Dutch Bros (NYSE: BROS) stock appears to have started off its life as a public company on the wrong foot. It sells today at a 68% discount to the all-time high it set soon after it went public in the fall of 2021

Still, even as investors were bidding down the stock, Dutch Bros was pushing headlong into its nationwide expansion plan, adding coffee shops at a rapid clip and growing revenue. This growth, along with other factors, should bode well for the coffee stock over time.

The state of Dutch Bros stock

Dutch Bros appears to have been a victim of the 2022 bear market. This was unfortunate timing on the company’s part as its stock launched near the peak of a bull market.

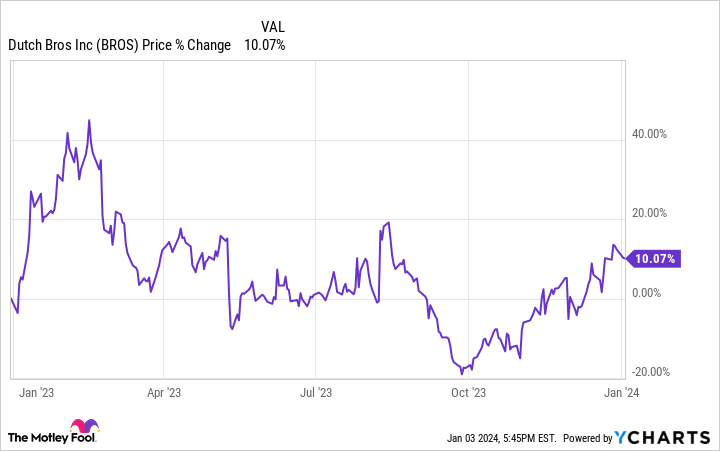

However, the stock price behavior seems to offer the characteristics one might look for in a bear market stock. After a massive drop in 2022, Dutch Bros struggled with range-bound trading as the sluggish economy weighed on investor confidence.

Moreover, the coffee market is highly competitive. Aside from industry giant Starbucks, it must also compete with privately held chains such as Dunkin’ and countless independent coffee shops. Furthermore, McDonald’s has begun to build a beverage-focused chain called CosMc’s, and its first location in the Chicago area has shown early signs of success.

In that environment, Dutch Bros stock rose by just over 10% over the last year, though at some points in early 2023, it was up by more than 40%.

Nonetheless, Dutch Bros carried on almost as if it was unaffected by these challenges and continued expanding. As of the end of the third quarter, its shop count had grown to 794 as it added 153 locations over the previous 12 months, an increase of 24%.

Dutch Bros by the numbers

The company’s financials show the fruits of that expansion. In the first three quarters of 2023, revenue rose 32% year over year to $712 million. That included a 4% increase in same-shop sales.

Moreover, it began reporting profitable quarters in 2022, which mainly continued into the following year. In the first nine months of 2023, its net income was $14 million, compared to a $16 million loss in the prior-year period.

In short, even as its stock has lost value, Dutch Bros has become more attractive — and that trend should continue. Management forecasts between $950 million and $1 billion in revenue for 2023, which would amount to growth of 32% at the midpoint.

Admittedly, its forward earnings multiple is currently a lofty 87, but that ratio is skewed by its recent shift to profitability. Its price-to-sales (P/S) ratio, however, is a more reasonable 2. That’s also significantly cheaper than rival Starbucks, which has a P/S ratio of around 3.

Since Dutch Bros’ relatively smaller size allows for higher growth on a percentage basis, the coffee chain may present a more compelling investment opportunity than the market leader.

Consider Dutch Bros stock

Dutch Bros stock is in a solid position to profit investors. Even as investors sold the stock, the company continued to push forward with its aggressive expansion plans. Also, its recent transition to profitability and its low P/S ratio make the stock more attractive.

The company could face a more competitive landscape as competing coffee shops continue to appear. But with Dutch Bros adding around 150 stores every 12 months, its rapid growth will likely take the stock higher over time.

Should you invest $1,000 in Dutch Bros right now?

Before you buy stock in Dutch Bros, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dutch Bros wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of December 18, 2023

Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Starbucks. The Motley Fool has a disclosure policy.

1 Growth Stock Down 68% to Buy Right Now was originally published by The Motley Fool

Credit: Source link