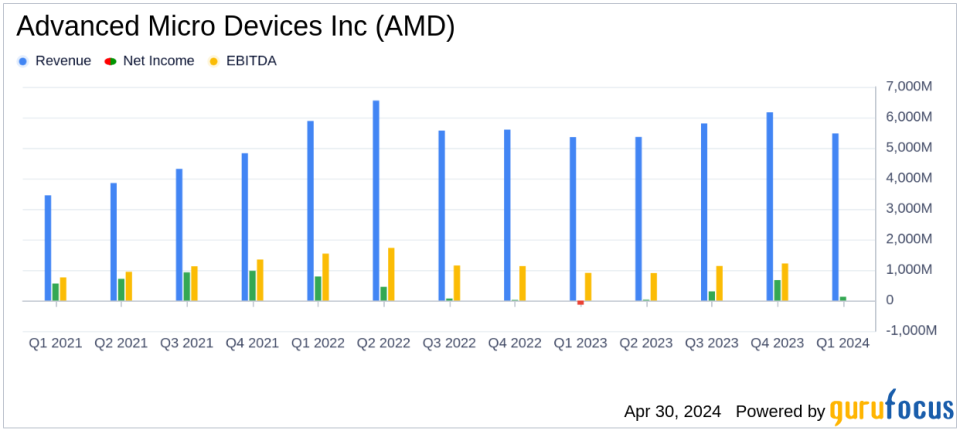

Revenue: Reported Q1 2024 revenue of $5.5 billion, up 2% year-over-year, falling short of the estimated $5.46 billion.

Net Income: Q1 2024 net income reached $123 million, significantly exceeding the estimated $985.43 million due to a substantial year-over-year increase.

Earnings Per Share (EPS): Diluted EPS for Q1 2024 was $0.07, below the estimated $0.61.

Gross Margin: Improved to 47% in Q1 2024 from 44% in Q1 2023, reflecting a 3 percentage point increase year-over-year.

Operating Income: Saw a dramatic recovery to $36 million in Q1 2024 from a loss of $145 million in Q1 2023.

Data Center Revenue: Achieved a record $2.3 billion, marking an 80% increase year-over-year, driven by strong sales of AMD Instinct GPUs and 4th Gen AMD EPYC CPUs.

Outlook for Q2 2024: Expects revenue to be around $5.7 billion, indicating a 6% year-over-year growth, with a non-GAAP gross margin projected at approximately 53%.

On April 30, 2024, Advanced Micro Devices Inc (NASDAQ:AMD) released its 8-K filing, revealing a quarter of robust revenue growth in its Data Center segment, though its earnings per share fell short of analyst expectations. The company announced a revenue of $5.5 billion and a diluted earnings per share (EPS) of $0.07, compared to the estimated EPS of $0.61.

Advanced Micro Devices designs a variety of digital semiconductors for markets such as PCs, gaming consoles, data centers, industrial, and automotive applications. The company’s strength lies in CPUs and GPUs used in PCs and data centers. Additionally, AMD supplies chips for game consoles like Sony PlayStation and Microsoft Xbox. The acquisition of Xilinx in 2022 has further diversified AMDs business, enhancing its presence in data centers and automotive markets.

Financial Performance and Market Challenges

AMD’s financial performance this quarter reflects a significant year-over-year growth in its Data Center segment, with revenue increasing by 80% driven by the ramp of MI300 AI accelerator shipments and the adoption of Ryzen and EPYC processors. However, the company faced challenges in the Gaming and Embedded segments, witnessing a decline in revenue by 48% and 46% respectively, attributed to decreased semi-custom revenue and lower GPU sales.

The company’s gross margin improved to 47% from 44% in the previous year, indicating better profitability. However, the operating income of $36 million, though significantly better than last year’s loss, highlights operational challenges amid competitive pressures and high operating expenses.

Strategic Moves and Future Outlook

AMD’s strategic focus on AI and data centers appears promising. The company’s CEO, Dr. Lisa Su, emphasized the widespread deployment of AI driving demand for more compute power across various markets. AMD’s record quarterly Data Center segment revenue and the introduction of new AI-driven products across multiple segments showcase its commitment to innovation and market expansion.

Looking ahead, AMD expects revenue for the second quarter of 2024 to be approximately $5.7 billion, targeting a year-over-year growth of about 6%. The anticipated non-GAAP gross margin is around 53%, reflecting continued profitability improvements.

Analysis of Financial Health

AMD’s balance sheet remains robust with significant gross profits and improved net income compared to the previous year. The company’s strategic investments in AI and expansion into new markets are poised to bolster long-term growth, despite short-term fluctuations in earnings and segment-specific challenges.

In conclusion, while AMD’s Q1 2024 showcased impressive revenue growth and strategic positioning in high-growth areas, the earnings miss and the volatility in some segments suggest a complex path ahead. Investors and stakeholders will likely watch closely how AMD navigates these challenges while capitalizing on the burgeoning AI market.

Explore the complete 8-K earnings release (here) from Advanced Micro Devices Inc for further details.

This article first appeared on GuruFocus.

Credit: Source link