said: “The consumer resilience that we saw helping to drive the pound higher earlier this year appears to be fading slightly earlier than we expected.

“We have been bullish on the pound since November last year, with a forecast it would hit $1.30. Having breached that level – briefly – last month, risks are building that it may now represent the peak in the currency rather than a more sustainable level beyond the end of the drizzly summer.”

So far this year, the pound has climbed 5.3pc against the dollar to $1.27 and 3.5pc on the euro at €1.13.

This chart shows sterling’s performance versus the dollar.

12:54 PM BST

Need for ECB interest rate rises questioned

Given the outlook for Germany’s economy, questions have been asked about whether more interest rate rises are needed from the European Central Bank.

The ECB deposit rate stands at a record 3.75pc:

12:28 PM BST

US chipmaker Broadcom given go-ahead for £54m UK cloud firm takeover

Broadcom’s proposed purchase of VMware would not substantially reduce competition in the supply of server hardware components in the UK, the industry regulator has said.

The UK’s competition watchdog has cleared the largest deal in its history as it said that the tie-up of US companies Broadcom and VMware would not damage UK competition.

The $69bn (£54bn) deal – the largest the Competition and Markets Authority (CMA) has ever investigated – raises “no competition concerns”, the regulator said.

It cleared the deal after an in-depth investigation which considered several areas where there had been some concern.

Broadcom makes computer chips, while VMware is a cloud technology company. The CMA had looked at whether by owning VMware, Broadcom would be able to spy on its competitors who used VMware services.

It assessed whether rival chipmakers would have to share commercially sensitive information with VMware to ensure their chips work with VMware’s software.

But the watchdog said that “this is unlikely to be a concern, in particular since information about new product adaptations only needs to be shared with VMware at a stage when it is too late to be of commercial benefit to Broadcom.”

It also looked at whether the merged companies could make VMware’s software work less well with products made by Broadcom’s rivals. But it concluded that this would not make sense for the company, as the benefit would be outweighed by the financial cost.

12:14 PM BST

British landlords face £3bn hit as WeWork warns of collapse

Landlords face losing billions in rent owed by WeWork, as the work space provider grapples with the rise of home working.

Our technology editor James Titcomb has the latest:

British landlords are exposed to more than £3bn in rental commitments from WeWork, London’s biggest private tenant.

A Telegraph analysis of WeWork’s UK subsidiaries shows the pay-as-you-go office provider has signed leases worth £3.1bn at more than 50 locations in Britain.

But the firm, once valued at $47bn (£37bn), has warned that there are “substantial doubts” over its ability to keep operating and its shares have lost 97pc of their value over the past 12 months.

The company, which takes long leases from office providers and sublets them on monthly contracts, slammed the brakes on a global expansion and pursued profitability after founder Adam Neumann’s 2019 plans for a New York flotation publicly unravelled.

The company went public two years later. However, the rise of working from home and a surplus of office capacity has hit the business.

Read about the landlords facing a hit amid the company’s struggles.

11:59 AM BST

Germany’s central bank raises alarm on ‘lacklustre’ economy

Germany’s “lacklustre” economy will likely stagnate again in the third quarter, the Bundesbank has said, as weak demand from abroad and high interest rates take their toll on Europe’s industrial powerhouse.

After preliminary estimates suggested that the economy recorded zero growth in the second quarter of 2023, the outlook for the July to September period was not much better, the country’s central bank said in its monthly report.

“German economic output will probably remain largely unchanged again in the third quarter,” it said.

Europe’s largest economy is “still lacklustre” and “still experiencing a period of weakness”, it added.

The gloomy outlook adds to concerns that Germany will drag down the eurozone’s economic performance this year, with the International Monetary Fund predicting it will be the only major advanced economy to shrink in 2023.

National statistics agency Destatis will release final data for the second quarter on Friday.

The German economy shrank over the two preceding quarters, meeting the technical definition of a recession.

