CoinShares, Europe’s largest cryptocurrency investment firm, recorded approximately $42 million USD profit in Q4 2023.

The firm highlighted “securitisation” of crypto and real-world asset tokenization in its long-term strategy.

CoinShares Experience Profit, After Challenging 2022

In a recent report, CoinShares states that it has begun experiencing growth again after a challenging 2022.

“We continued to execute our strategy and delivered combined revenue, gains and income of £33.3 million in Q4. Our focus on profitability has led to adjusted EBITDA of £25.7 million for the quarter, at a margin of 77%.”

Read more: Top 5 Spot Trading Crypto Exchanges

The firm further explained its intention to expand services across Europe this year and enter the US market through asset management firm, Valkyrie. CoinShares recently exercised its option to acquire Valkyrie.

“As we move into 2024, our focus is firmly set on consolidating our leadership in Europe and expanding our reach in the US market through the Valkyrie partnership by building a strong product platform.”

The United States Securities and Exchange Commission (SEC) recently approved Valkyrie as one of 11 spot Bitcoin exchange-traded fund (ETF) applicants. CoinShares’ decision to acquire the firm was influenced by the SEC’s favorable ruling.

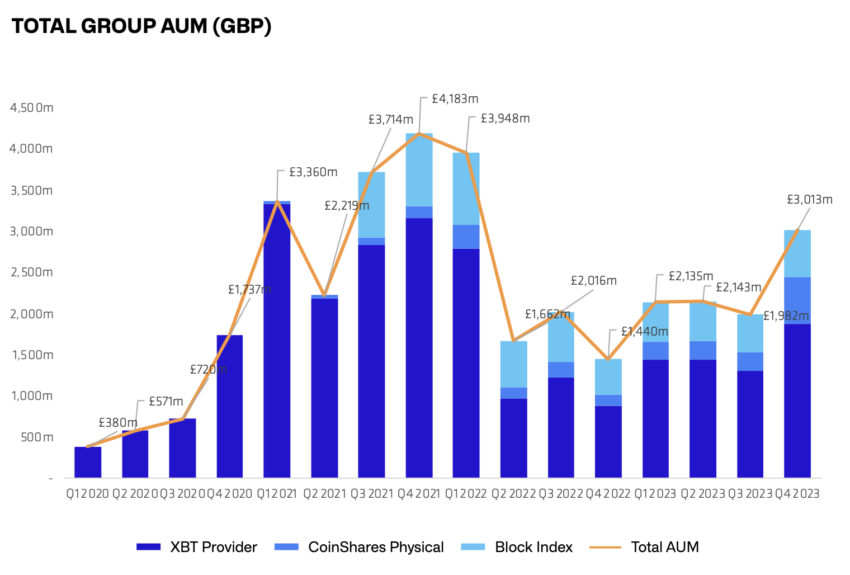

Meanwhile, CoinShares also reported that it currently has the equivalent of $5.87 billion USD in total assets under managements (AUM).

CoinShares Records Profit Amidst Widespread Crypto Adoption in Europe

This follows rapid expansion in the crypto industry in Europe. Most recently, BeInCrypto reported that Binance’s recent survey indicates a strengthening adoption of crypto in Europe.

In a recent report published by Binance, the company conducted interviews with participants from four European countries: France, Italy, Spain, and Sweden.

“A recent Binance survey reveals that a whopping 73% of European residents are optimistic about the future of cryptocurrencies!”

Read more: 11 Best Altcoin Exchanges for Crypto Trading in January 2024

Meanwhile, as crypto adoption surges in Europe, regulators are imposing strict regulations on Bitcoin mining within the region.

On January 31, crypto environmentalist and venture capital investor Daniel Batten shared a section of a report by the European Commission highlighting its plans to curtail crypto.

“While we were sleeping, the European Commission has been creating a report which they plan to label Bitcoin environmentally harmful, a threat to EU energy security, and a haven for financial criminals.”

Meanwhile global crypto exchanges continue to eye off different parts of Europe where to launch in recent times.

On February 9, crypto exchange Kraken announced that it obtained a Virtual Asset Service Provider (VASP) registration from the Dutch Central Bank (DCB) in the Netherlands.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Credit: Source link