Renewable and low-emission energy sources will likely play an essential role in controlling humankind’s climate impact over the coming decades. Solar and wind have gotten much attention, but hydrogen could unlock renewables to displace even more fossil fuel use.

Plug Power (NASDAQ: PLUG) is a leader in commercialized hydrogen fueling and strives to build a hydrogen energy business across North America and Europe. Success could mean life-changing investment returns from a stock worth just $2 billion today.

How likely is Plug Power to make investors millionaires over the coming years? Anything is possible, but there are three significant roadblocks facing optimistic investors. Here is what you need to know.

1. A chicken-or-egg dilemma

Hydrogen has potential as a fuel because it produces only water vapor as a byproduct when consumed in a fuel cell. Plug Power has been around since the late 1990s, and after starting with hydrogen fuel cells for forklifts, it is trying to expand as a leader in broader hydrogen use. That includes production and fuel cell technologies for applications like long-haul transports, power, and industrial factories.

The company has invested heavily to build hydrogen production facilities in Georgia, Louisiana, New York, and Texas. Its Georgia location will reach total production later this year, with the rest following sometime in 2025.

Looking beyond hydrogen’s benefits, the economics of adopting it will ultimately decide its long-term success and Plug Power’s fate. According to the International Energy Agency (IEA), global hydrogen use grew just 3% in 2022. Its studies point to long-term potential but also cite uncertainty over demand as a barrier to attracting investments into adoption.

In other words, hydrogen faces a chicken-and-egg problem. Hydrogen needs to become cheaper to grow demand, but you need demand to justify the investment in producing cost-effectively.

2. An unclear road to profitability

Solving this dilemma could take time, something Plug Power has in limited supply. The company is spending a ton of money on building factories. Plug Power has steadily issued stock to raise money, and it had as much as nearly $4.8 billion on its balance sheet a few years ago.

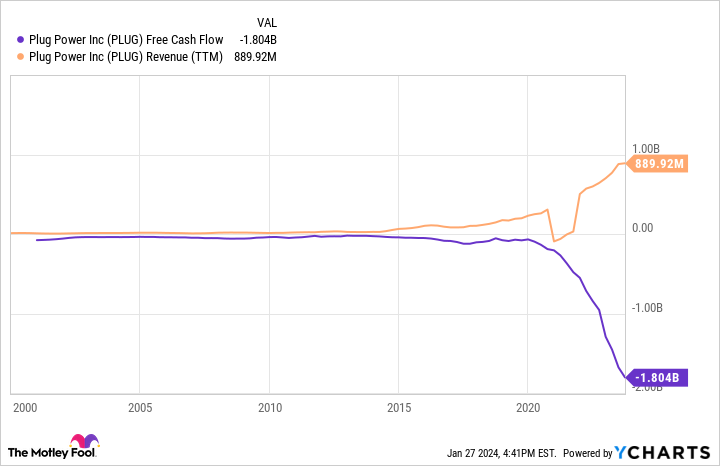

While the money has gotten these production facilities underway, Plug Power has burned through most of it. It’s generated $890 million in revenue over the past 12 months and burned $1.8 billion in cash. The company now has a combined $1.3 billion cash, restricted cash, and sellable securities as of Sept. 30, 2023.

As it has before, Plug Power is working to raise more funds by issuing shares and may secure a $1.6 billion government loan. Otherwise, cash would dry up before Plug Power can generate profits. It states in its third-quarter filings that it will incur losses for the foreseeable future. This puts shareholders in a sticky situation, as the company must continue to raise new money to keep the lights on.

3. Shareholders face a lot of dilution

Is Plug Power destined to fail? Of course not. However, the question is whether the stock can be a millionaire maker. Plug Power’s most significant risk to investors is how much damage investors will take to keep Plug Power afloat long enough to become a sustainable business.

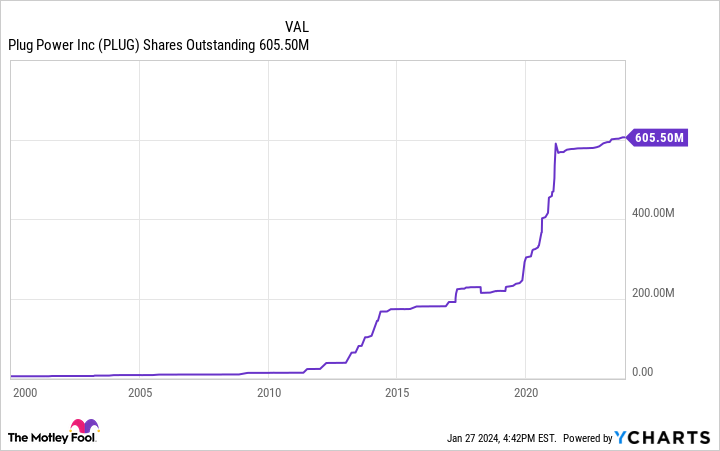

You can see in the chart below that the number of outstanding shares has increased exponentially over the past decade. Issuing stock to raise money is common but can hurt when the share price isn’t doing well. Plug Power raised $2.09 billion in 2021 by issuing 32.2 million shares at a price of $65.

The company filed two weeks ago to raise another $1 billion, but since shares trade around $3.70 today, it would require issuing far more shares, roughly 270 million. That would increase total shares by over 40%, significantly diluting existing shareholders.

When companies issue more shares, it’s like cutting a pie into smaller pieces. The size of the pie doesn’t change. Everyone gets less. Adding 270 million more shares would mean that each share existing investors hold would represent far less of the company than before. That will undoubtedly hurt the share price further.

The scariest part is that without making strides toward making money, it might not be long before the company would potentially need more. While obtaining that government loan would buy time, it doesn’t answer Plug Power’s long-term questions. This company looks more like a money pit than a millionaire maker.

Investors should avoid the stock until Plug Power proves it’s financially stable.

Should you invest $1,000 in Plug Power right now?

Before you buy stock in Plug Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Plug Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of the S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of January 22, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is Plug Power a Millionaire Maker? was originally published by The Motley Fool

Credit: Source link