11:38 AM BST

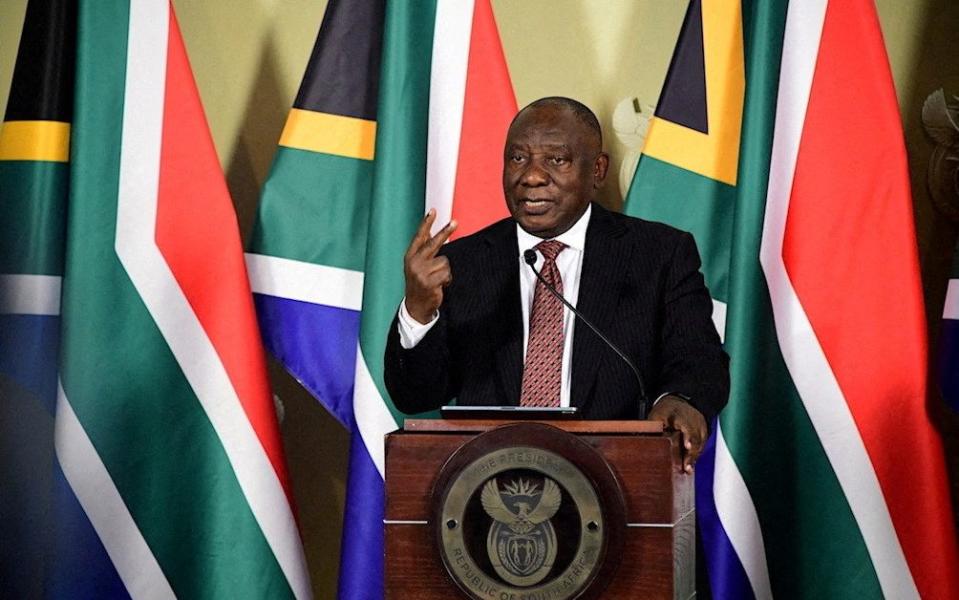

Ramaphosa backs expansion of Brics group to rival G7

South African president Cyril Ramaphosa expressed support for an expansion of the Brics group of emerging market powers, which will gather for its annual summit in Johannesburg this week.

The leaders of Brics — Brazil, Russia, India, China and South Africa — are due to hold three days of talks starting on August 22, with a possible expansion high on the agenda.

More than 20 nations have formally applied to join, Mr Ramaphosa said.

He said: “An expanded Brics will represent a diverse group of nations which share a common desire to have a more balanced world order.”

The summit will be attended by United Nations Secretary-General Antonio Guterres and more than 30 African heads of state, as well as others from the Global South.

Chinese President Xi Jinping, in an op-ed published in several South African media outlets on Monday, said his country and South Africa, as “natural members” of the Global South, should push for developing countries to have more sway in international affairs.

11:13 AM BST

Wall Street poised to open higher

US stocks have risen in premarket trading after a sharp selloff last week, with investors awaiting more clues on interest rates from an upcoming gathering of central bank policymakers in Jackson Hole.

Strong gains in equities this year have been tested in August, with the S&P 500 losing more than 5pc from its intra-day high in late July.

Fresh evidence of a robust US economy last week yet again stoked expectations that the Federal Reserve could keep rates higher for longer, driving 10-year Treasury yield to its highest level since October.

The yield on the 10-year note was up at 4.28pc on Monday and a breach above 4.338pc would take it to levels not seen since 2007.

Investors are now keenly waiting for comments from Fed Chair Jerome Powell on Friday at a meeting of central bankers at Jackson Hole in Wyoming that begins on August 24.

Charu Chanana, a market strategist at Saxo Markets, said:

The symposium will be key to assess Powell’s dovishness meter. If he raises concerns on the economic momentum or the rising credit risks, that may prompt the markets to price in rate cuts to start earlier.

In premarket trading, the Dow Jones Industrial Average was up 0.4pc, the S&P 500 was 0.5pc higher and Nasdaq 100 futures had risen 0.7pc.

10:50 AM BST

Pound weakens as dollar holds firm

The pound has dipped against the dollar, which has held steady as investors looked ahead to the Federal Reserve’s Jackson Hole symposium for guidance on where interest rates might settle.

The event – where Fed chair Jerome Powell is set to speak on Friday – is the major market focus and may set the direction for US Treasury yields.

The pound has fallen 0.1pc against the dollar to $1.27 and is down 0.3pc against the euro, which is worth more than 85p.

Meanwhile, the Australian dollar, at $0.6402, and the New Zealand dollar, at $0.5919, were pinned close to last week’s nine-month lows after a rate cut from China disappointed markets worried about a stalling economy.

China cut its one-year benchmark lending rate by 10 basis points and left its five-year rate unchanged, against economists’ expectations for larger 15 basis points cuts to both.

The yuan slid to the weak side of 7.3 per dollar despite a firm fixing of its trading range by the central bank.

10:24 AM BST

Tesco to cover cost of VAT on period pants

Tesco has become the first retailer to cover the cost of VAT on its range of period pants, following an industry campaign calling on the Government to remove the 20pc tax that applies to the product.

