The cryptocurrency market is teeming with anticipation as the next Bitcoin halving approaches. The pre-programmed event halves the number of Bitcoin rewarded for successfully mining blocks. For investors, understanding the mechanics and implications of the Bitcoin halving is crucial for informed decision-making and effective portfolio management.

By examining the historical impact of past halvings and analyzing current market trends, investors can better prepare for the upcoming halving and better position themselves in the ever-evolving cryptocurrency landscape.

In this article, the Investing News Network (INN) teamed up with crypto expert Peter Eberle to explore the intricacies of the halving process and discuss the potential market volatility that may arise.

What is the Bitcoin halving?

Bitcoin is created through a process called mining, in which Bitcoin miners compete with each other to solve an algorithmic problem. Once the problem is solved, a new block is added to the blockchain, and the miner who solved the problem is rewarded with a set amount of newly generated Bitcoin. When Bitcoin was introduced in 2009, the reward rate was 50 Bitcoin for every block mined.

The Bitcoin halving is scheduled to happen approximately every four years or after the mining of 210,000 blocks; the halving is not triggered by the passing of a specific amount of time, and the actual time between halvings can vary slightly due to fluctuations in mining difficulty and network hash rate, which is a measure of the total computational power being used to mine Bitcoin.

This year’s halving is set to take place on or around April 20, 2024. The date is based on this estimate, which changes with the mining of each new block. Following the three previous halving events, which occurred in 2012, 2016 and 2020, the reward rate now sits at 6.25 Bitcoin. The upcoming halving will drop the rate even further to 3.125 Bitcoin per block.

The principles of the halving are written directly into Bitcoin’s network. By reducing block rewards, the halving slows down the rate at which new Bitcoins are created. This controlled supply is intended to combat inflation so Bitcoin can maintain its value over time. As the halving events progress, the supply of new coins will gradually decrease until all 21 million Bitcoins are in circulation.

How do halvings impact Bitcoin miners?

Bitcoin’s halving has significant implications for the cryptocurrency’s mining activity and supply because of how Bitcoin mining works.

The mining process, also known as block time, typically takes around 10 minutes. To maintain a consistent block time, the Bitcoin network adjusts the mining difficulty based on hash rate, a measure of computational power used to mine Bitcoin and process transactions. An increase in power indicates that more miners are competing to create new blocks and earn Bitcoin rewards, so the puzzle becomes harder. When fewer miners are competing, the puzzle becomes easier. This ensures that new blocks are created at a steady rate, regardless of how many miners are competing to create them.

Historically, the hash rate has risen leading up to halving events, only to drop off in the weeks after as inefficient miners are weeded out.

“One of the things that happens is that these miners that have less efficient equipment have to get out of the business, right? If they have old equipment and equipment that absorbs too much energy, they’re not going to be able to pay for that when the mining reward drops,” Eberle explained.

Currently, hash rates that he describes as “record-high” are driven by large mining companies introducing new, faster and more efficient machines while still utilizing older machines that may become obsolete in a few months. Mining companies have already been making moves to this end in 2024. For example, Bitcoin miner Riot Platforms bought new miners in anticipation of the halving on February 27, the same day that CleanSpark completed the acquisition of three data centers in Mississippi.

This efficiency benefits investors as miners consistently sell Bitcoin to cover operational costs and make a profit when production costs are lower than the selling price.

CoinShares suggested in its 2024 Crypto Outlook report that miners may be in “better shape” in 2024 due to reduced debt, larger scale of operations and equity finance options. Bitcoin’s price has also been bolstered by the approval of spot Bitcoin ETFs and the US Federal Reserve’s current plans to ease monetary policy later this year.

The authors of the report, which was released in January, predicted that 2024 will be a “dual cycle year.” The sector began the year in a rebalancing phase, which CoinShares expects to persist until after the halving. At that point, it will enter the mining gold rush as the price of Bitcoin outpaces miners’ ability to deploy new hash rate. The firm estimates that mining 1 Bitcoin will cost approximately US$37,856 after the halving.

