February’s flash PMI surveys brought mixed news on inflation,

with European prices looking stickier than in the US. The UK was

also notable in seeing a greater incidence of supply chain delays,

linked in part to Red Sea shipping disruptions, which is a

potential harbinger of higher prices in the coming months.

Leading indicators of inflation

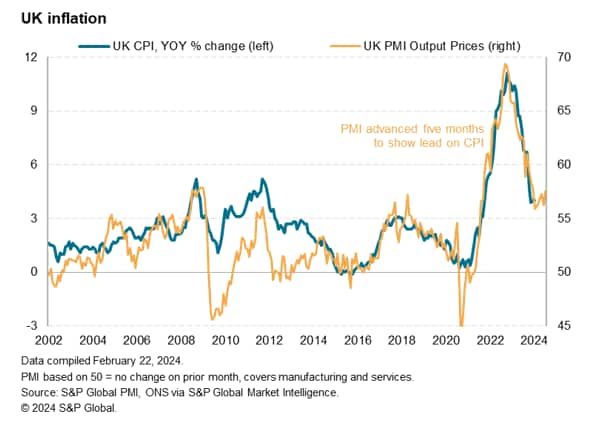

A key indicator of inflation is the PMI survey data relating to

average prices charged for goods and services. While some of these

goods and services are offered directly to consumers, notably the

latter including many consumer-focused offerings such as meals,

hotel accommodation, event tickets, haircuts and more, many are

also sold to other companies, meaning the PMI price data act

similarly to wholesale prices. As such, the PMI data tend to change

before retail or high street prices, with retailers usually passing

higher (or lower) supplier prices on after a delay. Hence the PMI

data tend to exhibit their highest correlations with consumer price

(CPI) inflation rates with leads ranging from 3-6 months.

US inflation

Looking at the latest data, the numbers from the United States

are especially encouraging. Although the S&P Global PMI index

of average prices charged for goods and services rose slightly

according to February’s provisional ‘flash’ reading, indicating a

marginally faster rate of increase, the index remained low by

historical standards. In fact, after January, February’s reading of

52.9 was the lowest since June 2020.

Furthermore, historical comparisons suggest this latest reading

is broadly indicative of annual consumer price inflation running at

a 2% level, which is consistent with the US central bank’s

target.

The US survey data have provided a clear advance indication of

US inflation surging during the pandemic, correctly signaling a

peak in June 2022 and a subsequent rapid easing over the course of

late-2022. After some stickiness was indicated around the 3% mark

in 2023, the latest readings are an encouraging sign that inflation

is cooling further to meet the FOMC’s target.

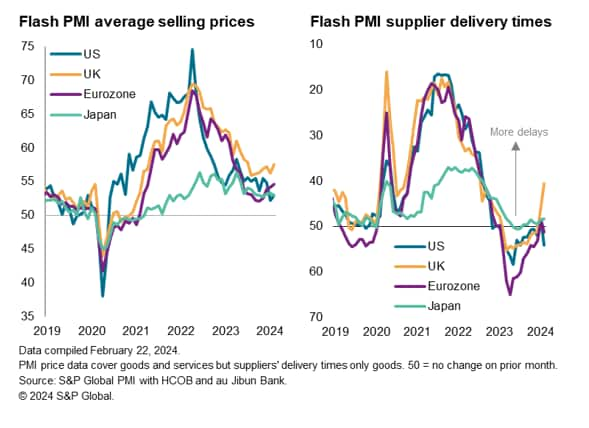

Eurozone inflation

The prices charged data for the eurozone PMI likewise correctly

anticipated the peaking of inflation in 2022 and the subsequent

steep decline, also hinting at some potential attainment of the

central bank’s 2% target. But recent months have seen the PMI index

regain some ground, rising for a fourth month in February’s flash

survey to reach 54.6, a level well above that of the equivalent US

index. Importantly, the latest reading is broadly indicative of

consumer price inflation running close to the 3% level.

UK inflation

If the eurozone data are sending a disappointing signal to the

European Central Bank, an even more worrying picture is presented

by the UK PMI data. Here the average selling price index for goods

and services rose in February to a four-month high of 57.5;

according to the flash results, considerably higher than both the

eurozone and the US.

At this level the UK index is signaling consumer price inflation

around the 4% mark, double the Bank of England’s 2% target. Having

revived slightly from a low point seen last October, the data

suggest that the strong disinflationary trend witnessed between

2022 and 2023 has ended.

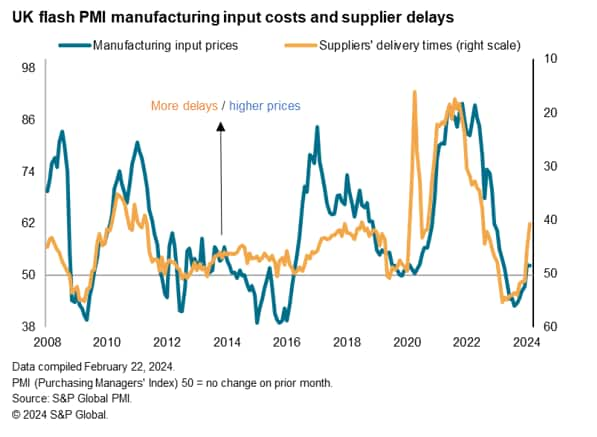

Adding to the UK’s woes in February was a lengthening of

supplier delivery times. The PMI Supplier Delivery Times Index is

itself a valuable advance indicator of pipeline inflationary

pressures (

read more about this index here). The flash February PMI

surveys showed the highest degree of UK supply chain delays for

over one-and-a-half years, linked to Red Sea shipping disruptions.

Barring the pandemic, the lengthening of supplier delivery times

was the second-greatest recorded over the past 13 years. The

resulting increased cost of shipping contributed to an overall rise

in factory input costs for a second successive month, which in turn

fed through to the largest monthly rise in selling prices for goods

seen over the past nine months.

By comparison, supplier delivery times quickened in both the US

and Europe in February after having lengthened in January,

suggesting far fewer supply chain incidents than in the UK and

hinting that improved supply conditions will help soften prices

further in their cases. This could potentially further widen the

inflation differential between the UK, the US and Eurozone in the

coming months.

Chris Williamson, Chief Business Economist, S&P

Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers’ Index (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Credit: Source link