The 20pc reduction in price brings the pants in line with other period products which have been exempt from VAT since 2021, the supermarket said.

The permanent reduction in price is across all eight lines of Tesco’s own-brand F&F period pants, with a three-pack reduced to £14.40 from £18 and a single pack of pants reduced to £6 from £7.50.

The announcement comes after Tesco joined the Say Pants To The Tax campaign, calling on the Government to reclassify period pants as a period product rather than garments in order for them to be exempt from VAT.

Marks & Spencer wrote an open letter to the Financial Secretary in partnership with period underwear brand Wuka earlier this month, calling for the removal of VAT from the pants.

10:07 AM BST

More than £500m wiped off UK housebuilders as downturn deepens

More than half a billion pounds has been wiped off Britain’s largest housebuilders amid a deepening downturn in the property sector.

The largest developers across the FTSE 100 and FTSE 250 were the biggest fallers today after poor industry data and a major profit warning.

Figures from Rightmove showed asking prices for homes in Britain suffered the biggest August fall since 2018 this month as soaring mortgage costs put buyers under pressure.

Meanwhile, more than £50m was wiped off the value of Crest Nicholson shares as the housebuilder issued a profit warning today after trading “worsened during the summer of this year”.

In all, housebuilders have taken a hit of more than £552m in early trading, as Redrow, Vestry, Taylor Wimpey, Persimmon, Barrett and Berkeley sank to the bottom of the UK’s main stock markets.

Victoria Scholar, head of investment at Interactive Investor said: “Shares in Crest Nicholson have had a tough time lately, underperforming the UK market, weighed down by the prospect of ongoing inflation, higher interest rates and subdued borrowing.

“And the stock is trading sharply lower in today’s trade, shedding over 12pc, pricing in the hefty profit downgrade.

“Its update is weighing on other stocks in the sector like Taylor Wimpey, Persimmon and Barratt Developments which have sunk to the bottom of the FTSE 100. Real estate is the worst performing sector across Europe today.”

09:50 AM BST

Soy hits three-week high amid US heatwave

Soybean prices have risen to the highest since July as hot weather grips the US growing region, raising concerns about crops.

Parts of US states including Iowa, Illinois and Nebraska — large corn and soy growers — are under excessive heat warnings, the National Weather Service said.

While it can be notoriously hot from mid- to late August, temperatures for the areas are expected to break numerous daily and potentially monthly records.

The “heat dome” could last for more than a week and is boosting crop prices, Paris-based adviser Agritel said.

The weather is a particular concern for soybeans, as they are still in a crucial development phase — while most corn has finished pollinating.

Meanwhile, wheat futures fell, reversing earlier gains. It comes as Ukraine could finalise a deal with global insurers as early as next month to cover grain ships sailing to and from its Black Sea ports, according to the Financial Times.

09:19 AM BST

Oil ticks higher as dollar rally slows

Oil has risen for a third day amid signs of tightening supplies in the market and a stall in the dollar’s rally.

Global benchmark Brent traded 0.7pc higher above $85 a barrel, and is up more than 2pc since last Wednesday’s close.

Supply curbs from Russia and Saudi Arabia have driven a rally since late June, while US crude stockpiles have shrunk to the least since January.

The dollar was steady today following declines in the previous two sessions, making commodities that are priced in the currency cheaper for many buyers. That came after the greenback had been strengthening from mid-July.

Yeap Jun Rong, a market strategist for IG Asia said a stall in the dollar rally over the past few sessions is aiding oil.

He said: “All eyes will be on whether China will be able to pull off a recovery through the rest of the year to provide further conviction for oil prices to continue higher.”

08:54 AM BST

Domino’s franchisee to declare Russian business bankrupt

The Russian arm of fast food chain Domino’s is likely to close after its London-listed parent company decided to put it into bankruptcy.

Apparently failing to find a buyer for the Russian business, DP Eurasia said it has decided its subsidiary should instead file for bankruptcy.

The franchisee runs around 170 Domino’s pizza sites in the country, and had previously said it was “evaluating its presence” there.

The Russian economy has been hit by sanctions since President Vladimir Putin launched his unprovoked full-scale invasion of Ukraine in February 2022, a continuation of the Kremlin’s campaign in eastern Ukraine and Crimea which started in 2014.

Although DP Eurasia has not been named by Ukraine as one of the International Sponsors of War – a list which includes businesses such as Unilever, Procter & Gamble, Yves Rocher, and Mondelez – it has faced criticism for continuing to do business in Russia.