“So, from an investor standpoint,” Eberle continued, “the reason the halving is substantial is that these miners, to pay for their ongoing operations — whether it’s electricity costs for their warehouses (or) buying new equipment — they’re a consistent seller of Bitcoin. As long as their cost to produce Bitcoins is lower than what they’re selling for, they make a profit. Inefficient miners will be forced out if they don’t do those upgrades.”

How do halvings impact the Bitcoin price?

Bitcoin often surges leading up to the halving, although, with only three halvings in history, it’s difficult to assertively identify price trends.

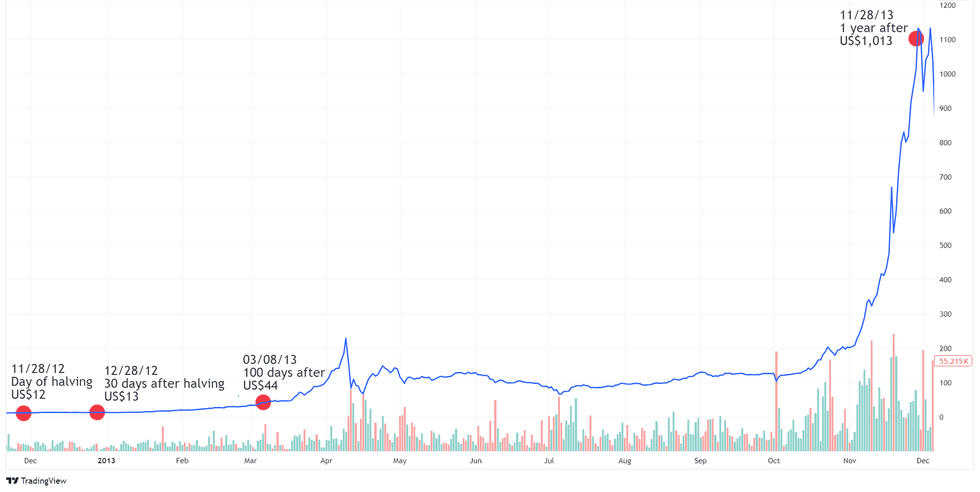

Bitcoin USD price chart 11/21/2012 to 12/05/2013

Chart via TradingView

The first Bitcoin halving on November 28, 2012, saw the mining reward drop from 50 to 25 Bitcoins. While Bitcoin was still a niche product at the time, it had started to gain mainstream attention, partly due to economic uncertainty in Europe. Bitcoin’s value had risen from around US$5.50 in January 2012 to about US$12 by the November halving, indicating a gradual increase in interest and adoption. In the following months, Bitcoin continued to attract attention and its price grew substantially. By the time a year had passed after the halving, Bitcoin’s price was US$1,013. This growth marked the beginning of its journey toward mainstream recognition as a potential alternative asset class. However, it was not long-lived, and moved back down to under US$300 by mid-2015.

