After a rocky month of April, investor sentiment has improved somewhat. At least in part, this can be attributed to a better-than-expected earnings season. So far, about 80% of the S&P 500-listed companies have reported their Q1 results, and 77% of those have shown a quarterly EPS above the forecasts. Overall, the earnings reported are 7.5% better than the estimates, a beat that’s well above the 6.7% decadal average.

Scott Chronert, a U.S. equity strategist at Citigroup, comments on the broader implications: “We’re now far enough through the Q1 earnings period to provide some perspective on both the quarter itself as well as implications for our full-year S&P 500 earnings projection. At a high level, this earnings period provides further support to our ongoing bullish view toward S&P 500 fundamentals, even as we navigate the Fed and underlying economic conditions… To us, the good news is that market-implied growth expectations have come in with the index pullback, creating a more beatable setup relative to analyst expectations.”

“All told,” Chronert summed up, “valuations are still telling us strong fundamentals are expected, and need to be delivered on. We remain comfortable that our full-year $245 S&P 500 EPS estimate should be attainable, if not conservative.”

The stock analysts at Citigroup are turning this large-scale view into concrete recommendations, pointing out 3 stocks to buy right now. These include one call with 77% upside potential, a solid gain for investors to cash in on. Using the TipRanks database, we can also found out what other analysts have in mind for these names. Here’s a closer look.

Ford Motor (F)

We’ll start with a Detroit classic, Ford Motor Company. This company, based just outside the Motor City in Dearborn, Michigan, was the first to develop the assembly line method for building automobiles, in 1913, and has been a leader in the automotive industry ever since. The company was a pioneer in low-cost, mass-produced cars, and its famous Model T, priced at $300 in the late 1920s, was one of the first motor vehicles to be truly accessible to the masses. Ford is also famous for its muscle cars, particularly the Mustang, and its F-series light-, medium-, and heavy-duty pick-up trucks are the best sellers in their niche. The company’s F-150 pickup is consistently among the best-selling vehicles in the US.

In recent years, Ford has made significant moves in the development and production of electric vehicles (EVs), including developing and marketing electric versions of the Mustang and the F-150. The company has seen mixed results from this initiative; on the one hand, Ford’s EV sales grew by 129% year-over-year in the April 2024 sales update, while internal combustion vehicle sales were down by 9%, but on the other hand, the company is still losing money on its EVs. Ford’s electric vehicle unit, Model e, reported a net loss in Q1 of this year totaling more than $1.3 billion.

The company does have strengths to compensate for the losses in EVs. The Ford Blue segment, which focuses on future developments of combustion engine vehicles, including gas-electric hybrids, is proving strong. The segment’s hybrid vehicle sales are on track to grow by 40% this year, and Ford’s compact Maverick was the best-selling hybrid truck in the US market during Q1. The company has hybrid versions of the F-150 in production, as well – and the fully electric F-150 Lightning saw its April sales grow by 56% year-over-year.

A particular bright spot for Ford in Q1 was the Ford Pro commercial division. This segment saw support from increased demand for Super Duty work trucks, Transit vans, and various software and physical services. The commercial division saw Q1 revenue of $18 billion, for a 36% year-over-year gain, and offset the losses in EVs.

Overall, Ford reported $42.8 billion at the top line in 1Q24, for a 3.2% year-over-year gain that beat the forecast by $1.31 billion. The company’s bottom line, the non-GAAP EPS, came to 49 cents per share, 5 cents better than had been anticipated. The company declared a common share dividend of 15 cents, for payment on June 3. The dividend annualizes to 60 cents per common share, yielding a forward yield of 4.8%, which surpasses inflation expectations.