Late last year the company was named and shamed in the House of Commons for its ongoing presence in the country.

DP Eurasia has Domino’s franchise sites in Turkey, Russia, Azerbaijan and Georgia. In Turkey it is the biggest pizza delivery chain, with 673 sites, and it is the third-largest in Russia.

08:37 AM BST

FTSE 250 slumps amid property sector worries

Housebuilders have dragged down the FTSE 250 after disappointing data on asking prices and a profit warning from Crest Nicholson.

The UK’s midcap stock index has fallen 0.3pc, with the housing sector index slipping 2.9pc.

Data from website Rightmove showed asking prices for homes in Britain fell sharply this month, as rising mortgage costs caused sellers to lower their expectations of what they can get for their properties.

It was the biggest monthly fall for August since 2018 and twice as steep as the usual summertime fall.

Meanwhile, Crest Nicholson tumbled 14.4pc after the housebuilder lowered its annual profit expectations.

The FTSE 100 opened higher as it was boosted by energy stocks in a rebound from six-week lows hit in the previous session.

The UK’s blue-chip index rose as much as 0.2pc as oil and gas stocks added 1pc amid a bounce in oil prices caused by lower exports from Saudi Arabia and Russia.

08:25 AM BST

Asking prices for homes plunge to lowest level in five years

Advertised house prices have fallen by the biggest amount in five years as high mortgage rates ward off potential buyers.

Our personal finance reporter Alexa Phillips has the details:

The average asking price of newly marketed properties dropped by 1.9pc (£7,012) this month, to £364,895, marking the biggest cut in August since 2018, according to Rightmove.

Sellers are pricing competitively to attract buyers hit by high mortgage rates and cost of living pressures, the property website said.

While a number of big-name lenders have announced rate cuts over the past few weeks, the average two-year mortgage rate has only marginally slipped from 6.78pc to 6.76pc in the past month, according to Moneyfacts, an analyst.

The number of sales agreed is now 15pc lower than in 2019, while there was a 10pc decline for properties bought by first-time buyers.

This chart shows how monthly mortgage payments have increased as a share of income.

08:14 AM BST

European gas prices jump nearly a fifth

European natural gas prices have surged as Australian workers prepare for a strike if no deal is reached in pay talks on Wednesday.

Benchmark Dutch front-month gas soared as much as 18pc to €42.90 a megawatt-hour in early trading as the looming walkouts threaten global supplies.

The industrial action could start as early as September 2 if Woodside Energy, the operator of the plant, does not offer a suitable agreement, unions said over the weekend.

Workers at Chevron plants also began voting on potential strikes last week.

The possibility of supply disruptions in Australia, which may impact 10pc of global LNG exports, has kept European traders on edge this month.

Anxiety has surged even though the continent is well-stocked for winter and it rarely receives fuel from Australia.

08:06 AM BST

Mixed start for UK markets

Stock markets in London have struggled for direction after the interest rate cut in China.

The internationally-focused FTSE 100 has gained 0.1pc to 7,266.29 while the FTSE 250 was down 0.2pc to 18,068.09.

07:57 AM BST

Housing slowdown triggers profit warning at Crest Nicholson

Housebuilder Crest Nicholson has said that the housing market has slowed considerably this summer, especially in recent weeks, as it downgraded its profit forecast for the year.

The builder said that “trading conditions for the housing market have worsened during the summer of this year”, as “the economic uncertainty is deterring prospective home movers”.

It came despite prices remaining resilient because there is not much supply of homes to buy and not many people who are being forced to sell because of a deterioration in their financial situations.

The business said that it expected adjusted pre-tax profit to reach £50m in the year ending October 31. It had previously indicated that profit would reach around £73.7m.

07:54 AM BST

China to spearhead push for G7 rival as economy weakens at home

China will push the world’s leading emerging market powers to become a full-scale rival to the G7 group of wealthy nations as it seeks to enlist more members.

The Brics bloc — Brazil, Russia, India, China and South Africa — will use an annual leaders’ summit in Johannesburg this week to begin the process of enlisting more members to bolster its global status.

The push has been driven mainly by Chinese President Xi Jinping but also backed by Russia and South Africa.

There will also be talks on how to accelerate a shift away from the dollar, in part by increasing the use of local currencies in trade between members, which is surging, according to a draft agenda seen by Bloomberg.

It comes as China’s central bank cut interest rates today in an attempt to counter the post-Covid growth slowdown in the world’s second-largest economy.

Activity has been dragged down recently by uncertainty in the labour market and global economic sluggishness, weakening demand for Chinese goods.

