Walmart’s WMT beat-and-raise quarterly release should ordinarily provide favorable read-throughs for Target TGT, which is scheduled to report results before the market’s open on Wednesday, May 22nd. But the two companies have different business models, and that makes expectations off target.

To start, Walmart has effectively added a technological component to its well-established reputation for value. Walmart’s digital prowess has allowed it to offer a variety of convenient shopping options, allowing it to gain market share, with mostly high-income households finding the company’s service offerings hard to resist. The company’s revenues in the quarter increased +5.8% (in constant currency), with digital sales up +21% from the same period last year.

Another major point of distinction between the two retailers is their merchandise mix, with Walmart heavily weighted towards groceries and Target towards discretionary merchandise. Walmart enjoyed mid-single-digit same-store sales growth in the latest quarter, with the aforementioned high-income households attracted to the retailer for its convenient delivery and pick-up options.

Walmart’s general merchandise, which can roughly be considered comparable to the bulk of Target’s merchandise mix, continued to show soft results, with same-store sales down in the low single digits in the quarter. Most analysts expect Target to show low single-digit same-store sales declines but also expect some sequential improvement in the trend line

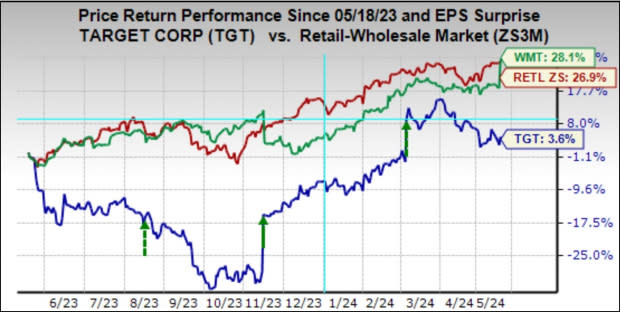

Target is expected to bring in $2.05 in EPS on $24.5 billion in revenues, with earnings unchanged from the year-ago period on -3.2% lower revenues. The stock was up big following each of the last two quarterly releases in March and November, as can be seen in the one-year performance chart below relative to Walmart and the Zacks Retail sector.

Image Source: Zacks Investment Research

With respect to the Retail sector 2024 Q1 earnings season scorecard, we now have results from 23 of the 34 retailers in the S&P 500 index. Regular readers know that Zacks has a dedicated stand-alone economic sector for the retail space, which is unlike the placement of the space in the Consumer Staples and Consumer Discretionary sectors in the Standard & Poor’s standard industry classification.

The Zacks Retail sector includes not only Walmart, Target, and other traditional retailers, but also online vendors like Amazon AMZN and restaurant players.

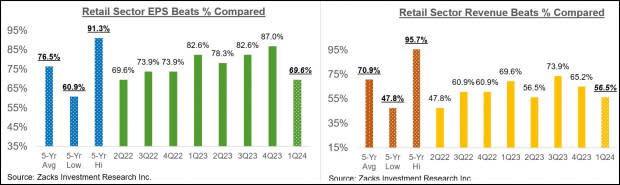

Total Q1 earnings for these 23 retailers that have reported are up +38.7% from the same period last year on +6.4% higher revenues, with 69.6% beating EPS estimates and 56.5% beating revenue estimates.

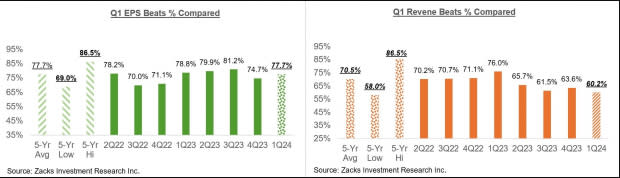

The comparison charts below put the Q1 beats percentages for these retailers in a historical context.

Image Source: Zacks Investment Research

Walmart beat both EPS and revenue estimates, but Home Depot missed on revenues. Aside from these two ‘conventional’ retailers, the scorecard at this stage primarily reflects the Q1 performance of the digital players and restaurant operators. As the above beats data shows, these companies have struggled to beat EPS and revenue estimates in Q1.

In fact, Q1 EPS and revenue beats percentages for these players remain below the average for this group of companies over the preceding 20 quarters (5 years) and are towards the lower end of the 5-year high-low range.

With respect to earnings and revenue growth rates, we like to show the group’s performance with and without Amazon, whose results are among the 23 companies that have already reported. As we know, Amazon’s Q1 earnings were up +278.7% on +12.5% higher revenues, beating top- and bottom-line expectations.

As we all know, digital and brick-and-mortar operators have been converging for some time now, with Amazon now a decent-sized brick-and-mortar operator after Whole Foods and Walmart a growing online vendor. This long-standing trend got a huge boost from the Covid lockdowns.

The two comparison charts below show the Q1 earnings and revenue growth relative to other recent periods, both with Amazon’s results (left side chart) and without Amazon’s numbers (right side chart)

Image Source: Zacks Investment Research

As noted earlier, we have started seeing signs of stress at the lower-end of income distribution, and one can intuitively project moderation in consumer spending as the economy further slows down under the weight of tighter monetary conditions. Inflation may be down from the multi-decade highs of a few quarters back, but it still remains a headwind, particularly for the lower end of income distribution. That said, the labor market remains very strong, with wages still going up.

We will hear more about issues on the Q1 earnings calls, likely in the context of their outlooks for the coming periods.