Covering Ford stock for Citigroup, analyst Itay Michaeli lays out the company’s strengths: “Anchored by our U.S. industry thesis, we believe Ford sports unique defensive & growth attributes that aren’t reflected in the stock: (1) Defensive—(a) Pro being amongst the strongest & most defensive global auto franchises, with ~13% of EBIT already coming from SW/services. We value Pro alone at ~$66bln. (b) Blue, with leading franchises (F-150, Bronco) that should also prove stronger & more resilient vs. the industry. (2) Growth—Significant self-help (material/warranty), next-gen EVs (where we see a net-share gain oppty) and SW/services—where proof points already exist.”

Michaeli goes on to explain why he believes that Ford offers investors a sound buying opportunity, adding, “Net-net, we see a path to ~$3 EPS power in the coming years, well above consensus of <$2. Execution is key (launches, costs), but we’re encouraged by recent trends. If Ford can continue executing in the coming quarters, the stock should benefit from positive EPS revisions and an increasingly compelling case for multiple expansion post last year’s re-segmentation—all anchored by a strong B/S & improved FCF conversion.”

These comments back up Michaeli’s Buy rating on Ford’s stock, while his $18 price target suggests that the shares will gain 44% in the next 12 months. (To watch Michaeli’s track record, click here)

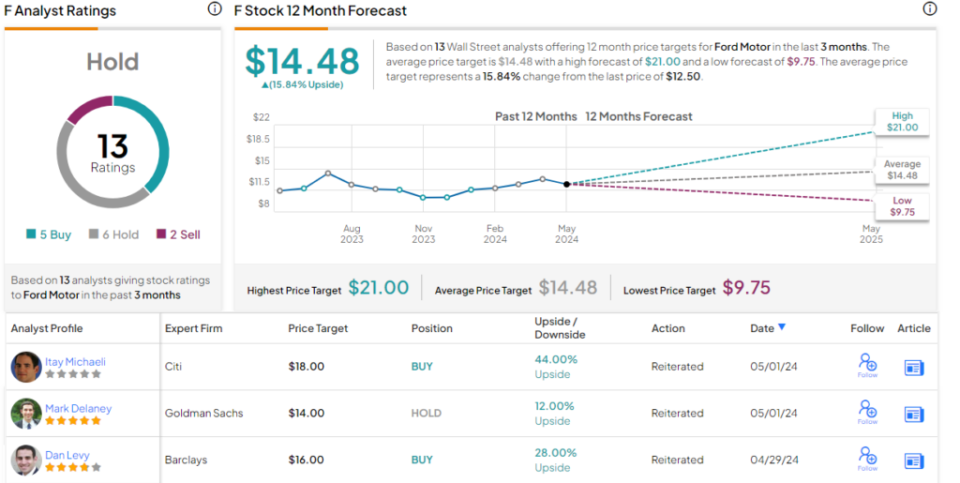

This view from Citi is not the Street’s most popular one. Ford gets a Hold rating from the analyst consensus, based on 13 reviews that include 5 Buys, 6 Holds, and 2 Sells. The shares are priced at $12.50, and their $14.48 average price target implies a one-year upside potential of 16%. (See Ford stock forecast)

Mobileye Global (MBLY)

Next up is Mobileye, another stock in the automotive sector. Mobileye is known as a leader in the driver assistance niche and has built up a strong reputation based on its high-quality automotive sensors. The systems help drivers keep a safe distance from other cars on the road, from lane markers, and from road shoulders and crash barriers, and the various Mobileye systems can be retrofitted to existing cars or installed at the factory.

Mobileye is currently working with more than 50 original equipment manufacturers within the auto industry to put its products into cars – with the ultimate aim of creating safer roads. The systems work by placing a network of sensors around the vehicle, a combination of digital cameras and LiDAR sensors that provide ‘eyes’ for the car. The various Mobileye systems can be scaled to vehicles of different sizes and types. Mobileye’s technology has found application in the developing autonomous vehicle niche, as its 360-degree vision is essential for a self-driving car.

