The “Magnificent Seven” was coined by Bank of America analyst Michael Hartnett to describe seven large, tech-focused companies. Due to a combination of their size, underlying fundamentals, and growth, these companies led the market rally in 2023. They have also contributed the bulk of the S&P 500’s gains in 2024.

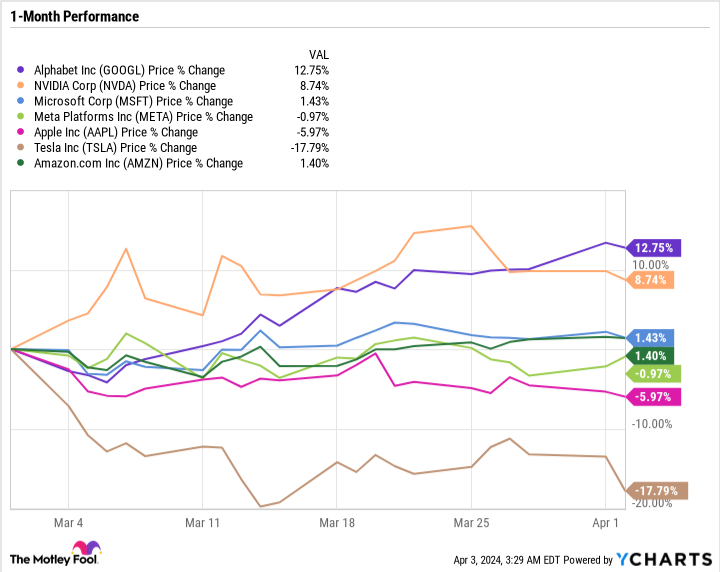

However, something has changed over the last month. One of the three Magnificent Seven stocks that had been down year to date is suddenly up — a lot — over the last month.

Here’s why Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) has suddenly become the hottest Magnificent Seven stock and why it remains a great value even though it is hovering around a 52-week high.

In and out of favor

It has been a wild ride for Alphabet stock in 2024. In late January, it was around the same price it is today — above $150 a share. But in early March, it fell to the low $130 per-share range due to investor pessimism regarding its artificial intelligence (AI) investments — specifically, Google Gemini AI and its inaccuracies.

But then, in mid-March, news surfaced that Alphabet was in talks with Apple to license Gemini AI in iPhones, putting a much-needed stamp of approval on Alphabet’s AI endeavors. The stock rose as much as 7.7% on March 18, which contributed to its over 12% gain in the past month.

Partnering with Apple would be a huge deal for Alphabet. Despite owning various differentiated businesses, like Google Search, YouTube, Google Cloud, and Android, Alphabet still depends on ads for the vast majority of its revenue. The more it can diversify its business away from ads, the wider its moat and the more levers it can pull to unlock growth.

At least in the short term, Alphabet stock has moved in and out of favor with Wall Street based on its perceived AI aptitude and potential. In reality, this is a company that has been monetizing AI for some time and has a massive research and development budget and cash to invest in innovation.

There’s a target on Alphabet’s back

With so many growth narratives flooding the market, it can be easy to get caught up in implied-growth trajectories and overlook the companies that have already accomplished so much and are earning a ton of profit. In other words, outweighing the unknown and discounting proven winners.

Alphabet is a proven winner, but there are question marks surrounding how it will stay a winner in the midst of so much competition.

Google Search and YouTube rely on complex AI-driven algorithms. But platforms like TikTok and Meta Platforms‘ Instagram Reels have been cited as alternative search engines to Google by younger generations like Gen Z.

Meanwhile, Google Cloud is third behind Microsoft Azure and Amazon Web Services in cloud-infrastructure market share.

Android is still the dominant operating system globally, but iOS is bigger in core areas like the U.S., and Apple has more control over its hardware and software integration than Alphabet.

Invert your thinking

The glass-half-empty outlook on Alphabet is that it is a market leader across many different industries but that all of its industries are ripe for disruption.

It has been the leader in search for decades, but can it maintain pole position in the face of mounting competition from short-video platforms or new competition remains to be seen?

Consumers have more entertainment options than ever, so will YouTube lose market share to other streaming sites?

Will Google Cloud be able to take market share against its larger peers?

These are all valid questions.

When you like a company, it’s always good to consider the counterargument. Charlie Munger used to talk about the inversion process as a way to expand a line of thinking. Before buying a stock, we usually think about the reasons why the company is a good investment. But inversion would involve thinking about all the reasons why folks would want to sell the stock, why it could go lower, underperform the market, etc.

There’s usually a halfway decent counterargument to even the best stocks. But sometimes, even bad counterarguments can become dominant market sentiment if the market is pessimistic on a stock as it had been on Alphabet relative to the rest of the Magnificent Seven.

Alphabet is a good value

Alphabet has an established, cash-cow business model and plenty of ways to monetize AI. It is no stranger to competition, as there are always other companies that want a slice of a high-margin industry.

In Alphabet’s favor is its inexpensive valuation. It has a mere 26.7 price-to-earnings ratio, slightly above Apple’s 26.3 for the second-lowest of the Magnificent Seven stocks. It also has a 28.8 price-to-free-cash-flow (FCF) ratio, also second-lowest behind Apple in the Magnificent Seven.

Alphabet may not be the most exciting growth stock out there right now. But what it does have is a profitable business and room to take risks and unlock growth. Alphabet’s deep pockets and track record of innovation are reason enough for the stock to not trade at a discount to the S&P 500 (like it does today).

Alphabet stock should have never fallen as much as it did. And even now, it looks like a reasonable long-term buy for patient investors.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $539,230!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of April 4, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Bank of America, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the Best-Performing “Magnificent Seven” Stock Over the Last Month (Hint: It’s Not Nvidia) was originally published by The Motley Fool

Credit: Source link