Earnings Season Scorecard and This Week’s Earnings Reports

The bulk of the Q1 earnings season is now behind us, with results from 467 S&P 500 companies already out through Friday, May 17th. We have almost 150 companies reporting results this week, including 15 S&P 500 members. This week, the most keenly awaited earnings release isn’t from Target but rather from Nvidia NVDA, which reports after the market’s close on Wednesday, May 22nd. Lowe’s, TJX Cos, Macy’s, and Ralph Lauren are some of the other companies reporting this week.

Total Q1 earnings for these 467 index members are up +4.6% from the same period last year on +4% higher revenues, with 77.7% beating EPS estimates and 60.2% beating revenue estimates.

The comparison charts below put the Q1 earnings and revenue growth rates in a historical context.

Image Source: Zacks Investment Research

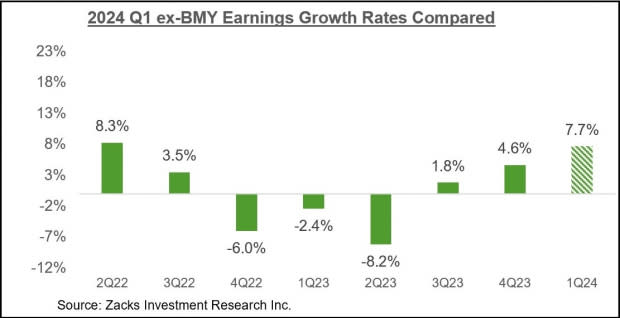

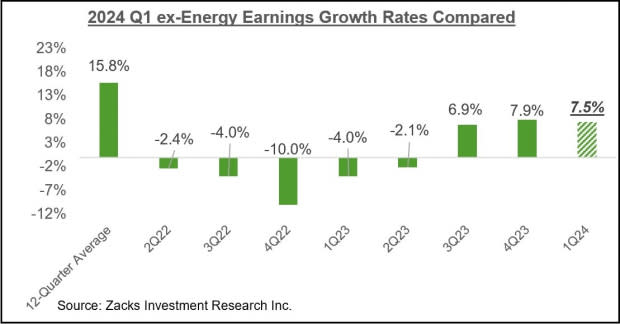

We have been flagging an acceleration in the earnings growth trend, which becomes more clear once the Bristol Myers drag is removed from the data; the pharma giant came out with a huge one-time charge. The chart below shows the Q1 earnings growth pace for these companies on an ex-BMY basis.

Image Source: Zacks Investment Research

Earnings growth for these companies would have been +7.5% instead of +4.6% had it not been for the substantial Energy sector drag. The chart below puts the Q1 ex-Energy earnings growth pace in the context of other recent quarters.

Image Source: Zacks Investment Research

The comparison charts below put the Q1 EPS and revenue beats percentages in a historical context.

Image Source: Zacks Investment Research

As we noted in the context of the Retail sector, beats percentages have been weaker for the index as a whole, with the variance relative to other recent periods particularly notable on the revenues side.

The Earnings Big Picture

Looking at Q1 as a whole, total S&P 500 earnings are expected to be up +6.3% from the same period last year on +4.3% higher revenues, which would follow the +6.9% earnings growth on +3.9% revenue gains in the preceding period.

The chart below shows current earnings and revenue growth expectations for 2024 Q1 in the context of where growth has been over the preceding four quarters and what is currently expected for the following three quarters.

Image Source: Zacks Investment Research

As you likely know already, the Tech and Energy and sectors are having the opposite effects on the aggregate growth picture. Excluding the Tech sector, Q1 earnings for the rest of the index would be down -0.7% while the growth pace improves to +9.2% on an ex-Energy basis.

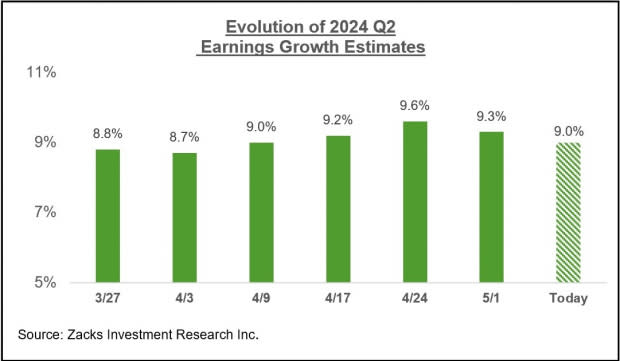

For the current period (2024 Q2), total S&P 500 earnings are currently expected to be up +9% on +4.5% higher revenues.

The revisions trend has been very favorable for Q2 estimates, as the chart below shows.

Image Source: Zacks Investment Research

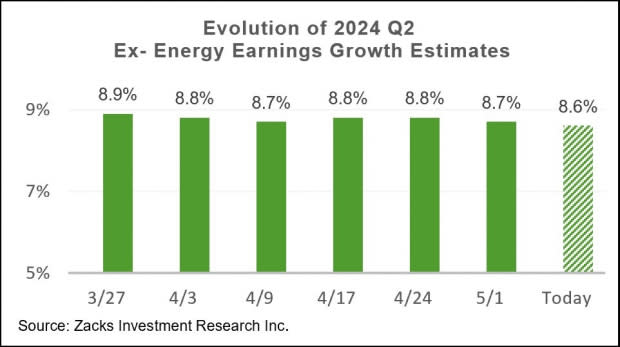

Here is the Q2 revisions trend on an ex-Energy basis

Image Source: Zacks Investment Research

Looking at the overall earnings picture on an annual basis, total 2024 S&P 500 earnings are expected to be up +8.9% on +1.6% revenue growth.

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>> Current Earnings Outlook Reflects Positivity

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Credit: Source link