Mobileye has benefited from a steady demand for improved safety technology in the automotive industry, although the company saw a sharp drop in revenues and earnings in Q1 of this year due to an inventory drawdown among its Tier 1 customer base. Simply put, Mobileye’s customers had built up backlogs of stock and had to work through that, putting a crimp in the company’s new orders. The company did realize $239 million in revenue for the quarter – a 47% year-over-year drop – a figure that actually beat the forecast by $8.29 million. At the bottom line, the company recorded a net loss of 7 cents per share, missing expectations by a penny.

Even though Mobileye’s 1Q24 results were lower compared to previous quarters, there were indications of underlying strength. The company described its core ADAS (advanced driver assistance system) business as ‘strong,’ with projected future volume totaling over 26 million units. In addition, the company generated $40 million in net cash from operating activities during the quarter, a figure that adds to an already strong balance sheet. Mobileye reported having $1.2 billion in cash and other liquid assets as of March 30 – and no debt.

When we check in again with Citi’s Michaeli, an auto sector expert, we find him upbeat on Mobileye, with the analyst seeing the Q1 results as “encouraging.” “Net-net,” he goes on to say, “despite slower pipeline conversion— which reflects in our updated estimates/target—we believe our underlying thesis remains very much intact, with the rest of 2024 poised to see potential catalysts from new business wins and Supervision OTAs.”

Michaeli goes on to rate MBLY as a Buy, and his price target, now set at $53 (down from $58), points toward a robust 77.5% upside for the year ahead.

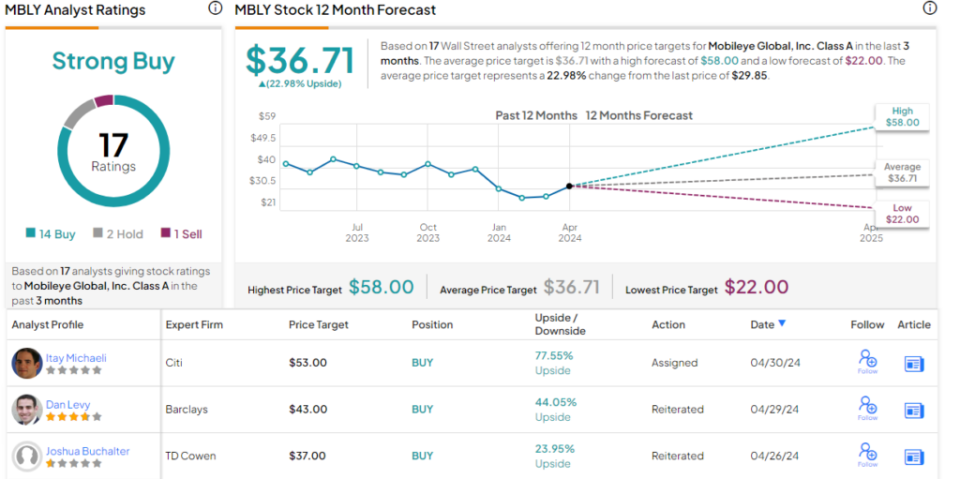

Mobileye receives a Strong Buy consensus rating from Wall Street’s analysts, based on 17 reviews that include 14 to Buy, 2 to Hold, and 1 to Sell. The shares have a current trading price of $29.85, and the average price target of $36.71 suggests they will increase by 23% from that level. (See Mobileye stock forecast)

Schrodinger (SDGR)

Last on our list of Citigroup picks is Schrodinger, an interesting company that works in both the software and pharmaceutical industries. The company uses a proprietary computational platform to develop new molecular compounds with therapeutic applications, based on a combination of sciences – chemistry, physics, and predictive modeling. Schrodinger’s discovery platform can create novel molecules quickly and at lower cost than other methods, resulting in a faster lead time for the development of new drug candidates for the pharmaceutical industry. The platform can also be used to create new compounds in other industries – this is materials science, and it is not limited to a single niche.

The pharmaceutical applications are the most notable, for now, and the company has a large and varied proprietary pipeline of new molecular compounds under investigation as possible treatments in the field of oncology. Most of these are at preclinical research stages, but two of them – SGR-1505 and SGR-2921 – are currently undergoing human clinical trials.