07:49 AM BST

China cuts key interest rate in bid to kickstart economy

China’s central bank cut a key interest rate but kept another on hold in a move that has confused economists as it attempts to counter the post-Covid slowdown in the world’s second-largest economy.

Activity has been dragged down recently by uncertainty in the labour market and global economic sluggishness, weakening demand for Chinese goods.

Growth has also been hit by financial troubles in the real estate sector, with several leading developers on the verge of bankruptcy and struggling to complete projects.

The People’s Bank of China said today cut the one-year loan prime rate (LPR), which serves as a benchmark for corporate loans, from 3.55pc to 3.45pc.

However, the five-year LPR, which is used to price mortgages, was held at 4.2pc, despite economists predicting the rate to be cut by 15 basis points following a similar reduction last week to an important central bank policy loan rate.

Goldman Sachs economist Maggie Wei described the LPR cut as “disappointing”, adding that it “would not help with building confidence” as Chinese authorities pursue an economic recovery.

Zhang Zhiwei, chief economist at Pinpoint Asset Management, said: “The decision to keep the 5-year unchanged is puzzling.

“It is not clear how to interpret this decision and the cut last week.”

China stocks fell to around nine-month lows as investors were disappointed by the milder-than-expected measures to boost confidence.

Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group, said: “The surprising hold of five-year LPR is inconsistent with the overall policy tone of property bailout.

“The policy message of this LPR hold will confuse the market and dilute the sentiment impact.”

Julian Evans-Pritchard, head of China Economics at Capital Economics, said: “The big picture is that the PBOC’s approach to monetary policy is of limited use in the current environment and won’t be enough, on its own at least, to put a floor beneath growth.”

He added: “But the disappointing follow-through from the MLF cut to the LPR strengthens our view that the PBOC is unlikely to embrace the sizeable declines needed to revive credit demand.”

07:31 AM BST

Good morning

Chinese banks kept a key interest rate that guides mortgages on hold, a surprise move that sowed confusion over the country’s approach to stemming the nation’s property slump.

The five-year loan prime rate (LPR) was unexpectedly held steady at 4.2pc on Monday, according to data from the People’s Bank of China.

Most economists had predicted the rate to be cut by 15 basis points following a similar reduction last week to an important central bank policy loan rate. That was seen as precursor for a cut to the 5-year LPR.

The one-year LPR was lowered by 10 basis points to 3.45pc from 3.55pc, a smaller cut than what most economists surveyed by Bloomberg had expected.

5 things to start your day

1) Rudderless EY gripped by soul searching as private equity circles | After tumbling from the peaks of ‘Project Everest’, the firm’s future hangs in the balance

2) Ocado-backed robot chef sold for pennies in the pound | Karakuri collapses into administration as venture investment dries up

3) Taxpayer-funded Welsh sports car factory still empty 12 months after refurbishment | British sports car brand TV has yet to formally sign the lease

4) MumsGPT: the AI chatbot trained on two decades of parenting advice | Mumsnet uses technology from OpenAI to comb through threads of 10 million users

5) Airline baggage and add-on fees boost Ryanair’s revenue by £18bn | Passengers face ‘eye watering’ charges to book seats and stow bags

What happened overnight

Asian stocks were mixed as investors were disappointed by China’s milder-than-expected measures to boost confidence, with the country’s sluggish recovery and property woes keeping sentiment fragile.

China cut its one-year benchmark lending rate today but surprised markets by keeping the five-year rate unchanged, falling short of market expectations of cuts to both rates.

China’s blue-chip CSI 300 Index dropped 0.5pc by the midday recess to its lowest since late November 2022, while the Shanghai Composite Index lost 0.4pc.

Hong Kong’s Hang Seng Index fell 1.4pc, and the Hang Seng China Enterprises Index declined 1.3pc.

Meanwhile, Tokyo shares ended a three-day losing streak to close higher, with bargain-hunting supporting the market.

The benchmark Nikkei 225 index gained 0.4pc to end at 31,565.64, while the broader Topix index added 0.2pc to 2,241.49.

The Kospi in Seoul gained 0.1pc to 2,507.16 while Sydney’s S&P-ASX 200 shed 0.3pc to 7,124.60.

India’s Sensex opened up 0.3pc at 65,147.47. New Zealand and Singapore retreated while Bangkok and Jakarta gained.

Broaden your horizons with award-winning British journalism. Try The Telegraph free for 1 month, then enjoy 1 year for just $9 with our US-exclusive offer.

Credit: Source link