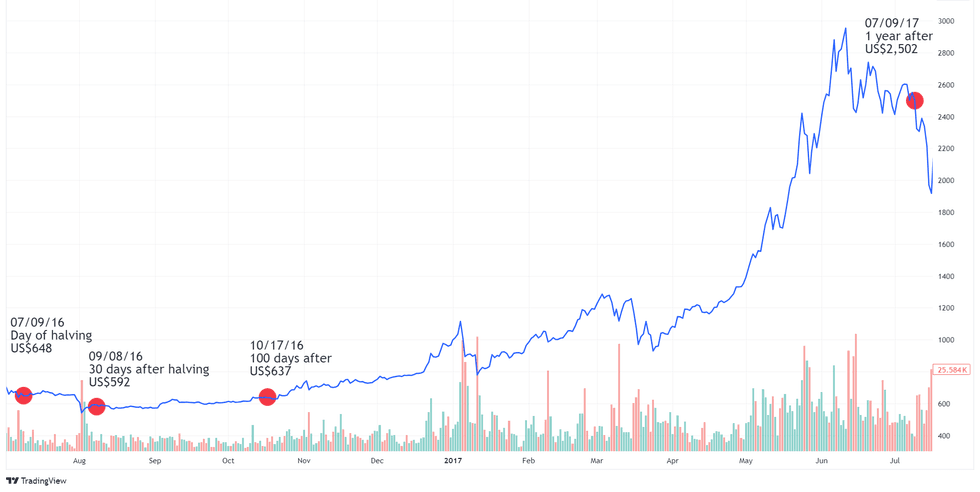

Bitcoin USD price chart 07/02/2016 to 07/16/2017

Chart via TradingView

By the time the second Bitcoin halving occurred on July 9, 2016, the cryptocurrency’s value had climbed back up to US$648. Over the following year, Bitcoin experienced substantial growth as the growing excitement and positive sentiment surrounding it resulted in FOMO — fear of missing out — leading more people to invest and pushing the price past US$2,500 on June 3, 2017.

Large financial institutions began to take notice of blockchain technology’s potential, which resulted in further price appreciation for the most well-known cryptocurrency. Bitcoin hit a then all-time high of US$19,783.21 in December 2017.

Bitcoin’s overall upward trend in this period demonstrated the increasing interest in cryptocurrencies and their potential for substantial long-term growth. However, growing concerns about potential regulatory crackdowns led many investors to sell their Bitcoin holdings in early 2018, causing a decline in its value.

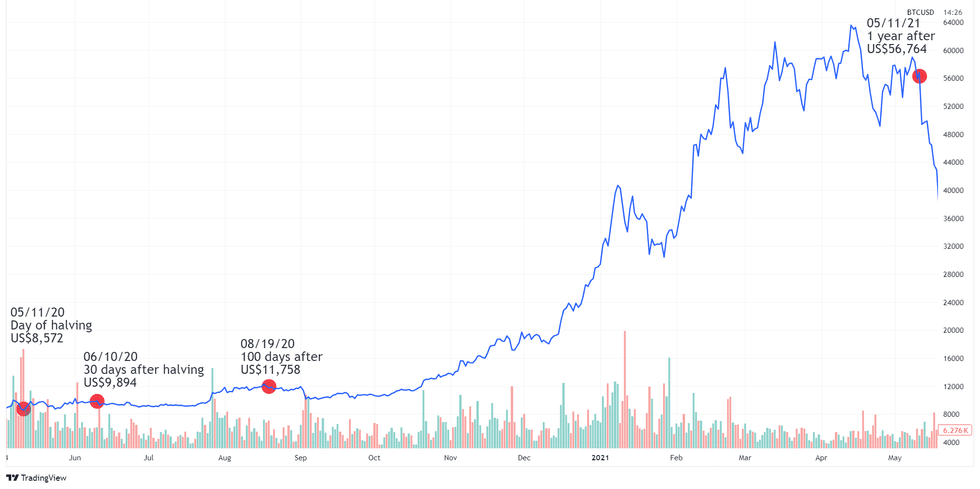

Bitcoin USD price chart 05/04/2020 to 05/18/2021

Chart via TradingView

The most recent halving happened on May 11, 2020, and it reduced block rewards from 12.5 Bitcoin to the current rate of 6.125. Bitcoin’s price on the day of the halving was US$7,935.10. Amidst all that was going on in the world in 2020, the halving was anticlimactic, with little fanfare and not much price movement.

However, 2020 became a very influential year for crypto overall, and myriad factors contributed to Bitcoin price action. The outbreak of COVID-19 hit global economies hard, and some experts became worried that large stimulus packages could lead to inflation and a weakening of fiat currencies. At the time, macro trader Paul Jones and economist Lorenzo Giorgianna named cryptocurrency as a potential safe-haven asset akin to gold, which prompted an influx of new investors.

Additionally, excitement for the decentralized finance industry (DeFi) kicked off circa June to September 2020, and billions of dollars were poured into the subsector. By the fall, the world was awash in DeFi and crypto projects as Bitcoin kept gaining momentum, hailed as the “gold standard” among digitized currencies. Large institutions like PayPal (NASDAQ:PYPL) and Square, now a part of Block (NYSE:SQ), began investing in or adopting Bitcoin and other cryptocurrencies, arguably kicking off mainstream adoption.

