Net Income: Reported at $6.2 million for Q4 2023, a decrease from $13.0 million in Q4 2022.

Earnings Per Share (EPS): Q4 2023 EPS stood at $0.37, down from $0.77 in the same quarter the previous year.

Net Interest Income: Slight increase to $31.5 million in Q4 2023 from $31.0 million in the previous quarter.

Balance Sheet Growth: Total assets grew to $4.83 billion, up from $4.64 billion at the end of 2022.

Dividend: A quarterly cash dividend of $0.08 per share declared, payable on February 20, 2024.

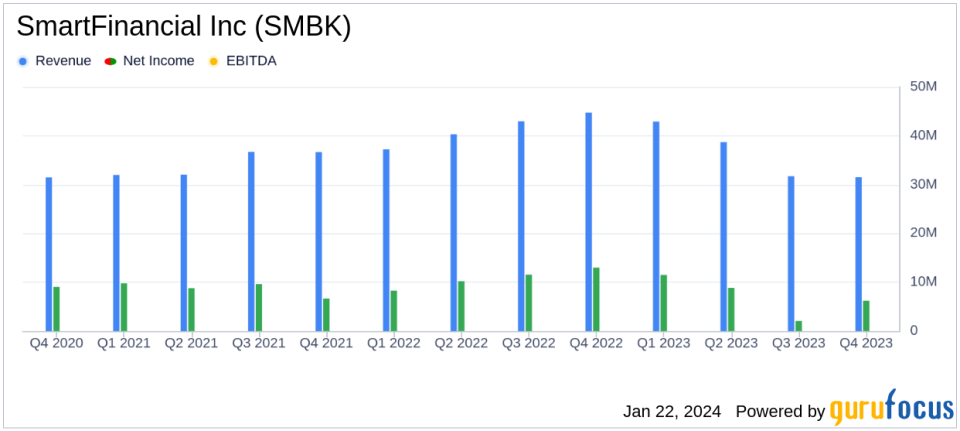

On January 22, 2024, SmartFinancial Inc (NYSE:SMBK) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. As a bank holding company for SmartBank, SmartFinancial Inc offers a range of banking and financial services, focusing on commercial loans, real estate loans, consumer loans, and construction loans. The company’s primary revenue comes from interest income on these earning assets.

Performance and Challenges

SmartFinancial Inc reported a net income of $6.2 million for the fourth quarter of 2023, a significant decrease from the $13.0 million reported in the fourth quarter of 2022. This decline in net income is a critical indicator of the challenges faced by the company, including an operating environment marked by high competition and economic headwinds. However, operating earnings, which exclude non-recurring expenses, were $6.9 million, or $0.41 per diluted common share, showing a degree of resilience in the company’s core operations.

Financial Achievements and Industry Significance

Despite the decrease in net income, SmartFinancial Inc achieved a modest increase in net interest income, rising to $31.5 million in the fourth quarter from $31.0 million in the prior quarter. This growth is significant for banks like SmartFinancial Inc, as net interest income is a fundamental source of revenue. The company also saw balance sheet growth, with total assets increasing to $4.83 billion, up from $4.64 billion at the end of 2022, indicating continued expansion and customer trust.

Key Financial Metrics

SmartFinancial Inc’s net interest margin improved slightly to 2.86% in the fourth quarter of 2023, up from 2.81% in the previous quarter. The cost of interest-bearing liabilities also increased, reflecting the rising interest rate environment. The allowance for credit losses to total loans and leases was 1.02% as of December 31, 2023, compared to 1.00% as of September 30, 2023, suggesting a cautious approach to credit risk management.

Analysis of Company’s Performance

The company’s performance in the fourth quarter shows a mixed picture. While there was a year-over-year decline in net income, SmartFinancial Inc managed to grow its balance sheet and maintain a stable net interest margin. The increase in noninterest income to $7.6 million, primarily due to gains on the sale of securities, also highlights the company’s ability to capitalize on market opportunities. However, the rise in nonperforming loans and leases to 0.24% of total loans and leases indicates an area that requires close monitoring.

SmartFinancial Inc’s Chairman, Miller Welborn, expressed pride in the team’s efforts and the operational enhancements made throughout the year. President & CEO Billy Carroll noted the positive momentum at the year’s end, despite the persistent challenges in the operating environment.

“Our Company closed 2023 with positive momentum despite persistent operating environment challenges. The fourth quarter was highlighted by continued growth in our balance sheet with loans growing at 8% and deposits growing at 2%, annualized, respectively quarter over quarter. Our operating earnings were bolstered by stabilization of our net interest margin, as well as continued expense control. Despite the headwinds our industry faced during the year, our team responded incredibly well, positioning SmartBank to continue its upward trajectory,” said Billy Carroll, President & CEO.

Looking ahead, SmartFinancial Inc appears to be positioning itself for continued growth and operational efficiency, which could bode well for future performance. Investors and stakeholders will likely keep a close eye on how the company navigates the evolving economic landscape and maintains its growth trajectory.

For a more detailed analysis and information on SmartFinancial Inc’s fourth quarter performance, please visit the full 8-K filing.

Explore the complete 8-K earnings release (here) from SmartFinancial Inc for further details.

This article first appeared on GuruFocus.

Credit: Source link