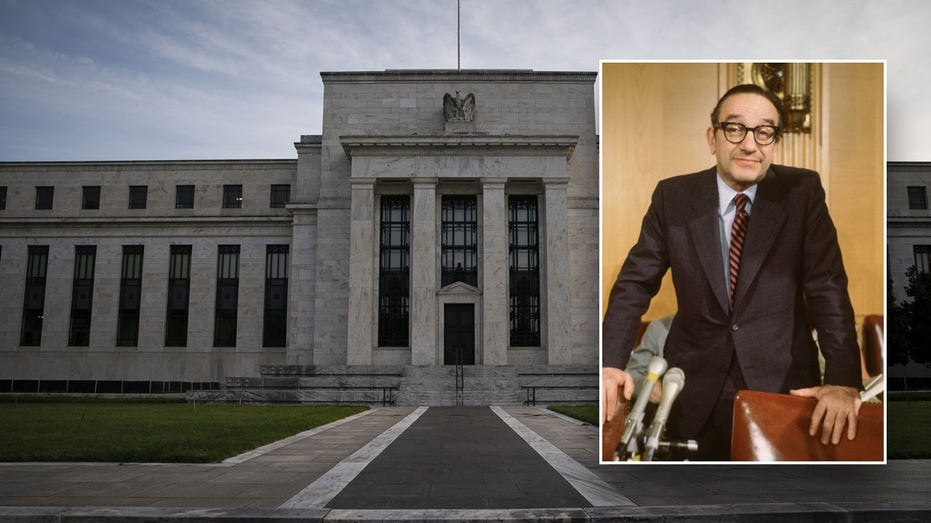

Former Federal Reserve Bank of St. Louis President and CEO James Bullard analyzes latest inflation readings and the Fed’s expected rate path.

The Federal Reserve’s preferred inflation gauge is “stuck” in the Alan Greenspan era, according to the former St. Louis Fed president.

Former Federal Reserve Bank of St. Louis President and CEO James Bullard explained how Personal Consumption Expenditures (PCE) got its reputation and why it’s here to stay during an appearance on “Cavuto: Coast to Coast” Thursday.

“Alan Greenspan in the 90s did a review of all the different ways to measure inflation, and the outcome of that was that the personal consumption expenditures was viewed as a broader measure of inflation and, maybe, a better signal of the overall inflation picture,” Bullard said.

“And ever since then, there hasn’t been another review,” he continued.

JPMORGAN CEO DIMON CAUTIOUS ABOUT SOFT LANDING FOR ECONOMY

The PCE rose again in January as the Fed continues to grapple with the country’s fluctuating economy.

Former Federal Reserve Bank of St. Louis President and CEO James Bullard explains the PCE’s reputation in the Fed.

The personal consumption expenditures (PCE) index showed that consumer prices rose 0.3% from the previous month, according to the Labor Department. On an annual basis, prices climbed 2.4% – down slightly from the 2.6% reading recorded the previous month.

Speculation has been swirling around the Fed as experts are trying to pinpoint when the country’s central bank will eventually start cutting rates.

US NATIONAL DEBT TRACKER FOR FEB. 28, 2024: SEE WHAT AMERICAN TAXPAYERS (YOU) OWE IN REAL TIME

“I think if you’re sitting on the committee and the economy looks like it’s been rebounding here some and inflation seems to be coming down, but maybe not as fast as you thought. Why do anything? Why not just sit where you are?,” Bullard told FOX Business’ Neil Cavuto.

The Bear Traps Report founder Larry McDonald reacts to January’s PCE report and its impact on the Federal Reserve’s highly monitored rate decision.

He went on to add that as inflation comes down, the Fed will “have to get to a lower value of the policy rate.”

“But exactly when the committee will get to that is what everyone’s arguing about,” Bullard stressed.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

FOX Business’ Megan Henney contributed to this report

Credit: Source link