“I think cryptocurrency’s here to stay,” Rick Rieder, chief investment officer of BlackRock, told CNBC at the time.

Bitcoin ended 2020 valued above US$28,000, and exactly one year after the 2020 halving it was worth around US$56,000. While it faltered in mid-2021, it recovered, and in November 2021, it hit a then all-time high of US$68,000.

What we know about the next Bitcoin halving

Over the years, halvings have stirred up enthusiasm, but 2024’s halving might be the most highly anticipated given the recent surge in market activity brought on largely by the January 10 approval of spot Bitcoin ETFs. Bitcoin ETFs allow risk-avoidant investors to get in on the price action of Bitcoin without the hassle of buying it.

“There are people that enjoy the idea of being able to have their own hardware or software wallet and custody of Bitcoin itself, but for most people, it’s pretty intimidating,” Eberle said. “The last thing someone wants to do is make a mistake and then lose a substantial amount of their assets, right? And so this ETF, it’s not a perfect replication of Bitcoin, but it’s certainly a simple way to replicate exposure to Bitcoin. And so that’s opened it up to people that would have never bought Bitcoin in their own right.”

After a rough 2022, the latter half of 2023 saw a crypto renaissance, with legal victories against the SEC and the likely promise of spot Bitcoin ETFs bringing more institutional investment, reigniting faith in the industry.

Since the US Securities and Exchange Commission delivered its ruling, the price of Bitcoin has surged to highs not seen since 2021. On February 28, Bitcoin ETFs reached a new volume record of US$7.6 billion. Several sources have cited the upcoming halving as one of the forces that drove the price of Bitcoin above its previous highest value of US$69,000 on March 5. Demand for Bitcoin ETFs surged tenfold compared to miners toward the end of February.

“The demand side is certainly impacted by (the ETFs),” he said. “And one of the things that has happened previously before the halvings is that there is some sell pressure from the miners because they’re upgrading their equipment. And it looks like this time that supply that’s coming into the market is being absorbed by these ETFs. So traditionally, we’ve seen a pullback in the couple of months prior to the halving and then a real acceleration to the upside once the halving happens. And this time, we may be starting the process a little bit earlier, in that extra supply that the miners might be putting on the marketplace is already being absorbed by these ETFs, which could lead to some pretty impressive gains later on in the year.”

How to invest ahead of the Bitcoin halving?

Peter Brandt, an analyst and the CEO of Factor, predicted on X, formerly known as Twitter, that the price of Bitcoin could go as high as US$200,000 by September, a 66 percent jump from his previous estimate of US$120,000.

“We believe new all-time highs will be made,” Eberle said. “We think it’ll go (on a run) once that happens because of the ease with which one can buy the ETFs now. …The retail FOMO that comes in could drive the price to some incredible levels, and then I’m sure we’ll have another pullback.

“But I’ve seen estimates anywhere from US$75,000 to US$150,000, which I think are reasonable in the next 12 to 18 months. Some of these bigger numbers, I think those are for headlines more than anything else. But we’ll be happy, we’re getting into all-time highs and people not being down on the space. I think that would be a positive.”

For those looking to invest in Bitcoin, Eberle shared his advice for using Bitcoin to balance out an investment portfolio, specifically its effect on the standard 60/40 equity bond portfolio, which can be rebalanced quarterly by selling the asset that performed better and buying the other asset to enhance performance over time.

Eberle explained that regularly rebalanced portfolios can benefit from volatile assets, and said studies show that including a 3 to 5 percent allocation of Bitcoin in a standard 60/40 portfolio could decrease overall portfolio volatility and increase expected returns. This is because the non-correlated, highly volatile asset makes the funds move back and forth more during rebalancing.

“One area that’s critical to portfolio management, whether it has to do with Bitcoin or anything, is if the volatility of an investment is keeping you up at night, it’s not the volatility of the investment, but rather the size of your allocation to that investment,” Eberle advised.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

From Your Site Articles

Related Articles Around the Web

Credit: Source link