The first of these, SGR-1505, is a MALT1 inhibitor under investigation as a treatment for patients with relapsed/refractory B-cell malignancies. The drug candidate is currently in a Phase 1 dose escalation study with ongoing enrollment in both the US and the EU. The company expects to report initial data from the study later this year or in 2025.

The second candidate, SGR-2921, is a CDC7 inhibitor designed for the treatment of acute myeloid leukemia or myelodysplastic syndrome. As with -1505 above, the Phase 1 study has ongoing enrollment in the US, and data readouts are expected in late 2024 or in 2025.

Finally, in its 1Q24 report, Schrodinger announced that the IND application for SGR-3515 was cleared by the FDA. This compound is a novel Wee1/Myt1 inhibitor with potential in the treatment of solid tumors. The company is on track to initiate a Phase 1 study of this compound later this year.

Schrodinger is a revenue-positive company, generating income through licensing fees on its software platform. That said, the 1Q24 report was a bit of a letdown. The company brought in $36.6 million, missing the forecast by $5.37 million and falling 43% year-over-year. The bottom line came to a net loss of 86 cents per share – a loss that was 12 cents per share deeper than had been anticipated.

Nevertheless, Citigroup’s David Lebovitz finds the model worth a closer look – and worth a buy-in from investors, despite the Q1 miss. The analyst writes, “While shares have been under pressure since last quarter’s report, we believe the reset expectations could eventually mitigate the challenges associated with the q/q lumpiness in sales, which has been inherent to the business, over time. To this end, despite missing 1Q24 Street estimates, Schrodinger mgt. remains confident in its FY24 guidance. Looking forward, though the quarterly operating performance of the software and drug discovery business will remain a focus, data readouts for clinical assets SGR1505 & SGR-2921 (expected late 2024-2025) will emerge as key drivers for the stock as the year progresses.”

Lebovitz puts a Buy rating here, with a price target of $37 that suggests a solid one-year upside of 54%. (To watch Lebovitz’s track record, click here)

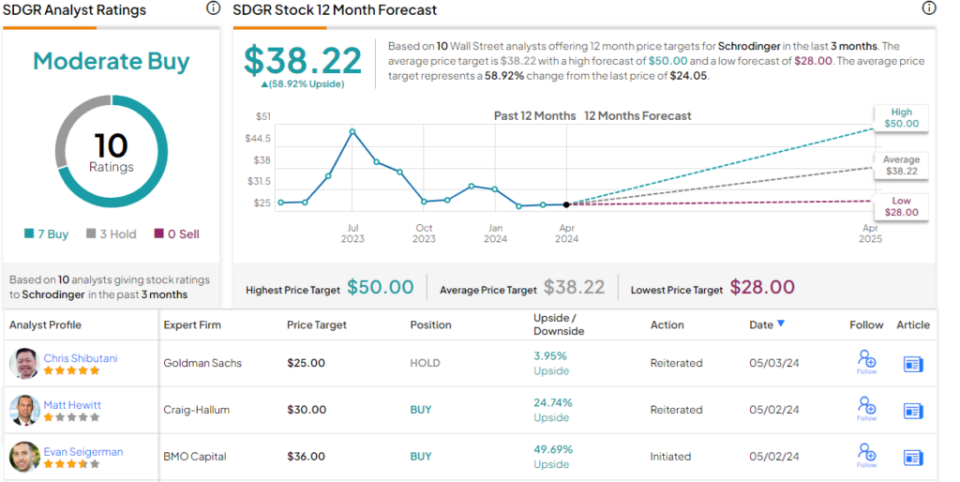

Overall, Wall Street is willing to buy these shares. SGDR has a Moderate Buy consensus rating based on 7 recent Buys and 3 Holds. The shares are priced at $24.05 and their $38.22 average target price implies a gain of 59% on the one-year horizon. (See Schrodinger stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Credit: Source link