Microchip Technology (NASDAQ: MCHP), a leader in providing semiconductors and total system software solutions for industrial markets, just threw shade at the state of the economy to kick off 2024. The company issued a warning that its revenue for the quarter ended in December 2023 will be even worse than previously expected.

This news comes hot on the heels of a similar warning from self-driving car and driver-assist chip designer Mobileye (NASDAQ: MBLY), which said a glut of inventory at the start of the new year will sharply reduce its sales.

Microchip is a far more diversified company, though, with end-market spanning data centers to cars, healthcare devices to manufacturing. Did Microchip just signal tough times for the economy in 2024?

Microchip’s ugly revenue update

This new current downturn for automotive and industrial chip demand has now been well-broadcast since autumn 2023. Industry giants from Texas Instruments (NASDAQ: TXN) to Analog Devices (NASDAQ: ADI) have signaled the weakening environment as their customers deal with an excess of inventory.

To be clear, this is a normal cyclical process for semiconductor suppliers. Customers, many of which are hypersensitive to even small changes in economic growth, tend to overpurchase in good times and later cut spending at the first sign of trouble (whether trouble ultimately comes or not).

At any rate, the current downcycle for chip demand is deepening. Even Microchip, which has picked up ample market share of its targeted markets in recent years with its focus on chip design and accompanying software (software tends to be far less cyclical than hardware sales), is now feeling the pinch.

Previously, Microchip had forecasted its third-quarter fiscal 2024 (which just ended in December 2023) revenue to decline 17.5% from the previous quarter, and 14.5% year over year, to $1.86 billion at the midpoint of guidance.

In its most recent update, though, Microchip now expects revenue to be down 22% from the prior quarter, implying revenue will be roughly $1.76 billion — about $100 million less than before. Ouch!

Is the 2024 economy in trouble?

In a prepared statement, Microchip CEO Ganesh Moorthy attributed the revenue miss to the following effect: “The weakening economic environment that our customers and distributors faced during the December 2023 quarter resulted in many of them wanting to receive a lower level of shipments as they took actions to further de-risk their inventory positions.”

That talk of “a weakening economic environment” certainly sounds like a bad omen. But bear in mind that this was already broadcast months ago. Industrial, manufacturing, and automotive companies began to feel the impact of higher interest rates in the second half of 2023. It takes time for the effects of hardware and component ordering — a reduction of which is an action to conserve cash — to trickle down to a supplier like Microchip.

In other words, a drop in quarterly sales is typically a lagging indicator of economic health, not necessarily an indicator of the future.

The best time to buy semiconductor stocks is counterintuitive

It will now be important to tune into the earnings calls of Microchip and its peers to see what kind of indication they give about a potential bottom of this semiconductor cycle. Previously, the indication was that excess inventories at industrial customers would be resolved by the middle of 2024.

This seems to be about a one-year lag behind the previous downturn in smartphone and PC sales, although that downturn ended up lasting a couple quarters longer than originally expected (excess consumer electronic inventories were cleared the second half of 2023, not by the first half).

However, counterintuitively, the time to buy semiconductor stocks is in the midst of a cyclical downturn for sales, not after sales have already returned to growth. Look no further than those chip stocks tied closely to PC and smartphone sales in 2023 — like Intel (NASDAQ: INTC), Qualcomm (NASDAQ: QCOM), and Micron Technology (NASDAQ: MU). Long before they started indicating a healthier level of customer chip inventory and a return of growth, their stocks rallied in grand fashion.

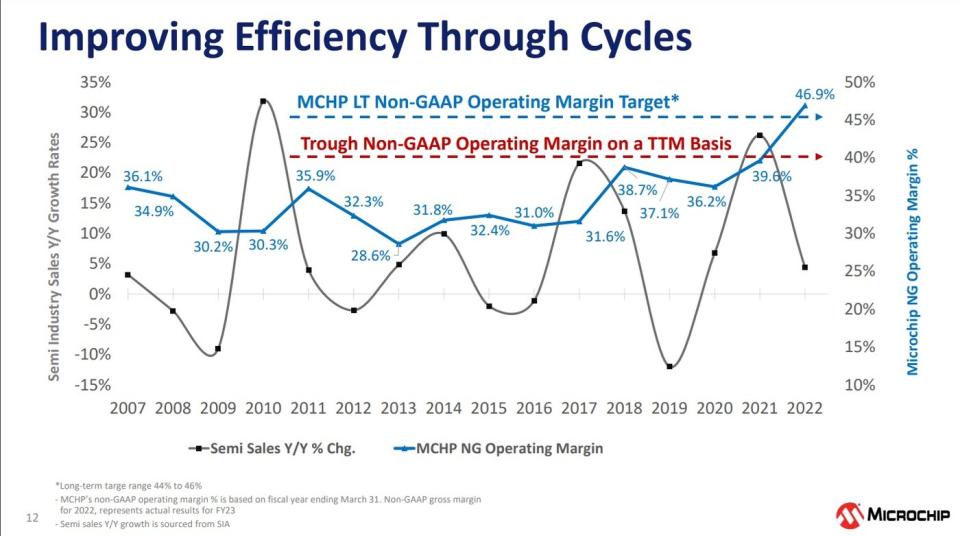

Something similar is likely in store for Microchip — which explains why the market has minimally penalized its share price despite management being very clear business is going to take a hit. All indications point to Microchip’s cyclical downturn being temporary. It will eventually return to growth. And along the way, Microchip has demonstrated an exceptional ability to remain highly profitable.

Like I did with stocks like Qualcomm and Nvidia (NASDAQ: NVDA) during their downturns over a year ago, I believe the time to buy a stock like Microchip is now. I plan on adding to my position early this year, despite headlines indicating the economy is getting off to a rocky start in 2024.

Should you invest $1,000 in Microchip Technology right now?

Before you buy stock in Microchip Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microchip Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of January 8, 2024

Nicholas Rossolillo and his clients have positions in Microchip Technology, Micron Technology, Nvidia, and Qualcomm. The Motley Fool has positions in and recommends Nvidia, Qualcomm, and Texas Instruments. The Motley Fool recommends Intel and Mobileye Global and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Did This 1 Top Chip Stock Just Indicate a Rocky 2024 for the Economy? was originally published by The Motley Fool

Credit: Source link