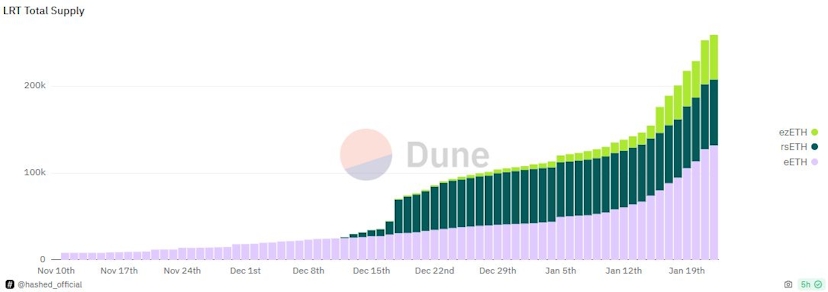

The market capitalization of liquid restaking tokens has surged 140% to $620M in January.

Ether.fi, a liquid restaking protocol based on Ethereum, has seen demand for its eETH token skyrocket over the past week, with the total value locked (TVL) in the protocol nearly doubling to $340M.

eETH is a liquid restaking token (LRT), a relatively new asset class that DeFi investors have been piling into ahead of the mainnet launch of EigenLayer, a protocol that looks to leverage Ethereum’s robust consensus mechanism to validate other applications through a process called restaking.

With EigenLayer’s capping deposits for liquid staking tokens but not setting limits on native restaking, eETH is being seen as an attractive native option by investors seeking exposure amid the recent hype.

Users who restake ETH can earn the regular staking yield in addition to rewards from projects that choose to bootstrap their security using EigenLayer, which can forego the time and expense associated with setting up their own networks of validators.

EigenLayer is running a points program for a future airdrop of its native token, which has caused over $1.7B worth of ETH and liquid staking tokens to be restaked as of Jan. 22.

However, as restaked ETH is illiquid – just like vanilla staked ETH – a wave of protocols like ether.fi, Renzo and KelpDAO have rushed to offer LRTs, which enable investors to retain their restaking exposure while also getting a liquid token that can be deployed across DeFi to earn additional rewards.

For example, ether.fi is proposing to incentivize an eETH-ETH market on Morpho, a lending protocol. Such a market would enable traders to borrow ETH against eETH and open up more aggressive strategies like ‘looping’ for additional EigenLayer exposure.

The nascent LRT sector now commands a TVL of $620M, up from $200M a month ago.

Credit: Source link