Building a $1 million retirement nest egg is still the default goal for many investors. Recent data suggests many of those nest creators still have plenty of building to do. According to research commissioned by The Motley Fool, the average U.S. household has just $87,000 saved for retirement.

Investing is a proven method for building that level of retirement, although how you invest can vary greatly. After all, everyone’s situation will vary. An investing style that suits one person may not suit you. What has been shown to work is buying into great companies and holding their stocks long-term, giving the companies a chance to grow their revenue and profits to produce great investment returns that have time to compound.

Here are three high-quality stocks you might want to consider for your diversified portfolio. These stocks best serve three different types of investors, emphasizing that there are different ways to reach that $1 million goal.

1. Berkshire Hathaway: The “set it and forget it” stock

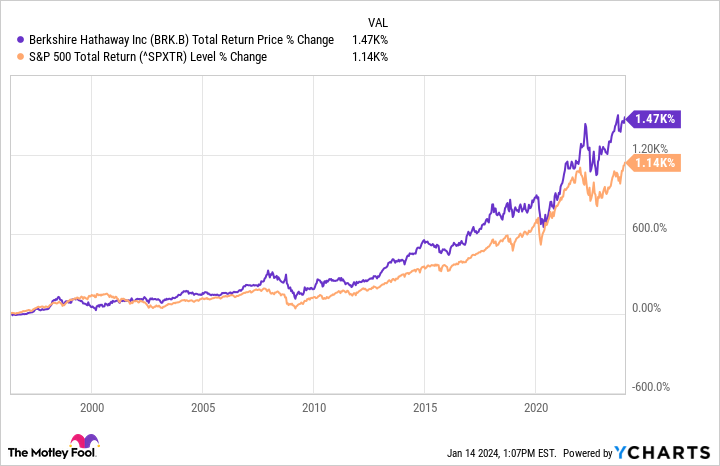

Some people don’t want to constantly tinker or put time into staying on top of the companies they invest in. Is that you? Then you might want to consider entrusting all-time great Warren Buffett with your money. His holding company, Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), has beaten the S&P 500 for decades already and grown into a behemoth worth nearly $800 billion today.

It’s one of the safest stocks you can own. Berkshire wholly owns dozens of companies as well as stakes in several dozen more publicly traded corporations. It’s almost like buying an exchange-traded fund led by Buffett and his brain trust. Berkshire’s private holdings include companies involved in insurance, railroads, energy, retail, and more. The investment portfolio holds significant stakes in blue chip stocks like Apple, Coca-Cola, American Express, and Bank of America.

To top it off, Buffett has always been a big fan of holding a lot of cash. It gives the company a financial safety net and leaves the door open for Berkshire to take advantage of the fast-pitch opportunities when they come along. Today, Berkshire Hathaway holds a staggering $157 billion in cash and short-term investments. Now in his 90s, Buffett won’t be around forever, but investors can feel confident in Berkshire’s future thanks to its robust fundamentals and succession plan.

2. Buy this stock for decades of dividend growth

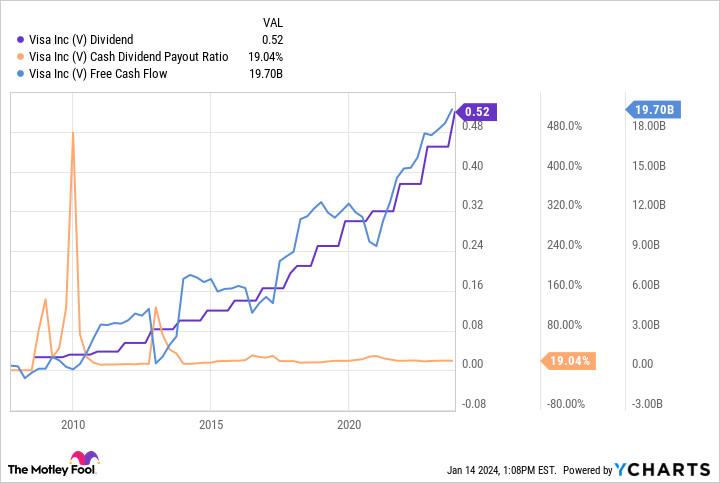

Investing in dividend stocks can be a powerful strategy, especially when you reinvest the dividends to buy more shares, boosting that compounding effect. Payment network Visa (NYSE: V) is a contender for the best dividend stock you can buy. But why? After all, the stock’s dividend yield is just 0.8% today. But when holding for decades, you want a company that can keep giving you raises.

Visa is the world’s leading payment network outside of China, helping people money move between their banks and the merchants where they swipe their payment card. Its massive size and lucrative business model make it a cash-printing machine. Visa generates nearly $20 billion in annual free cash flow, converting $0.60 of every revenue dollar to cash. The company has grown as people worldwide move from cash to debit cards, credit cards, and digital wallets.

Visa’s dividend has multiplied in size and still costs just 19% of the cash flow it produces. That sets the company up for potentially decades of solid dividend growth, which, for long-term investors, will turn that small starting yield into big dividend checks in the future.

3. A bold stock for growth-focused investors

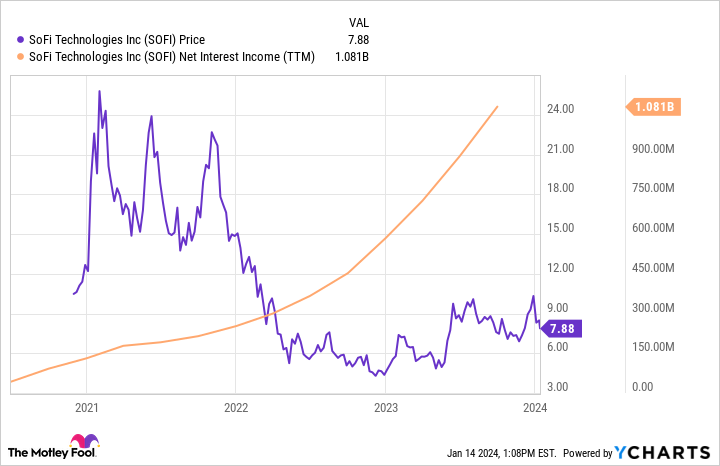

For other investors, it’s all about looking for the stock that could turn a single investment into life-changing wealth. SoFi Technologies (NASDAQ: SOFI) isn’t as established as the popular blue chip stocks, but its tantalizing upside lands the stock on this list. SoFi is a digital bank, meaning it doesn’t have physical branches. Instead, it offers all its products and services through its website and smartphone app.

The company targets younger consumers, who represent the economy’s future power spenders. SoFi started with student loans, which helped it build a reputation in this demographic. SoFi’s total package has resonated with its users. The company had just over a million users in early 2020, but that’s grown to exceed 7 million today, a massive increase in just under four years. Ironically, SoFi only just got its national banking charter in early 2022. The charter, which lets SoFi formally act like an actual bank instead of going through a third party, has immensely boosted its profits.

Net interest income, the spread between interest on money loaned and interest paid to depositors, has tripled since the charter. Considering how young SoFi’s banking business is and its explosive member growth, shareholders should be excited about what might come. The share price has been volatile, but it will be hard to keep the stock down if SoFi’s banking business keeps growing like it has.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of January 8, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising partner of The Ascent, a Motley Fool company. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, and Visa. The Motley Fool recommends the following options: long January 2024 $47.50 calls on Coca-Cola. The Motley Fool has a disclosure policy.

Want $1 Million in Retirement? 3 Stocks to Buy Now and Hold for Decades was originally published by The Motley Fool

Credit: Source link