Cybersecurity is a massive industry that has never been more important. Hackers are more adept at breaching systems and causing havoc for companies. Precautions must be taken to protect internal and customer data.

This requires implementing one (or several) cybersecurity solutions, and, as a result, investors should consider adding cybersecurity stocks to their portfolio, as demand for their products is massive.

Two of the most popular are Palo Alto Networks (NASDAQ: PANW) and CrowdStrike (NASDAQ: CRWD). But which one is the better buy? Let’s find out.

Palo Alto and CrowdStrike compete heavily

First, let’s discuss each company’s primary business within the cybersecurity realm.

Palo Alto divides its business into three segments: network security, cloud security, and security operations. Its network security business includes firewalls and a zero-trust platform that prevents outsiders from accessing a network. Its cloud security platform protects cloud workloads, and the security operations platform has products like endpoint security (endpoints are network access devices like laptops) and threat detection response.

CrowdStrike has a similar product lineup, although its initial business wasn’t firewalls like Palo Alto. It got its start with a cloud-first security approach that started with endpoint protections and then expanded into other areas like identity protection, cloud security, threat intelligence, and endpoint detection response. So Palo Alto and CrowdStrike are direct competitors in many of their offerings.

But when you dig into their financials, a leader begins to emerge.

CrowdStrike’s growth is projected to remain strong this year

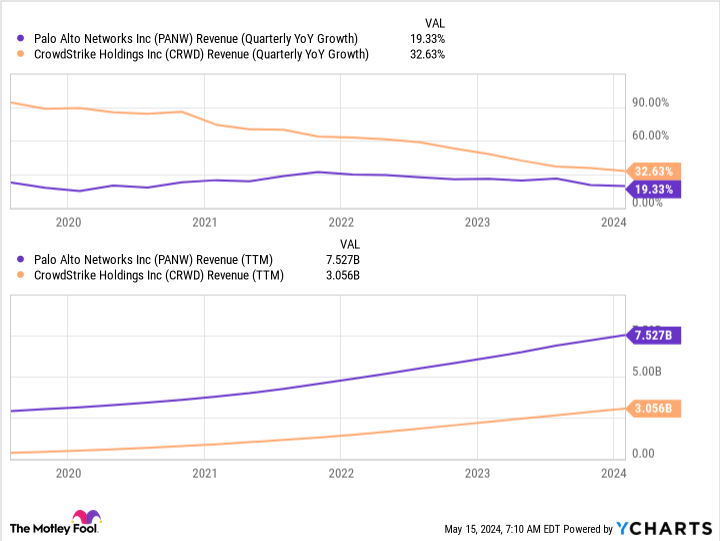

If you look solely at revenue growth, CrowdStrike seems to have an edge. However, this is a side effect of being a smaller business. This is on full display with CrowdStrike’s growth trajectory, as its year-over-year revenue growth is slowing down the larger it gets.

While CrowdStrike is growing faster than Palo Alto, the roles might be flipped if Palo Alto were the size of CrowdStrike. However, forward-looking indications aren’t as bright for Palo Alto.

In the quarter that ended April 30, Palo Alto is expecting revenue growth of only 3%. (It’s scheduled to report earnings results Monday.) This is a massive red flag, especially when compared to CrowdStrike, as well as other cybersecurity companies.

For the quarter that ended April 30, CrowdStrike expects revenue of around $904 million, indicating 31% growth. (It’s scheduled to report earnings results on June 4.) That’s quite the difference, and it shows that Palo Alto is struggling.

Or is it?

Palo Alto’s management said during the February conference call with analysts that its guidance was “a consequence of us driving a shift in our strategy in wanting to accelerate both our platformization and consolidation and activating our AI leadership.” Artificial intelligence (AI) can play a huge role in powerful cybersecurity products, so this shift makes sense.

However, CrowdStrike has been using AI since its inception to automatically detect and deal with threats without human intervention. This has given CrowdStrike an edge over Palo Alto networks in the endpoint protection game.

Which stock?

To me, this is all I need to declare CrowdStrike the winner. It already has significant AI experience, while Palo Alto is late to the game.

CrowdStrike is by far the better buy here, and I wouldn’t be surprised to see it starting to take some Palo Alto customers in the future.

Should you invest $1,000 in Palo Alto Networks right now?

Before you buy stock in Palo Alto Networks, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palo Alto Networks wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 13, 2024

Keithen Drury has positions in CrowdStrike. The Motley Fool has positions in and recommends CrowdStrike and Palo Alto Networks. The Motley Fool has a disclosure policy.

Better Cybersecurity Stock: Palo Alto Networks vs. CrowdStrike was originally published by The Motley Fool

Credit: Source link